Eve Air Mobility Third Quarter 2024 Results November 4, 2024 eveairmobility.com

..com

Eve Holding, Inc.

Third Quarter 2024

Financial Highlights

Eve Air Mobility is an aerospace company dedicated to the development of an eVTOL (electric Vertical Takeoff

and Landing) aircraft and the Urban Air Mobility (UAM) ecosystem that includes aircraft development, Customer

Services and Vector, an Urban Air Traffic Management (Urban ATM) system. Eve is pre-revenue; we do not expect

meaningful revenues, if any, during the development phase of our aircraft, and we expect financial results to be

mostly related to costs associated with the program’s development during this period.

Eve reported a net loss of $35.8 million in 3Q24 versus $31.2 million in 3Q23. Net loss increased due to higher

Research & Development (R&D) – these are costs and activities necessary to advance in the development of our

suite of products and solutions for the Urban Air Mobility (UAM) market, as well as Selling, General &

Administrative (SG&A) expenses. R&D expenses were $32.4 million in 3Q24, versus $28.6 million in 3Q23 and

were primarily driven by the Master Services Agreement (MSA) with Embraer who performs several development

activities for Eve. These efforts continue to intensify with increasing maturity of the development of our eVTOL.

Moreover, engagement of our engineering team continues high – after the roll-out of our engineering prototype

in July, who are now performing a series of system and integration ground tests on the aircraft before its debut

flight.

In the meantime, SG&A increased to $8.4 million in 3Q24, from $5.0 million in 3Q23, primarily due to a

combination of higher outsourced services, payroll costs and pre-operating industrialization costs associated with

our first eVTOL plant, in the city of Taubaté in Brazil. These increases were partly offset by savings on Director

& Officers insurance expenses after renegotiating and lengthening terms with our provider and a c.8%

depreciation of the Brazilian Real (BRL) vs. the USD over the last year. Most of SG&A expenses are incurred in

Brazilian currency. The growth in payroll expenses reflects mostly an increase in Eve’s headcount.

The increase in R&D and SG&A was partly offset by a $4.0 million gain in 3Q24 related to the fair value of

derivatives (as private warrants were marked to market), vs. a $0.9 million loss in 3Q23. Eve’s total cash used

by operations and capital expenditures in 3Q24 was $34.0 million, vs. $22.4 million in 3Q23. R&D expenses

associated with Eve’s development were the main contributors to the higher cash consumption during the quarter.

Eve’s Cash, Cash Equivalents and Financial Investments totaled $279.8 million at the end of 3Q24, and liquidity**

reached $305 million, including $25 million from the BNDES R&D standby facility available. Subsequent to 3Q24,

Eve secured a new ~$90 million credit line with the BNDES – Brazil’s National Development Bank, to support the

necessary investments in our Taubaté site, and a new $50 million loan with Citibank to support the funding of

R&D. The additional funding will strengthen our Balance Sheet and support our operations and program

investments in the upcoming years.

Key Financial Indicators

Eve Holding, Inc.

Third Quarter 2024

USD MILLIONS 3Q24 3Q23 9M24 9M23

INCOME STATEMENT

Research & Development (R&D) (32.4) (28.6) (96.2) (72.0)

Selling, General & Administrative (SG&A) (8.4) (5.0) (20.3) (17.8)

Change in fair value of derivative liabilities 4.0 (0.9) 12.4 (9.8)

Interest Income / Other Non-Operating Expenses, net 1.5 4.4 8.1 12.8

Net Earnings / (Loss) (35.8) (31.2) (97.5) (88.4)

CASH FLOW

Net Cash Used in Operating Activities (30.7) (22.4) (97.3) (70.0)

Net Additions to Property, Plant and Equipment (PP&E) (3.2) (0.0) (4.0) (0.2)

Free Cash Flow* (34.0) (22.4) (101.3) (70.2)

Net Cash (Used) Provided by Financing Activities 108.8 11.0 137.8 10.7

9M24 FY23

BALANCE SHEET

Other Assets 9.7 4.2

Total Payables 56.0 40.6

Cash, Cash Equivalents, Fin. Investments and Rel. Party Loan Receivable (Beg. of period) 241.1 310.6

Cash, Cash Equivalents, Fin. Investments and Rel. Party Loan Receivable (End of period) 279.8 241.1

Total Debt 68.3 25.8

Total Liquidity** 305.2 316.3

* Free Cash Flow is a non-GAAP measure and includes Net Cash Used in Operating Activities, Net Additions to PP&E

** Total Liquidity is a non-GAAP measure and includes Cash, Cash Equivalents, Financial Investments, Related Party Loan Receivable, undrawn BNDES R&D standby facilities

eveairmobility.com

1

Program Development

Following the roll-out of our full-scale prototype in early July, our engineering team continues to make significant

progress with the development of our eVTOL. Since then, we have installed the batteries and initiated a series

of tests to ensure that all the many systems are properly integrated amongst each other for a seamless flight

campaign. These include – among others, Flight Test Instrument (FTI) integration to validate proper system

conformity as well as the dedicated radio link between the Command & Control truck and the Prototype.

Importantly, our prototype was designed and built with multiple custommade carbon-fiber panels. The “skin” was designed to be easily

maintained with removable panels to facilitate access to internal

components. Engineers have easy access to the battery pack, flight

computers and all other flight-critical electric and electronic systems,

downloading of telemetry, repairs and any maintenance that might be

required.

We have performed Antenna Signal Tests to complete the integration of

the Command & Control truck to the aircraft. The truck will house the

pilot and the team of engineers who will measure and monitor several

operating metrics during the flights. The truck is designed to track the

eVTOL during its test flights and is equipped with several telemetry

sensors and cameras strategically placed throughout the eVTOL fuselage

to provide real-time flight performance data, visuals and diagnostics.

The goal is to guarantee that all systems are working seamlessly

amongst each other and minimal – if not zero, signal latency and

interruptions. This will guarantee optimal vehicular control, high fidelity

in data analysis and performance for continued aircraft development in testing phase.

As a reminder, the prototype was assembled at Embraer’s Gavião Peixoto site

(GPX). This is also where the flight tests and flight-test campaign will be conducted

and is home to Embraer’s defense division, parts of the executive aviation assembly

line and the largest runway in the southern hemisphere. This is a 5-kilometer (3.1

miles) long, 95-meters (312 feet) wide structure designed to test a wide variety of

aircraft – from military to experimental commercial and executive jets. On top of

these real-life tests – which are becoming more frequent and varied, our team of

engineers continues to perform a series of lab tests on the rigs and/or equipment

we had already received.

One such lab test experiment was the successful containment of thermal

runaway (exothermic chemical reaction that can be triggered with

overcharging, excessive currents, multiple discharges, etc.) that could

lead to increases in battery temperature and consequently

destabilization and degradation of the battery, and ultimately its failure.

There are multiple ways to prevent thermal events (cell isolation, control

of charging/discharging on a cell-by-cell basis) – all of which are part of

our aircraft design, but it must also be able to successfully contain a

thermal event to assure flight safety.

Eve has now completed the selection of flight-critical component

suppliers, and with a high level of project maturity, we are evolving to

the flight tests. Thus far, we have contracted suppliers for the following

components: electric motors, energy management systems, batteries,

propellers, thermal management systems, actuators, sensors, avionics, pilot control, wings (and internal

structural components such as spars and ribs), pilot control, transparencies, seats, fuselage doors, vertical and

horizontal tail.

Importantly, suppliers’ contracts have pricing mechanisms with adjustment ceilings and are linked to production

volumes, establishing lower unit prices as output increases. The contracts also include supplier commitment to

support the certification process

eveairmobility.com

2

Milestones checklist

• Conclude first airframe prototype assembly / initiate test campaign

As mentioned previously, our engineering team

has completed the assembly of our first full-scale

prototype in Embraer’s Gavião Peixoto facility. The

prototype was officially presented to the public,

investors, customers and partners at a July 3rd

event, and a video of the event was unveiled at the

Farnborough Air Show.

The remote-controlled eVTOL will be used to

validate the performance characteristics of the

many tests we have performed over the years –

either with sub-scale models, individual rigs, windtunnel or Computational Fluid Dynamics (CFD)

tests to estimate lift, aerodynamic drag, sound

emission, energy consumption, component

vibration, etc. The findings will be used to further

refine the commercial versions of the aircraft.

After the July roll-out and battery installation, our engineering team conducted a series of tests in the prototype,

as part of the protocol for flight readiness. These tests include high and low voltage tests to isolate potential

leakage in the system, a successful thermal-runaway containment test in the energy pack, as well as oscillatory

load tests in the rotor rig with different propeller configurations to maximize the power/energy consumption

equation and to minimize noise emission and vibration. Besides that, all flight instruments were integrated for

seamless interoperability. Lastly, our team of engineers linked the Command & Control station to the prototype

via a dedicated radio signal – this will allow the pilot to control the aircraft remotely and will feed telemetry and

images to the truck for later analyses.

• Definition of Certification Basis and Means of Compliance

On November 1st

, Brazil’s Civil Aviation Authority (ANAC) published the Basis of Certification for Eve’s eVTOL in

the country. This is a major milestone for the eVTOL industry and will allow Eve to progress towards ANAC type

certification (TC) and seek validation with the FAA (Federal Aviation Administration).

ANAC’s Basis of Certification establishes the first set of airworthiness criteria for eVTOLs in Brazil and follows

Eve’s application for TC in 2022. It is a standard process for developing a new certification basis and an important

milestone in the project.

Following the definition of the airworthiness criteria, Eve will focus on defining with ANAC the Means of Compliance

– these are specific tests, analyses and simulations that need to be successfully performed for TC to be granted.

These tests are performed to prove the aircraft design, and that construction meets the safety standards laid out

in the Basis of Certification.

On October22, the FAA issued the Special Federal Aviation Regulation (SFAR) that details the final rules for

Advanced Air Mobility (AAM) and covers eVTOL. In general, the new FAA SFAR has been well received by the US

Urban Air Mobility market, as it simplifies pilot training process and allows single control eVTOLs, among other

advances.

In addition to the engineering prototype rolled-out in July, Eve plans to deploy five prototypes for its certification

campaign, with an option for a sixth test aircraft deployed if needed. And while each prototype will have a specific

intended goal and distinct role in the campaign, they all serve a common goal – to prove the safety and reliability

of Eve’s eVTOL design for commercial operations.

Importantly, these aircraft will be piloted and have the systems/sub-systems and redundancies that will be

present in the commercial aircraft. For instance, they will be fitted with passenger and pilot seats, the batteries

placed between the passenger seats and the cargo area. This configuration will ensure that the prototypes have

the same dimensions and physical characteristics – including weight and center of gravity of the commercial

aircraft, to ensure high fidelity in the certification campaign vis-à-vis the expected performance of the commercial

aircraft at EiS

eveairmobility.com

3

In general terms, the prototypes are expected to excel in ground vibration tests (GVT) to be subsequently

validated in flight vibration tests (FVT). At each flight test point – and aided by telemetry collected throughout

the process, engineers will decide to proceed to subsequent stages. If successful, they will systematically expand

the flight envelope of the aircraft with greater speeds, at various altitudes. The aircraft will also be tested for

flutter.

Flight flutter tests are a type of load test performed on aircraft during the certification process to evaluate their

structural strength and stability. The tests involve measuring the aircraft's natural frequencies and damping

coefficients while increasing the speed in stages. This is a critical stage in the certification process, as it ensures

that the aircraft is flutter free throughout its entire flight envelope. This is a hazardous phase because it requires

flying close to flutter speeds to detect instabilities. Aeroelastic stability can also change abruptly with only a few

knots' change in air speed. The basic objective of a flight flutter test is to determine the speed at which critical

flutter would occur, and the type of flutter involved, from measurements made on the aircraft in flight at speeds

safely below the critical speeds.

The published airworthiness criteria are a result of a months-long public commenting phase and follows months

and countless interactions among all interested parties – including Eve, Embraer, other eVTOL OEMs, as well as

the FAA and EASA and the general population. ANAC has compiled all comments to align and harmonize different

requirements.

Once TC is granted, Eve plans to seek validation by other authorities. The company formalized the validation with

the FAA in 2023, which enables Eve to actively work with the FAA during the certification process with ANAC,

pursuing the concurrent issuance of each authority’s TC.

• Define configuration of eVTOL factory; secure manufacturing finance

Last year, we selected a former Embraer site in the city of Taubaté, São Paulo – Brazil, to house our first

production site, with a total expected output of up to 480 units/year. We are planning to expand the site’s capacity

on a modular basis, with four equally-sized modules – each with a capacity for 120 units/year, for a disciplined

and capital-efficient investment approach.

We intend to start preparing the facility to accommodate our initial production efforts shortly and estimate these

customizations will consume approximately $80 to 90 million. We have engaged Brazil’s National Development

Bank (BNDES) and secured the necessary funding for this project, completing then another important milestone

we had previously set for the year.

eveairmobility.com

4

While the Taubaté site will require specialized tooling and equipment for the manufacturing process of eVTOLs,

as well as some civil construction and an upgrade of facilities for aircraft and equipment tests, the building itself

is complete and already operational. By leveraging on one of Embraer’s sites in Brazil – rather than having to

build a new site from the ground up, we aim to implement relatively quick and inexpensive upgrades.

• Achieve 2024 total cash consumption between $130/$170 million

With intensifying program development efforts, continued supplier selection, assembly of our prototype, and

necessary investments in the production site, Eve expects a total cash consumption between $130 and $170

million in 2024. This compares to $59.9 million invested in the program in 2022 and $94.7 million in 2023. As of

3Q24, Eve had deployed $101.3 million in the program (vs. $70.2 million in 9M23).

The additional program activities will require an increase in the number of engineering hours – via our MSA with

Embraer as well as direct Eve personnel, and the acquisition of raw materials and parts/components for our

prototypes. Additionally, we will increase engagement with selected suppliers and receive equipment during the

remainder of 2024. This will trigger additional cash consumption in the coming months.

While we continue to expect sequentially higher investments and expenses in the quarters ahead due to

intensifying engineering engagement as well as potential supplier payments, we are confident that our capital

resources and liquidity – which includes the liquidity events executed recently, will be sufficient to fund our

operations, design and certification efforts through multiple years ahead.

Eve introduces aftermarket services portfolio, TechCare

Eve launched a fully integrated aftermarket services portfolio for efficient and safe UAM operations, TechCare.

This is a pioneer all-in-one suite of solutions designed to streamline eVTOL operations by providing the industry’s

most comprehensive services, expert customer support, and cutting-edge operational solutions.

TechCare was built on Embraer’s extensive aviation expertise and offers a unique portfolio of products and

services for customers with a global footprint and local presence. The aftermarket portfolio consists of technical

support and solutions, Maintenance, Repair and Overhaul (MRO) services, parts and battery solutions.

Importantly, TechCare will also include advanced training services for pilots, mechanics and ground handling

personnel and flight-operation solutions, available to operators via a digital platform.

The training service is powered by Eve and Embraer-CAE Training Services (ECTS), a joint venture between

Embraer and CAE Inc., with a proven track record of successful operations since 2007.

The app is a user-friendly system, the functions easily controllable and it is an all-inclusive digital platform

designed for reliable operations anywhere.

Among other offerings, the TechCare portfolio of services will include eVTOL health monitoring with real-time

data collection capabilities to help improve fleet performance. This will be used to run predictive maintenance,

schedule aircraft down time and optimize spare-parts inventory management. The system is connected to

operators, manufacturers, service centers and suppliers and will help facilitate repairs, and replacement of

different components, including batteries. Ultimately, TechCare will increase aircraft availability and reduce

operational costs.

eveairmobility.com

5

The portfolio was designed for operational efficiency and safety with a unique customer-centric approach. The

solutions were developed based on aerospace expertise and diverse interactions with customers and partners.

The result is a first-of-its-kind offer that will keep customers’ eVTOLs flying at a high availability rate.

Eve TechCare’s service and support solutions will cover all the operational aspects necessary to ensure the daily

eVTOL operation. This includes access to a 24/7 customer care center, pilot and mechanic training, entry into

service support, technical and operational publications, material and battery services, aircraft health monitoring,

and MRO services. Eve will offer a different support level approach to guarantee that each customer can benefit

from our solutions according to their needs, ensuring efficiency and profitability.

Click here to watch the video and learn more about Eve TechCare

Visit Eve TechCare’s webpage here: https://www.eveairmobility.com/techcare/

Latest Highlights

Eve Selects Embraer-CAE Training Services as Training Partner

Eve and Embraer-CAE Training Services (ECTS), a joint venture

between Embraer and CAE Inc. (CAE), announced on October 31

that ECTS has been selected as the training provider for Eve’s

electric vertical take-off and landing (eVTOL) aircraft pilots,

maintenance technicians and ground handling personnel. The

services will be part of the recently announced Eve TechCare, the

company’s all-in-one service portfolio for eVTOLs.

The joint venture between Embraer and CAE, established in 2007,

began with a contract to provide pilot and ground crew training for

Embraer’s Phenom 100 and Phenom 300 customers. Today, the JV

operates nine full-flight simulators globally, with more slated for

2025. Earlier this year, it marked a significant milestone by

launching the first E2 full-flight simulator in Asia, further

strengthening its growth trajectory. Leveraging CAE’s extensive global network of training centers, ECTS ensures

comprehensive training coverage, delivering the high-quality customer experience that has become a hallmark

of its service.

Eve takes advantage of Embraer’s 55 years of experience in designing, certifying, and manufacturing state-ofthe-art aircraft. Its customers will also benefit from having access to an existing global service and support

network, which is critical to ensuring reliable, safe, and efficient UAM operations.

Eve Announces $50 Million Bank Loan to Support eVTOL Development

Eve announced on October 30, a $50 million loan from Citibank. The funding, which will strengthen Eve's balance

sheet, will support the company’s aircraft research and development program.

With this additional loan, Eve's 3Q24 pro-forma liquidity increases to ~$445 million, when combined with recently

announced $96 million in equity financing from a diverse group of global industrial companies and financial

investors in July 2024. Eve also recently announced a new $88 million credit line agreement with Brazil’s National

Development Bank (BNDES) to fund the development of the company’s aircraft production facility in Taubaté, in

the state of São Paulo, Brazil.

Eve Presents Eve TechCare at MRO Europe

On October 22, Eve announced at MRO Europe in Barcelona the launch of its fully integrated aftermarket services

portfolio for efficient and safe Urban Air Mobility (UAM) operations. Eve TechCare is a pioneer all-in-one suite of

solutions designed to streamline electric vertical take-off and landing aircraft (eVTOL) operations by providing

the industry’s most comprehensive services, expert customer support, and cutting-edge operational solutions.

eveairmobility.com

6

Backed by Embraer’s 55 years of

history and aerospace industry

expertise, Eve TechCare offers a

unique way of serving customers

with a global footprint and local

presence. The aftermarket portfolio

consists of technical support and

solutions, MRO services, parts and

battery solutions, as well as training

services and flight operation

solutions, which operators will access

through a digital platform.

Eve TechCare’s service and support

solutions will cover all the

operational aspects necessary to

ensure the daily eVTOL operation.

This includes access to a 24/7

customer care center, pilot and

mechanic training, entry into service

support, technical and operational publications, material and battery services, aircraft health monitoring, and

MRO services. Eve will offer a different support level approach to guarantee that each customer can benefit from

our solutions according to their needs, ensuring efficiency and profitability.

Eve Secured $88 million from BNDES to Finance eVTOL Manufacturing

On October 15, Eve announced that the company secured a $88 million (US$-equivalent amount; loan in Brazil’s

local currency, BRL) loan agreement with Brazil’s National Development Bank (BNDES) to fund the development

of the company’s electric vertical take-off and landing (eVTOL) aircraft production facility in Taubaté, in the state

of São Paulo, Brazil. Under the BNDES Mais Inovação program, the financing reinforces BNDES’ commitment to

supporting innovative projects and Eve’s advancements in fostering decarbonization and the urban air mobility

(UAM) industry.

The manufacturing facility financing builds upon the successful partnership between Eve and BNDES following

the 2022 approval of a $95 million (as of September 30, 2024) line of credit to support Eve’s eVTOL development

program. The new funding agreement is structured by sub-credits from domestic and international sources,

including the bank’s foreign currency funds, and a maturity of 16 years.

With an eventual total expected output of up to 480 aircraft per year, Eve plans to expand the site’s production

capacity on a modular basis, with four equally sized modules of 120 aircraft per year. This will provide for a

disciplined, capital-efficient investment approach as the market grows.

Eve and Siemens Energize U.S. Advanced Air Mobility Industry

On July 23, Eve Air Mobility and Siemens Smart Infrastructure, a manufacturer of electrical and digital

technologies and solutions, announced through a Memorandum of Understanding, that they are teaming up to

evaluate the electrical infrastructure and energy management services needed to support safe, efficient and

scalable eVTOL operations. Together, the two companies will collaborate on evaluating the energy service needs

for eVTOL aircraft and demand for these services across the United States as the Advanced Air Mobility (AAM)

industry grows.

The AAM industry is rapidly taking shape around the world and now stands on the cusp of commercialization.

Integrating AAM into the existing transportation ecosystem offers an additional zero-emission option for urban

mobility, reduces travel time, and accelerates decarbonization efforts. Similarly, eVTOL technologies are expected

to transform communities through investments in infrastructure, electrification, new jobs and freedom of

movement, thereby creating a Target Addressable Market anticipated to be greater than US$760 billion by 2040.

The energy services Siemens and Eve are exploring will support the electrical infrastructure and provide fleet

operators with the confidence to launch and scale AAM operations. These models would ultimately help minimize

upfront capital impacts, thereby accelerating the transition to AAM while overcoming potential obstacles to entry.

eveairmobility.com

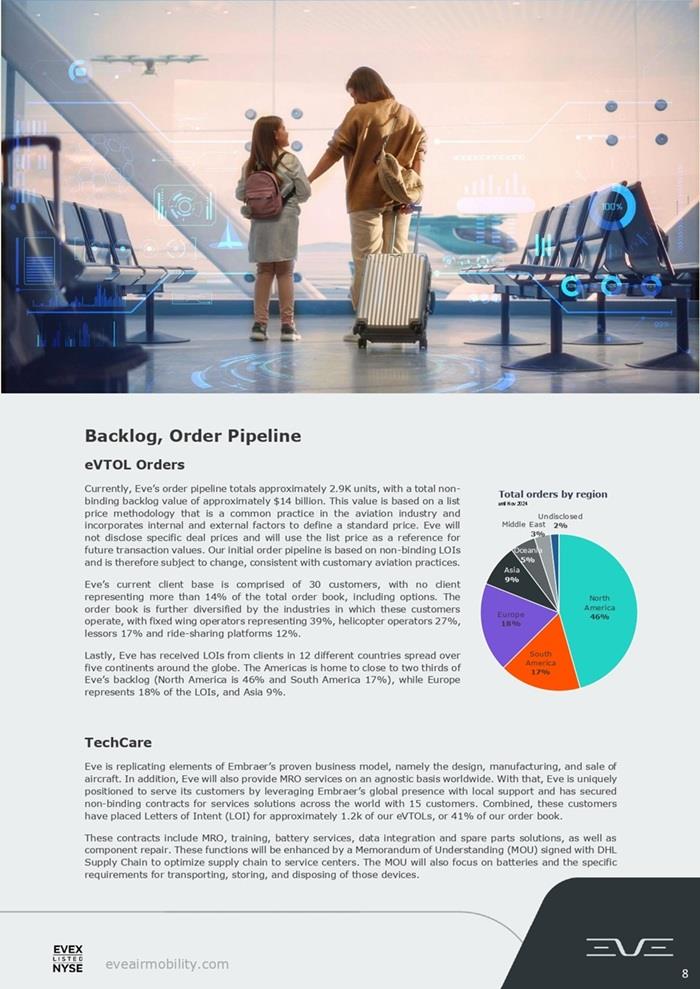

Backlog, Order Pipeline

eVTOL Orders

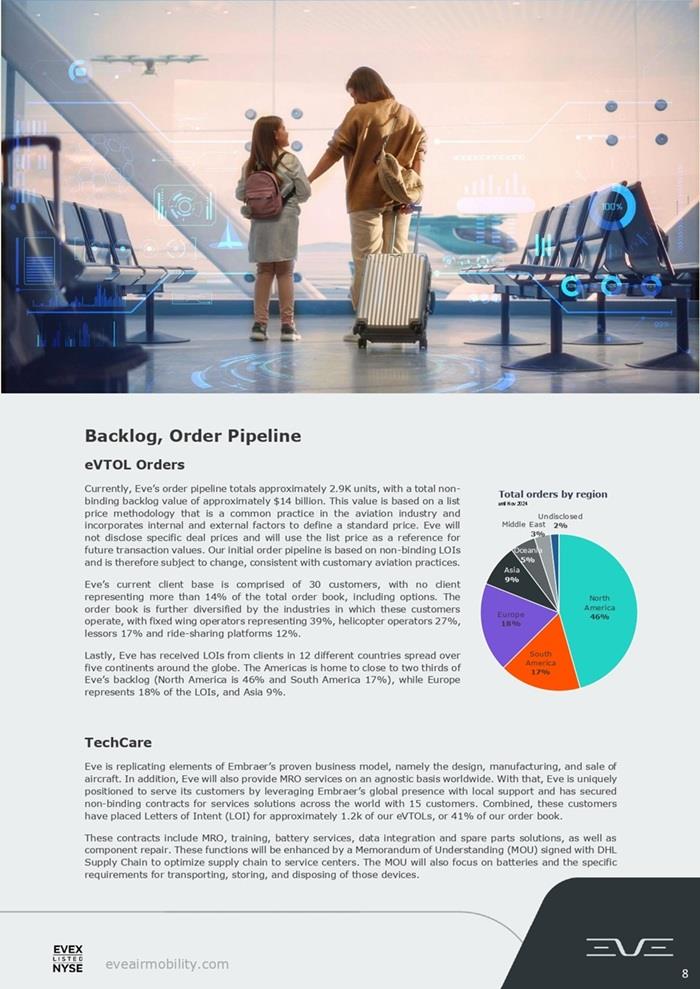

Currently, Eve’s order pipeline totals approximately 2.9K units, with a total nonbinding backlog value of approximately $14 billion. This value is based on a list

price methodology that is a common practice in the aviation industry and

incorporates internal and external factors to define a standard price. Eve will

not disclose specific deal prices and will use the list price as a reference for

future transaction values. Our initial order pipeline is based on non-binding LOIs

and is therefore subject to change, consistent with customary aviation practices.

Eve’s current client base is comprised of 30 customers, with no client

representing more than 14% of the total order book, including options. The

order book is further diversified by the industries in which these customers

operate, with fixed wing operators representing 39%, helicopter operators 27%,

lessors 17% and ride-sharing platforms 12%.

Lastly, Eve has received LOIs from clients in 12 different countries spread over

five continents around the globe. The Americas is home to close to two thirds of

Eve’s backlog (North America is 46% and South America 17%), while Europe

represents 18% of the LOIs, and Asia 9%.

TechCare

Eve is replicating elements of Embraer’s proven business model, namely the design, manufacturing, and sale of

aircraft. In addition, Eve will also provide MRO services on an agnostic basis worldwide. With that, Eve is uniquely

positioned to serve its customers by leveraging Embraer’s global presence with local support and has secured

non-binding contracts for services solutions across the world with 15 customers. Combined, these customers

have placed Letters of Intent (LOI) for approximately 1.2k of our eVTOLs, or 41% of our order book.

These contracts include MRO, training, battery services, data integration and spare parts solutions, as well as

component repair. These functions will be enhanced by a Memorandum of Understanding (MOU) signed with DHL

Supply Chain to optimize supply chain to service centers. The MOU will also focus on batteries and the specific

requirements for transporting, storing, and disposing of those devices.

eveairmobility.com

8

These non-binding services contracts are estimated to bring potential revenues of $1.6 billion during the first few

years of vehicle operation, and because of our agnostic approach to the maintenance business, Customer Services

revenues could precede the first delivery of our eVTOL.

Lastly, and in addition to eVTOL sales and Customer Services solutions, Eve is also engaged in developing Vector

and has signed LOIs from 23 customers globally.

Eve’s eVTOL concept and design

Rather than relying on traditional combustion engines, eVTOL aircraft are designed to use electric motors, providing

an alternative means of transportation in urban markets that does not produce carbon emissions. Eve’s design uses

a conventional fixed wing and empennage, rotors and a pusher, giving it a practical and intuitive lift-plus-cruise

design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly.

With an expected range of 60 miles (approximately 100 kilometers), Eve’s aircraft have the potential to not only

offer a sustainable and affordable commute, but also reduce sound levels compared to current conventional

helicopters.

Its human-centered design ensures the comfort of passengers, the pilot and the community by minimizing sound.

The all-electric aircraft features dedicated rotors for vertical flight and a fixed wing to fly in cruise, with no

components required to change position during flight. It will be piloted at launch but evolve towards uncrewed

operations in the future.

9

eveairmobility.com

These non-binding services contracts are estimated to bring potential revenues of $1.6 billion during the first few

years of vehicle operation, and because of our agnostic approach to the maintenance business, Customer Services

revenues could precede the first delivery of our eVTOL.

Lastly, and in addition to eVTOL sales and Customer Services solutions, Eve is also engaged in developing Vector

and has signed LOIs from 23 customers globally.

Eve’s eVTOL concept and design

Rather than relying on traditional combustion engines, eVTOL aircraft are designed to use electric motors, providing

an alternative means of transportation in urban markets that does not produce carbon emissions. Eve’s design uses

a conventional fixed wing and empennage, rotors and a pusher, giving it a practical and intuitive lift-plus-cruise

design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly.

With an expected range of 60 miles (approximately 100 kilometers), Eve’s aircraft have the potential to not only

offer a sustainable and affordable commute, but also reduce sound levels compared to current conventional

helicopters.

Its human-centered design ensures the comfort of passengers, the pilot and the community by minimizing sound.

The all-electric aircraft features dedicated rotors for vertical flight and a fixed wing to fly in cruise, with no

components required to change position during flight. It will be piloted at launch but evolve towards uncrewed

operations in the future.

9

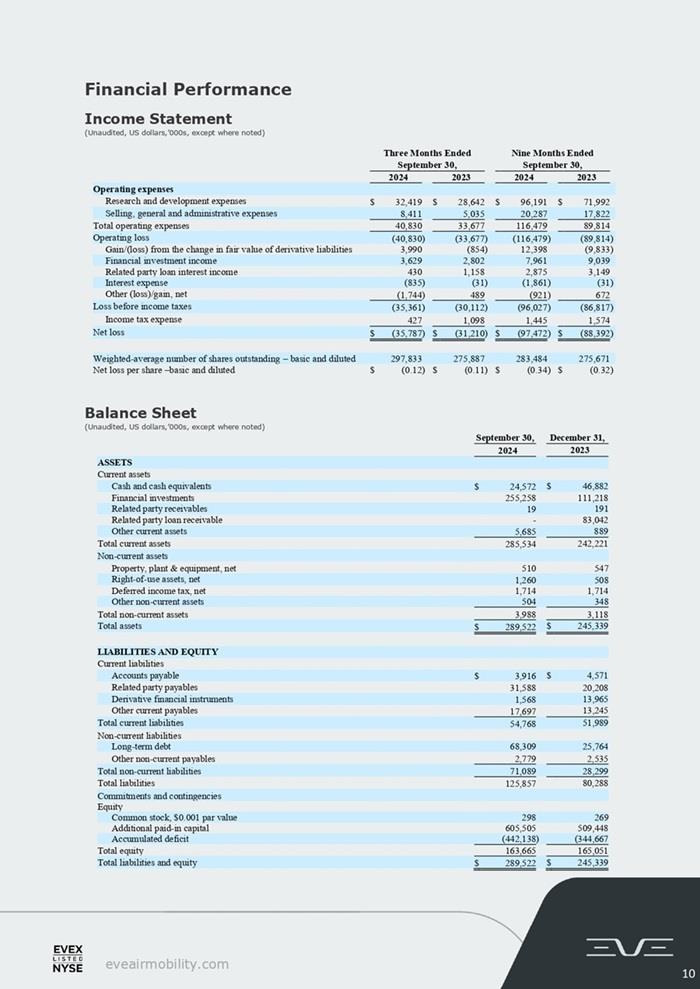

Financial Performance

Income Statement

(Unaudited, US dollars,’000s, except where noted)

Balance Sheet

(Unaudited, US dollars,’000s, except where noted)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024 2023 2024 2023

Operating expenses

Research and development expenses $ 32,419 $ 28,642 $ 96,191 $ 71,992

Selling, general and administrative expenses 8,411 5,035 20,287 17,822

Total operating expenses 40,830 33,677 116,479 89,814

Operating loss (40,830) (33,677) (116,479) (89,814)

Gain/(loss) from the change in fair value of derivative liabilities 3,990 (854) 12,398 (9,833)

Financial investment income 3,629 2,802 7,961 9,039

Related party loan interest income 430 1,158 2,875 3,149

Interest expense (835) (31) (1,861) (31)

Other (loss)/gain, net (1,744) 489 (921) 672

Loss before income taxes (35,361) (30,112) (96,027) (86,817)

Income tax expense 427 1,098 1,445 1,574

Net loss $ (35,787) $ (31,210) $ (97,472) $ (88,392)

Weighted-average number of shares outstanding – basic and diluted 297,833 275,887 283,484 275,671

Net loss per share –basic and diluted $ (0.12) $ (0.11) $ (0.34) $ (0.32)

September 30, December 31,

2024 2023

ASSETS

Current assets

Cash and cash equivalents $ 24,572 $ 46,882

Financial investments 255,258 111,218

Related party receivables 19 191

Related party loan receivable - 83,042

Other current assets 5,685 889

Total current assets 285,534 242,221

Non-current assets

Property, plant & equipment, net 510 547

Right-of-use assets, net 1,260 508

Deferred income tax, net 1,714 1,714

Other non-current assets 504 348

Total non-current assets 3,988 3,118

Total assets $ 289,522 $ 245,339

LIABILITIES AND EQUITY

Current liabilities

Accounts payable $ 3,916 $ 4,571

Related party payables 31,588 20,208

Derivative financial instruments 1,568 13,965

Other current payables 17,697 13,245

Total current liabilities 54,768 51,989

Non-current liabilities

Long-term debt 68,309 25,764

Other non-current payables 2,779 2,535

Total non-current liabilities 71,089 28,299

Total liabilities 125,857 80,288

Commitments and contingencies

Equity

Common stock, $0.001 par value 298 269

Additional paid-in capital 605,505 509,448

Accumulated deficit (442,138) (344,667

Total equity 163,665 165,051

Total liabilities and equity $ 289,522 $ 245,339

eveairmobility.com

10

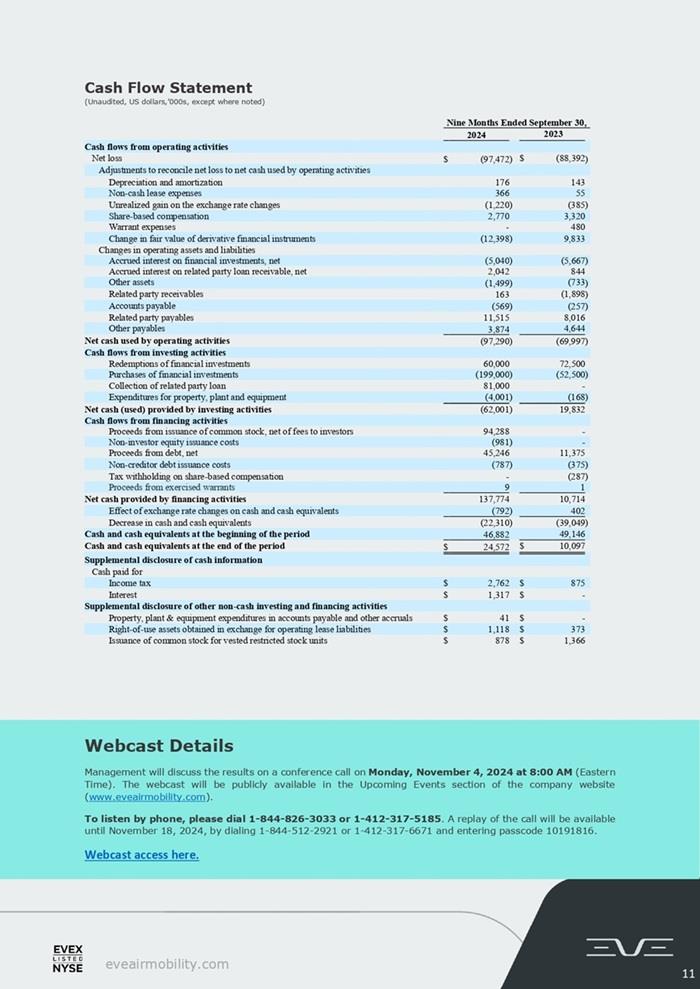

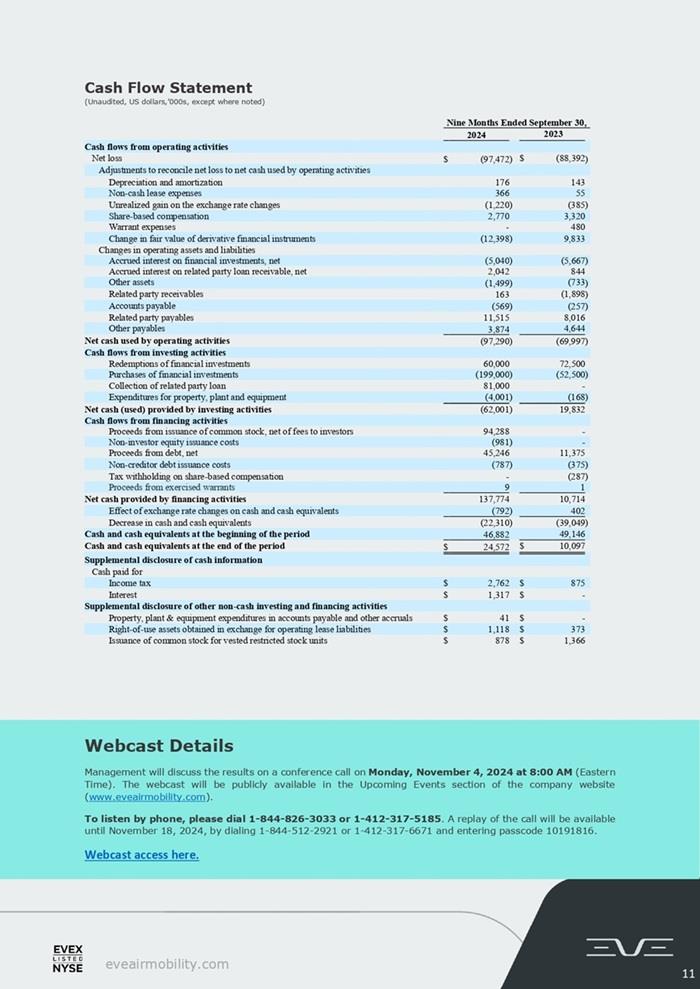

Cash Flow Statement

(Unaudited, US dollars,’000s, except where noted)

Webcast Details

Management will discuss the results on a conference call on Monday, November 4, 2024 at 8:00 AM (Eastern

Time). The webcast will be publicly available in the Upcoming Events section of the company website

(www.eveairmobility.com).

To listen by phone, please dial 1-844-826-3033 or 1-412-317-5185. A replay of the call will be available

until November 18, 2024, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 10191816.

Webcast access here.

Nine Months Ended September 30,

2024 2023

Cash flows from operating activities

Net loss $ (97,472) $ (88,392)

Adjustments to reconcile net loss to net cash used by operating activities

Depreciation and amortization 176 143

Non-cash lease expenses 366 55

Unrealized gain on the exchange rate changes (1,220) (385)

Share-based compensation 2,770 3,320

Warrant expenses - 480

Change in fair value of derivative financial instruments (12,398) 9,833

Changes in operating assets and liabilities

Accrued interest on financial investments, net (5,040) (5,667)

Accrued interest on related party loan receivable, net 2,042 844

Other assets (1,499) (733)

Related party receivables 163 (1,898)

Accounts payable (569) (257)

Related party payables 11,515 8,016

Other payables 3,874 4,644

Net cash used by operating activities (97,290) (69,997)

Cash flows from investing activities

Redemptions of financial investments 60,000 72,500

Purchases of financial investments (199,000) (52,500)

Collection of related party loan 81,000 -

Expenditures for property, plant and equipment (4,001) (168)

Net cash (used) provided by investing activities (62,001) 19,832

Cash flows from financing activities

Proceeds from issuance of common stock, net of fees to investors 94,288 -

Non-investor equity issuance costs (981) -

Proceeds from debt, net 45,246 11,375

Non-creditor debt issuance costs (787) (375)

Tax withholding on share-based compensation - (287)

Proceeds from exercised warrants 9 1

Net cash provided by financing activities 137,774 10,714

Effect of exchange rate changes on cash and cash equivalents (792) 402

Decrease in cash and cash equivalents (22,310) (39,049)

Cash and cash equivalents at the beginning of the period 46,882 49,146

Cash and cash equivalents at the end of the period $ 24,572 $ 10,097

Supplemental disclosure of cash information

Cash paid for

Income tax $ 2,762 $ 875

Interest $ 1,317 $ -

Supplemental disclosure of other non-cash investing and financing activities

Property, plant & equipment expenditures in accounts payable and other accruals $ 41 $ -

Right-of-use assets obtained in exchange for operating lease liabilities $ 1,118 $ 373

Issuance of common stock for vested restricted stock units $ 878 $ 1,366

eveairmobility.com

11

Upcoming Events

Eve senior management is scheduled to attend the following investor events:

Embraer Investor Day – New York (November 18)

UBS Global Industrials and Transportation Conference – Palm Beach, Fl. (December 2-4)

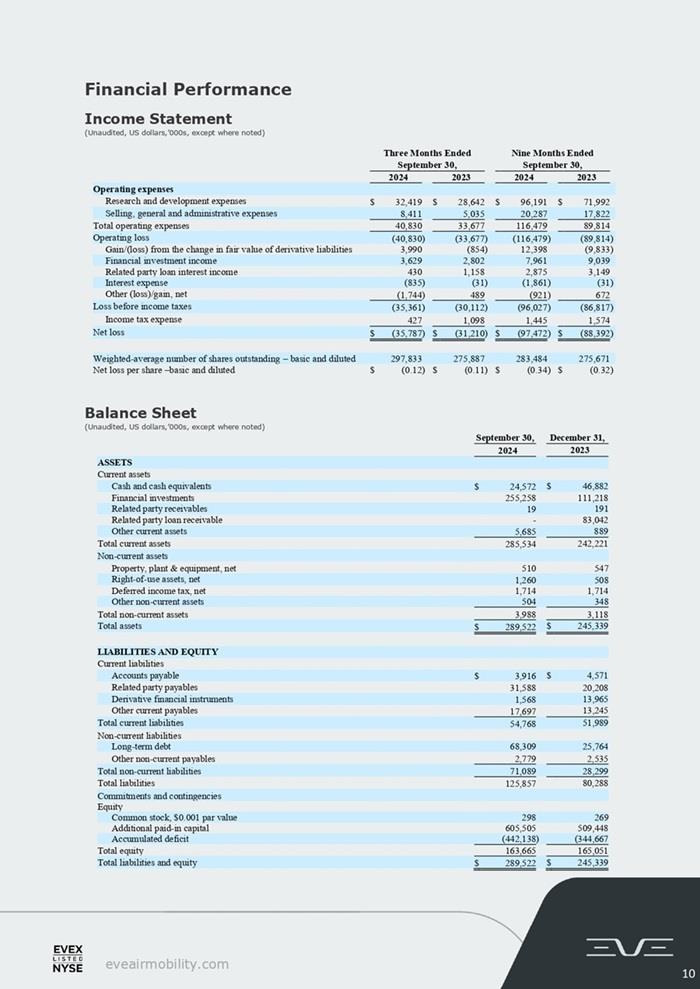

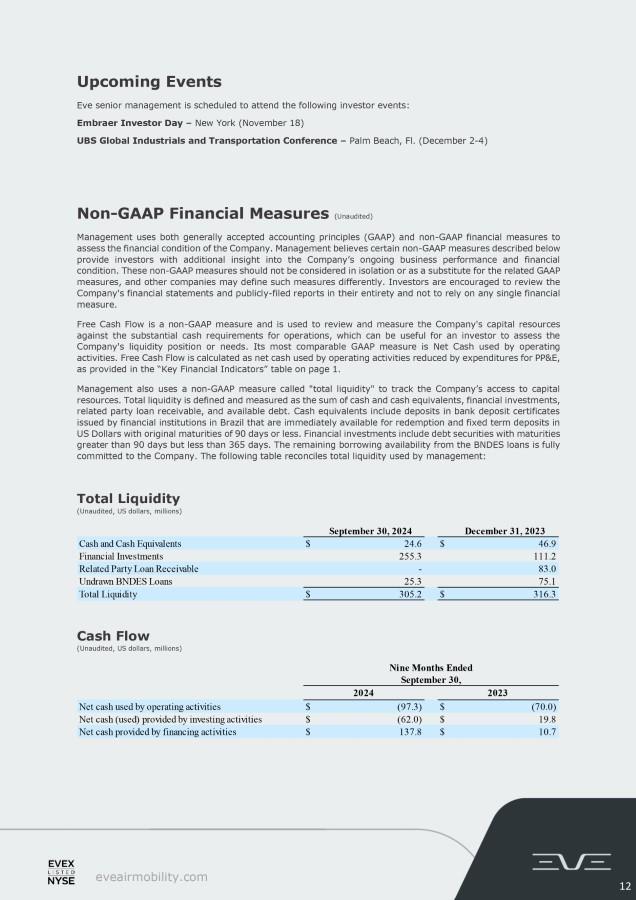

Non-GAAP Financial Measures (Unaudited)

Management uses both generally accepted accounting principles (GAAP) and non-GAAP financial measures to

assess the financial condition of the Company. Management believes certain non-GAAP measures described below

provide investors with additional insight into the Company’s ongoing business performance and financial

condition. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP

measures, and other companies may define such measures differently. Investors are encouraged to review the

Company's financial statements and publicly-filed reports in their entirety and not to rely on any single financial

measure.

Free Cash Flow is a non-GAAP measure and is used to review and measure the Company's capital resources

against the substantial cash requirements for operations, which can be useful for an investor to assess the

Company's liquidity position or needs. Its most comparable GAAP measure is Net Cash used by operating

activities. Free Cash Flow is calculated as net cash used by operating activities reduced by expenditures for PP&E,

as provided in the “Key Financial Indicators” table on page 1.

Management also uses a non-GAAP measure called "total liquidity" to track the Company’s access to capital

resources. Total liquidity is defined and measured as the sum of cash and cash equivalents, financial investments,

related party loan receivable, and available debt. Cash equivalents include deposits in bank deposit certificates

issued by financial institutions in Brazil that are immediately available for redemption and fixed term deposits in

US Dollars with original maturities of 90 days or less. Financial investments include debt securities with maturities

greater than 90 days but less than 365 days. The related party loan receivable from Embraer Aircraft Holdings,

Inc. has an original term of 12 months, is callable by the Company at any time, and can be extended upon mutual

written agreement by the parties. The remaining borrowing availability from the BNDES loans is fully committed

to the Company. The following table reconciles total liquidity used by management:

Total Liquidity

(Unaudited, US dollars, millions)

Cash Flow

(Unaudited, US dollars, millions)

September 30, 2024 December 31, 2023

Cash and Cash Equivalents $ 24.6 $ 46.9

Financial Investments 255.3 111.2

Related Party Loan Receivable - 83.0

Undrawn BNDES Loans 25.3 75.1

Total Liquidity $ 305.2 $ 316.3

Net cash used by operating activities $ (97.3) $ (70.0)

Net cash (used) provided by investing activities $ (62.0) $ 19.8

Net cash provided by financing activities $ 137.8 $ 10.7

eveairmobility.com

12

Glossary

ACMI – Aircraft, Crew, Maintenance and Insurance

AL – Airworthiness Limitations

AMP – Aircraft Maintenance Program

ANAC – Agência Nacional de Aviação Civil (National

Agency of Civil Aviation)

ATC – Air Traffic Control

ATM – Air Traffic Management

Capex – Capital expenditures are funds used by a

company to acquire, upgrade, and maintain physical

assets such as property, plants, buildings,

technology, or equipment

COGS – Cost of Goods Sold

ConOps – Concept of Operations

CPA – Capacity Purchase Agreements

DMC – Direct Maintenance Cost

EASA – European Union Aviation Safety Agency

EIS – Entry Into Service / Environment Impact

Statement

Embraer – A global aerospace company

headquartered in Brazil, Embraer has businesses in

Commercial and Executive aviation, Defense &

Security and Agricultural Aviation. The company

designs, develops, manufactures and markets

aircraft and systems, providing Services & Support

to customers after sales.

Embraer is the leading manufacturer of commercial

jets up to 150 seats and the main exporter of high

value-added goods in Brazil. The company maintains

industrial units, offices, service and parts distribution

centers, among other activities, across the Americas,

Africa, Asia and Europe.

eVTOL – electric Vertical Take Off and Landing

aircraft

FAA – Federal Aviation Administration

GAMA – General Aviation Manufacturers Association

IMC – Instrument Meteorological Conditions

LOI – Letter of Intent for new aircraft orders and/or

business partnership

MEL – Minimum Equipment List

MOU – Memorandum of Understanding

MPP – Master Phase Plan

MRB – Maintenance Review Board

MRO – Maintenance, Repair and Operations

MSA – Master Service Agreement

OEM – Original Equipment Manufacturer

PBH – Pay-by-the-hour contracts

PDP – Pre-Delivery Payment

POC – Proof of Concept

PSA – Product Support Agreements

QMS – Quality Management System

Research and Development (R&D) –Expenses

related to the development of technologies of our

eVTOL aircraft and UATM solutions

S&S MPP – Service and Support Master Phase Plan

SoS – System of Systems

SoSE – System-of-Systems Engineering

SVO – Simplified Vehicle operation

T&M – Time and Materials contracts

TRL – Technology Readiness Level

UAM – Urban Air Mobility

UAS – Unmanned Aircraft Systems

UATM – Urban Air Traffic Management

About Eve Holding, Inc.

Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed

by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a

holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global

services and support network and a unique air traffic management solution. Since May 10, 2022, Eve has been

listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the

tickers “EVEX” and “EVEXW”. The information on, or accessible through, any website referenced herein is not

incorporated by reference into, and is not a part of, this release.

eveairmobility.com

13

Forward Looking Statements

Certain statements contained in this release are forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as

“may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,”

“continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other

similar words or expressions. All statements, other than statements of historical facts, are forward-looking

statements, including, but not limited to, statements about the company’s plans, objectives, expectations,

outlooks, projections, intentions, estimates, and other statements of future events or conditions, including with

respect to all companies or entities named within. These forward-looking statements are based on the company’s

current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may

cause actual results and financial position and timing of certain events to differ materially from the information

in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth

herein as well as in Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of

Financial Condition and Results of Operations of the company’s most recent Annual Report on Form 10-K, Part

I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II,

Item 1A. Risk Factors of the company’s most recent Quarterly Report on Form 10-Q, and other risks and

uncertainties listed from time to time in the company’s other filings with the Securities and Exchange

Commission. Additionally, there may be other factors of which the company is not currently aware of that may

affect matters discussed in the forward-looking statements and may also cause actual results to differ materially

from those discussed. The company does not assume any obligation to publicly update or supplement any

forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting

these forward-looking statements, other than as required by law. Any forward-looking statements speak only as

of the date hereof or as of the dates indicated in the statement.

Investor Relations:

Lucio Aldworth

Caio Pinez

[email protected]

https://ir.eveairmobility.com/

Media:

[email protected]

14