Eve Holding, Inc.Second Quarter 2024Financial HighlightsEve Air Mobility is an aerospace company dedicated to the development of an eVTOL (electric Vertical Takeoff and Landing) aircraft and the Urban Air Mobility (UAM) ecosystem that includes aircraft development, Service & Operations Solutions and Vector, an Urban Air Traffic Management (Urban ATM) system. Eve is pre-revenue; we do not expect meaningful revenues, if any, during the development phase of our aircraft, and we expect financial results to be mostly related to costs associated with the program’s development during this period. Eve reported a net loss of $36.4 million in 2Q24 versus $31.4 million in 2Q23. Net loss increased due to higher Research & Development (R&D) – these are costs and activities necessary to advance in the development of our suite of products and solutions for UAM - despite a decrease in Selling, General & Administrative (SG&A) and a positive impact in the fair value of our outstanding derivatives. R&D expenses were $36.3 million in 2Q24, versus$21.8 million in 2Q23 and were primarily driven by the Master Services Agreement (MSA) with Embraer who performs several developmental activities for Eve. These efforts continue to intensify as the development of the eVTOL progresses, including the purchase of parts, assembly of our first full-scale prototype, and continued engineering, program development and testing infrastructure expenses.SG&A, decreased to $5.4 million in 2Q24, from $6.6 million in 2Q23, primarily driven by a combination of lower outsourced services and payroll costs – the latter reflect the forfeiture of Restricted Stock Units (RSUs) positively impacting SG&A during the quarter. Eve also reduced Director & Officers insurance expenses after renegotiating and lengthening terms with our provider. Lastly, Eve benefitted from the c.10% depreciation of the Brazilian Real BRL vs. the USD during the quarter, as most of SG&A expenses are incurred in Brazilian currency. The reduction in SG&A is despite an increase in Eve’s headcount, as well as industrialization and other costs associated with Eve’s Brazilian eVTOL manufacturing site, located in the city of Taubaté. The increase in R&D expenses was partly offset by a $2.1 million gain in 2Q24 related to the fair value of derivatives (due to marking to market of Eve’s private warrants), vs. a $6.8 million loss in 2Q23. Eve’s total cash used by operations and capital expenditures in 2Q24 was $31.4 million, versus $27.8 million in 2Q23. R&D expenses associated with Eve’s aircraft development were the main contributors to the higher cash consumption during the quarter.Lastly and subsequent to 2Q24, Eve entered into subscription agreements with financial and strategic investors, including Embraer, Space Florida and Nidec – our electric-motor supplier for $95.6 million in new equity financing. The additional funding will strengthen our Balance Sheet and will help support our operations and program investments in the upcoming years. Eve’s cash, cash equivalents, financial investments and related party loan receivable was $206.5 million and total liquidity** would have been $338.0 million as of June 30th, 2024.Key Financial IndicatorsUSD MILLIONS 2Q24 2Q23 1H24 1H23INCOME STATEMENT Research & Development (R&D) (36.3) (21.8) (63.8) (43.3)Selling, General & Administrative (SG&A) (5.4) (6.6) (11.9) (12.8)Change in fair value of derivative liabilities 2.1 (6.8) 8.4 (9.0) Interest Income / Other Non-Operating Expenses, net 3.7 4.1 6.6 8.4 Net Earnings / (Loss) (36.4) (31.4) (61.7) (57.2) CASH FLOW Net Cash Used in Operating Activities (30.8) (27.7) (66.6) (47.6) Net Additions to Property, Plant and Equipment (PP&E) (0.7) (0.1) (0.8) (0.2) Free Cash Flow* (31.4) (27.8) (67.3) (47.8) Net Cash (Used) Provided by Financing Activities 14.2 (0.3) 29.0 (0.3) 1H24 FY23 BALANCE SHEET Other Assets 8.1 4.2 Total Payables 51.3 40.6 Cash, Cash Equivalents, Financial Investments and Related Party Loan Receivable (Begin. of Period) 241.1 310.6 Cash, Cash Equivalents, Financial Investments and Related Party Loan Receivable (End of Period) 206.5 241.1 Total Debt 52.6 25.8 Total Liquidity** 244.5 316.3 * Free Cash Flow is a non-GAAP measure and includes Net Cash Used in Operating Activities, Net Additions to PP&E ** Total Liquidity is a non-GAAP measure and includes Cash, Cash Equivalents, Financial Investments, Related Party Loan Receivable and undrawn BNDES standby facility. Please see page 12 for reconcilliation eveairmobility.com1

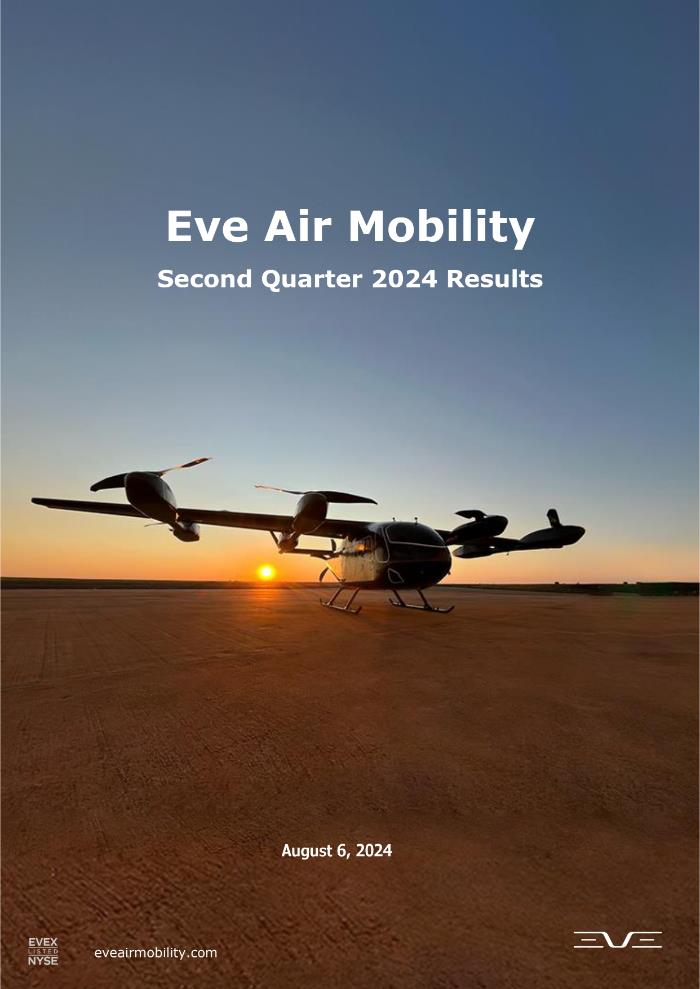

Milestones Checklist Eve continues to progress with its eVTOL development and testing phase, and has achieved key program milestones. The most important accomplishment during 2Q24 was the final assembly of our first full-scale prototype. On July 3rd it was unveiled during a special presentation for investors, customers and partners at the Embraer Gavião Peixoto site in Brazil, where it was constructed and will be tested later in the year. The rollout video was also presented at the Farnborough Air Show on July 22nd, 2024. In addition to having completed our prototype, we also announced during 2Q24 the selection of additional flight- critical component suppliers for our eVTOL. Lastly, Eve also secured additional Service & Operations Solutions contracts with customers that increases our revenue visibility as we enter into service, aided by Embraer’s heritage and global network.• Selection of eVTOL suppliers mostly concludedIn addition to selecting suppliers of flight-critical components earlier in the program – electric motors, energy management systems, propellers, thermal management systems, actuators, sensors, avionics, pilot controls, etc. Eve continues to select partners to supply components for our eVTOL. In early June 2024, we announced long- term agreements with four additional suppliers for structural components of our fuselage, doors and transparencies. The latest additions to our roster are KRD Luftfahrttechnik GmbH (KRD) for KASIGLAS® polycarbonate windows, Latecoere for the aircraft’s doors while, and RALLC and Alltec for fuselage components. In July 2024, Eve announced the selection of Diehl Aviation as the designer and producer of our eVTOL interior and ASE for the power distribution systems. Eve named earlier in the year KAI (Korea Aerospace Industries) for pylons, Aciturri for wing skin, spars and leading/trailing edges of the wing, Crouzet for pilot control – or joystick, and FACC for the horizontal and vertical tail. Overall, Eve has now selected and contracted most of the component suppliers for our eVTOL.• Definition of Certification Basis and Means of Compliance The certification basis definition is progressing with Brazil’s Civil Aviation Authority (ANAC) – Eve's primary certification authority, who completed the public commenting phase on March 15, 2024. The agency will now compile all comments to align requirements with comments made by the public, industry, other certifying authorities and Eve. We currently expect ANAC to publish the final certification basis later in 2024. eveairmobility.com 2

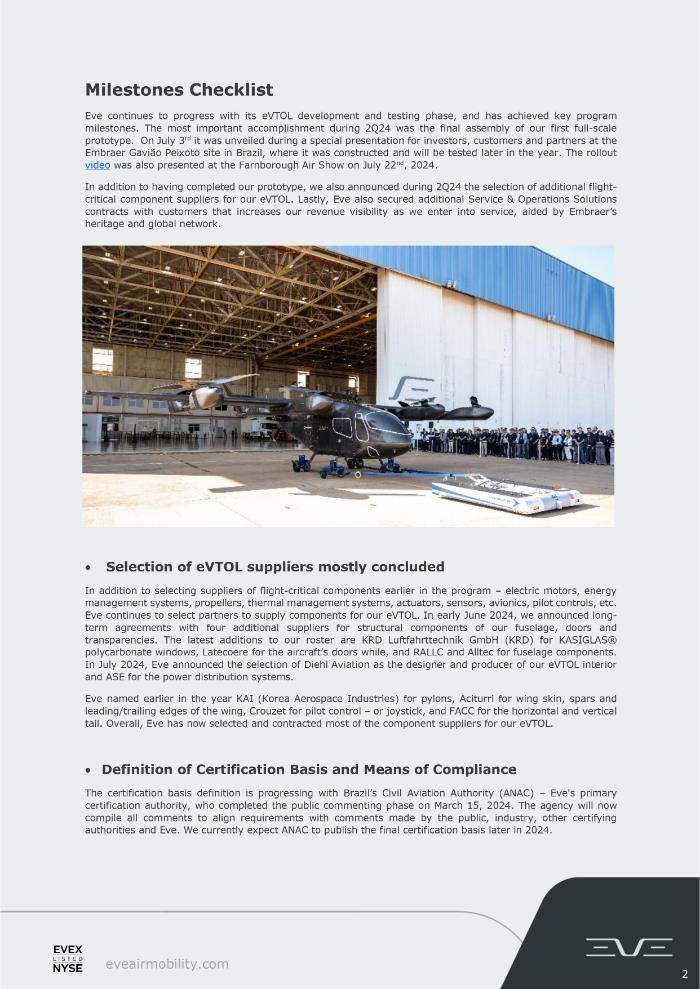

The certification basis defines the requirements to be complied with in order to receive Type Certification (TC) by the authorities, including the safety level of the eVTOL aircraft. The public commenting process allows for the general public to contribute to this definition, adding to the work pilots, engineers, regulatory experts, and representatives from Eve perform with the certification authority. The basis also includes requirements for the flight envelope to ensure stability and controllability of the vehicle in normal operation and the impacts of potential system failures. Additionally, it specifies how events such as bird and lightning strikes, as well as other external interferences, must be considered. This will establish the first set of airworthiness criteria for eVTOLs in Brazil and follows Eve’s application for TC in 2022. It is a standard process for developing a new certification basis and is an important milestone in the project. The next step will be for Eve and ANAC to define the Means of Compliance that specify in which manner Eve will show that each requirement is complied with. These can include analyses, simulations, and tests, among others, which are being carefully addressed considering the flight profile of the five prototypes available for Eve’s certification campaign. Once received, Eve plans to seek validation of the TC issued by ANAC by other authorities. The company formalized the validation with the U.S. Federal Aviation Administration (FAA) in 2023, which enables Eve to actively work with the FAA during the certification process with ANAC, pursuing the simultaneous issuance of each authority’s TC.• Conclude first airframe prototype assembly / initiate test campaignAs previously mentioned, our engineering team has completed the assembly of our first full- scale prototype in Embraer’s Gavião Peixoto facility. The prototype was officially presented to the public, investors, customers and partners at a July 3rd event, and a video of the event was unveiled at the Farnborough Air Show.The remote-controlled eVTOL will be used to validate the performance characteristics of the many tests we have performed over the years – either with sub-scale models, individual rigs, wind-tunnel or Computational Fluid Dynamics (CFD) tests to estimate lift, aerodynamic drag, sound emission, energy consumption, component vibration, etc. The findings will be used to further refine the commercial versions of the aircraft.Having said that, this initial prototype has electric and electronic harnesses – or cables, that connect the many sensors to the flight computer and control surfaces. Additionally, the carbon-fiber wing is made up of ribs – the “skeleton” that gives it a lightweight and robust structure and its aerodynamic shape, and spars – attachments to the fuselage. These are designed to be strong and flexible and support the weight of the aircraft safely considering the inherent in-flight stresses they will experience.We currently expect this prototype to be ready to initiate the flight-test campaign in late 2024, after we receive the electric motors and perform successful ground tests. These tests will assess various characteristics of the motors and substantiate our thrust and lift expectations vs. sound, emission and energy consumption estimates, among other metrics.eveairmobility.com3

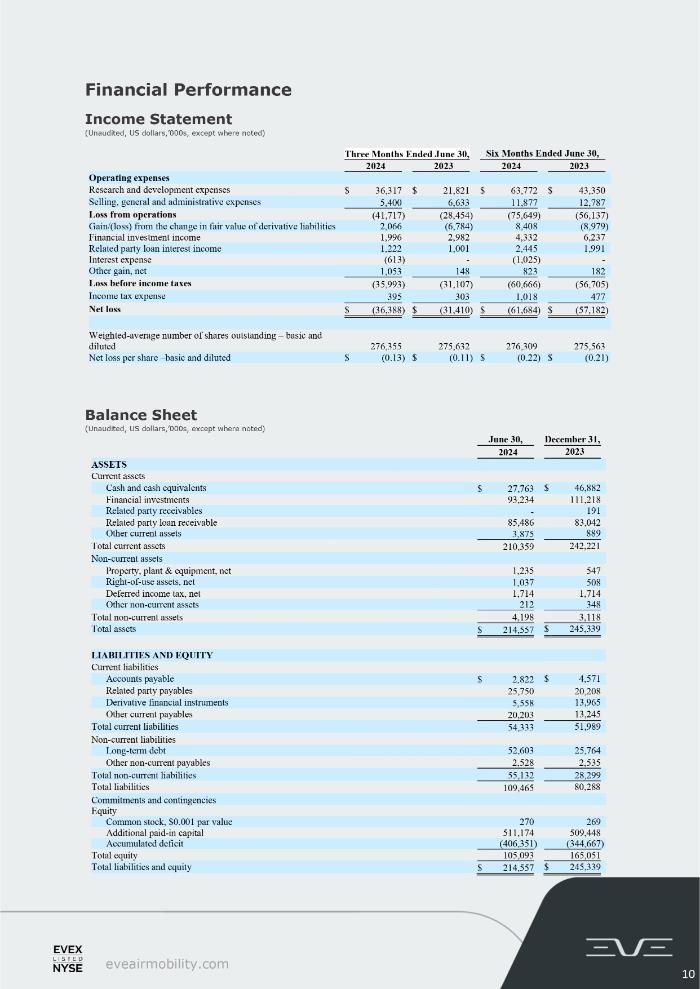

The empennage is also made up of composite materials – for a lightweight and reliable structure, and has imbedded harnesses and a rudder on each side. The empennage is reinforced, as it houses the dual in-line electric motors for the pusher. This will be used in the cruise phase of the flight and is driven by a 5-blade carbon-fiber propeller. Each of the aircraft’s propellers – including the eight rotors, were designed to optimize the thrust / energy consumption / sound emission equation.We have thoroughly tested several different propeller configurations with varying shapes, angles of attack and areas in our CFD models, as well as in custom-built motor-propeller rigs and a truck-mounted rig to help achieve optimal efficiency. Unlike the propeller in the pusher for horizontal flight, the rotors will have two blades. To reduce aerodynamic drag during the cruise flight, the lifter motors will be turned off, and the propellers will rest perpendicular to the wing once the aircraft has enough lift in the wing for airplane-like flight.Importantly, the prototype is fitted with four pylons – structures that are designed to support the entire weight of the aircraft, including passengers and luggage, during take-off and landing, as well as nacelles to house the motors. During take-off and landing, the lifters will provide thrust for vertical flight, and the pylons will push the eVTOL up and control it during descent. They must be robust, lightweight and flexible. Each pylon has an electric propulsion system at the front and one at the rear. Lastly, the composite “skin” of the fuselage has been installed in multiple panels. It is comprised of custom-made carbon-fiber parts that were designed to be easily removed to facilitate access to any internal component. Engineers will have easy access to the battery pack, flight computers and all other flight-critical electric and electronic systems for maintenance, downloading of telemetry and repairs. The prototype will be piloted remotely from inside a custom-built truck that is designed to track the prototype’s flight path, with minimal latency between the pilot and the aircraft. The flight-test campaign will be conducted at Embraer’s Gavião Peixoto site, home of its military division, parts of the executive aviation assembly line and the largest runway in the southern hemisphere. This is a 5-kilometer (3.1 miles) long, 95-meter (312 feet) wide structure designed to test a wide variety of aircraft. The prototype is also equipped with sensors and high-definition, strategically placed cameras to provide real-time diagnostics for the flight-rehearsal engineering team. The prototype aircraft has similar dimensions to popular helicopters that also have a capacity for four passengers. With a wingspan of 50ft (15.2m) and a 11ft (3.3m) cabin length, it was designed to fit in most of the currently available helipads. As a non-conforming aircraft, the prototype does not have all the systems, subsystems and redundancies that will be present in the 5 prototypes that we plan to build for the certification campaign – scheduled to initiate next year, and subsequently the commercial versions of the aircraft.Eve’s eVTOL aircraft will utilizes eight dedicated propellers for vertical flight and fixed wings to fly in cruise, with no change in the position of the components during flight. The aircraft will include an electric pusher powered by dual electric motors that provide propulsion redundancy, with the goal of ensuring the highest levels of performance and safety. The aircraft is designed to offer numerous advantages including a lower cost of operation, fewer parts, and optimized structures and systems, and is being developed to offer efficient thrust with low sound emission.The 5-conforming prototypes will be extensively tested and used to accumulate hours to be counted towards our certification campaign. We expect to initiate our first prototype tests in late 2024 and intensify our flight test campaign with the additional prototypes beginning in 2025.Eve’s eVTOL aircraft utilizes a lift+cruise configuration with eight dedicated propellers for vertical flight and fixed wings to fly in cruise, with no change in the position of these components during flight. Our aircraft includes an electric pusher powered by dual electric motors that provide propulsion redundancy to ensure the highest levels of performance and safety.eveairmobility.com4

• Initiate configuration of eVTOL factory Last year, we selected a former Embraer site in the city of Taubaté, São Paulo – Brazil, to house our first production site, with a total expected output of up to 480 units/year. We are planning on expanding the site’s capacity on a modular basis, with four equally-sized modules with a capacity for 120 units/year, for a disciplined and capital-efficient investment approach. In late 2024, we intend to start preparing the facility to accommodate our initial production efforts. While this will require specialized tooling and equipment for the manufacturing process of eVTOLs, as well as some civil construction and an upgrade of facilities for aircraft and equipment tests, the building itself is complete and already operational. By leveraging on one of Embraer’s sites in Brazil – rather than having to build a new site from the ground up, we believe we will manage to implement relatively quick and inexpensive upgrade efforts.• Operating cash consumption production site, Eve expects a total cash consumption between $130 and $170 million in 2024. This compares to $59.9 million invested in the program in 2022 and $94.7 million in 2023. As of 2Q24, Eve has deployed $67.3 million in the program. The additional program activities will require an increase in the number of engineering hours – via our MSA with Embraer as well as direct Eve personnel, and the acquisition of raw materials and parts/components for our prototypes. Additionally, we will increase engagement with selected suppliers and receive equipment during the remainder of 2024. This will trigger additional cash consumption in the coming months.While we continue to expect sequentially higher investments and expenses in the quarters ahead due to intensifying engineering engagement as well as potential supplier payments, we are confident that our capital resources and liquidity – which includes our recent capital raise of $95.6 million, will be sufficient to fund our operations, design and certification efforts through multiple years ahead.Latest HighlightsEve Names Suppliers for eVTOL Interior and Power Distribution SystemOn July 21, and before the Farnborough Air Show, Eve announced it had named Diehl Aviation as the designer and producer of interior and ASE as the supplier for the power distribution system for the company’s eVTOL aircraft.Diehl Aviation, an industry leader in the design, development and production of integrated solutions for aircraft cabin, was selected to design and produce the interior of Eve’s eVTOL aircraft. Diehl will work closely with Eve’s engineering and design team to turn the company’s vision for an innovative and comfortable cabin into a reality to deliver the best flight experience for passengers.ASE, a world-class supplier of electrical power systems for aerospace and defense industry, will develop and produce the Primary High Voltage Power Distribution System, the Primary Low Voltage Power Distribution System and the High Voltage DC-DC converter which will connect the two systems aboard the eVTOL. ASE has consolidated experience in design, development, integration, production and support of electrical power systems for multiple types of aircraft.eveairmobility.com5

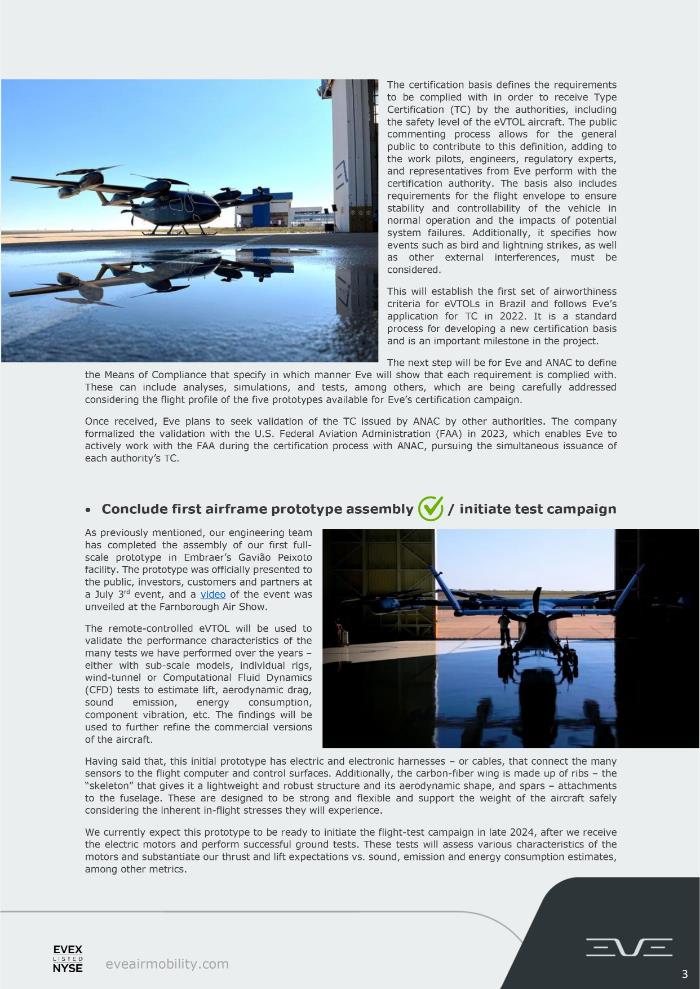

Eve Announces $95.6M in New Equity to Support eVTOL DevelopmentIn late June and early July 2024, Eve entered into subscription agreements with multiple investors for $95.6M in new equity financing. The funding, which includes the issuance of new shares of common stock and warrants, includes participation from a diverse group of global industrial companies that includes Embraer, Nidec and additional financial investors. We believe the new funding will strongly position the company for future success and will support the continued development and manufacturing of the company’s eVTOL.Concurrently, Eve continues to develop a comprehensive portfolio of agnostic services and operations solutions, including Vector, a unique Urban Air Traffic Management software to optimize and scale Advanced Air Mobility operations worldwide.Eve Names Suppliers for Windows, Doors, and Fuselage ComponentsEve announced on June 5th four additional suppliers for its eVTOL.KRD Luftfahrttechnik GmbH (KRD) will supply its KASIGLAS® polycarbonate windows, Latecoere will supply the aircraft’s doors, while RALLC and Alltec will both supply fuselage components. KRD, which is headquartered in Germany, will supply custom designed KASIGLAS windows including the cockpit and passenger door windows. Each window has been developed for extreme durability, and their polycarbonate construction will not only minimize the weight of each window but provide additional protection including increased impact resistance.Latecoere, headquartered in France, will supply the doors for Eve’s eVTOL aircraft. As the world’s leading independent manufacturer of aircraft doors, the company has been recognized for its extremely high standards of safety and performance. Latecoere supports multiple aircraft manufacturers, including Embraer, and provides design and development, production, certification and in-service support for all of their doors.RALLC and Alltec, both headquartered in Brazil, were selected to supply various fuselage components. RALLC is a supplier that covers all stages of the manufacturing processes for structural components, providing integrated and innovative solutions for several aerospace companies including Embraer.eveairmobility.com6

Alltec specializes in the development and production of components and subassemblies in high-performance composite materials for the aeronautical, defense and security markets. With nearly 30 years of experience, the company, recognized for its expertise, is also a supplier to Embraer. Alltec will supply its thermoplastic composite and thermosetting composite technologies for the fuselage of the eVTOL.Eve and Saudia Technic Sign MOA to Explore MRO Activities and eVTOL Reassembly in Saudi Arabia On May 21st, Eve and Saudia Technic, the leading MRO service provider in the Middle East, announced during the third edition of the Future Aviation Forum in Riyadh, Saudi Arabia, the signature of a Memorandum of Agreement (MoA) to explore the potential demand of Maintenance, Repair and Overhaul (MRO) activities for eVTOL aircraft in the region. The agreement includes eVTOL MRO training and the evaluation of the infrastructure requirements and processes for the potential reassembly of Eve’s eVTOL in Saudi Arabia. The collaboration with Eve marks a significant milestone in Saudia Technic’s quest for innovation.Saudia Technic stressed the strategic fit of the agreement with Eve Air Mobility and Saudia Technic’s vision and national aviation strategy. It highlights the transformative impact of their MRO++ approach, which modernizes maintenance practices with a comprehensive solution covering all aspects of aircraft maintenance. Through initiatives like ST Nova™, Saudia Technic boosts its service capabilities and paves the way for future innovations.In addition to the eVTOL development, Eve has also been developing several solutions to support its customers from Day 1, from services and support to network optimization with Vector, Eve’s Urban Air Traffic Management (Urban ATM) software designed to safely address the unique air traffic and network management challenges of current and future Advanced Air Mobility (AAM) operations, focusing on fleet and vertiport operators, and future service providers for AAM, including Air Navigation Service Providers (ANSPs).Eve Named a Member of Japan’s Advanced Air Mobility Public-Private CommitteeOn April 30th, Eve was named a member of Japan’s Advanced Air Mobility (AAM) Public-Private Committee. The committee is responsible for evaluating and making recommendations to the Japanese Ministry of Economy, Trade & Industry and Ministry of Land, Infrastructure, Transport & Tourism on AAM regulations & policies for Japan.eveairmobility.com7

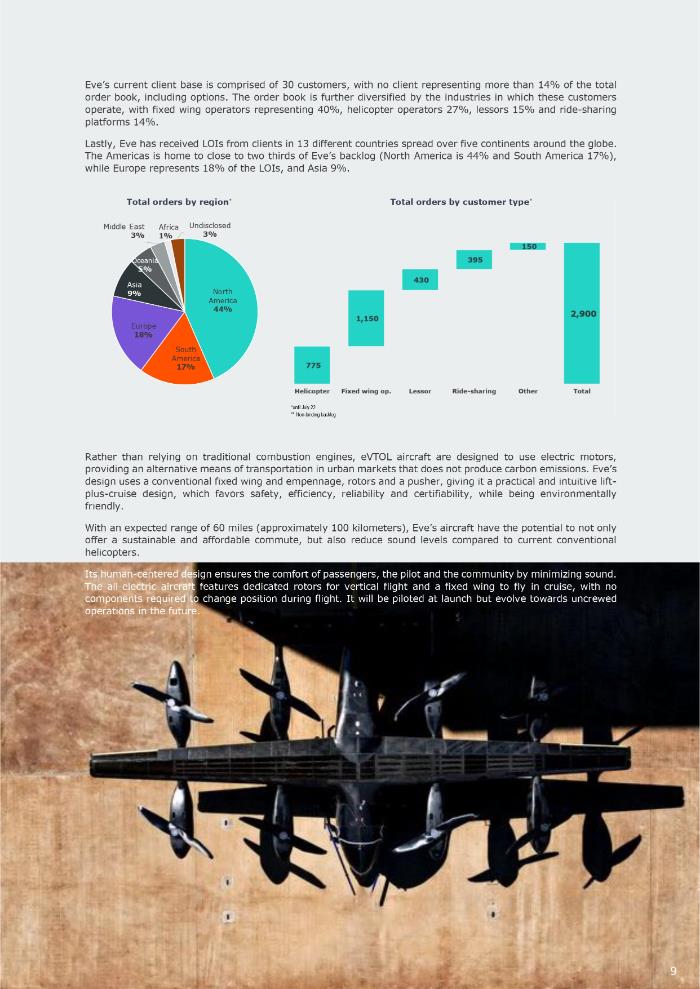

Established in 2018, the committee is made up of selected members who discuss the development of various AAM services such as passengertransportation, scenic flights, and air ambulance services throughout Japan. Prior to Eve being selected, the company presented an overview of how it could support and contribute as a member of the committee. With the most diverse customer base in the industry, Eve will bring its global perspective and expertise to help contribute to advancements being made to develop the AAM industry in Japan. Eve’s official induction into the Japan Advanced Air Mobility Public-Private Committee is expected to expand Japan public’s knowledge of Eve and help continue to advance the company’s reputation in the country. Backlog, Order PipelineServices & Operations SolutionsEve is replicating elements of Embraer’s proven business model, namely the design, manufacturing, and sale of aircraft. In addition, Eve will also provide MRO services on an agnostic basis worldwide. With that, Eve is uniquely positioned to serve its customers by leveraging Embraer’s global presence with local support and has secured non-binding contracts for Services & Operations Solutions across the world with 14 customers. Combined, these customers have placed Letters of Intent (LOI) for approximately 1,100 of our eVTOLs. These contracts include MRO, training, battery services, data integration and spare parts solutions, as well as component repair. These functions will be enhanced by a Memorandum of Understanding (MOU) signed with DHL Supply Chain to optimize supply chain to service centers. The MOU will also focus on batteries and the specific requirements for transporting, storing, and disposing of those devices. These non-binding Service & Operations Solutions contracts are estimated to bring potential revenues of $1,2 billion during the first five years of vehicle operation, and because of our agnostic approach to the maintenance business, Service & Operations Solutions revenues could precede the first delivery of our eVTOL.Lastly, and in addition to eVTOL sales and Service and Operations solutions, Eve is also engaged in developing Vector, and has signed LOIs from 17 customers globally.eVTOL OrdersCurrently, Eve’s order pipeline totals 2,900 units, with a total non-binding backlog value of approximately $14.5 billion. This value is based on a list price methodology, vs. the reference price previously used and is a common practice in the aviation industry and incorporates internal and external factors to define a standard price. Eve will not disclose specific deal prices and will use the list price as a reference for future transaction values. Our initial order pipeline is based on non-binding LOIs and is therefore subject to change, consistent with customary aviation practices.eveairmobility.com8

Eve’s current client base is comprised of 30 customers, with no client representing more than 14% of the total order book, including options. The order book is further diversified by the industries in which these customers operate, with fixed wing operators representing 40%, helicopter operators 27%, lessors 15% and ride-sharing platforms 14%. Lastly, Eve has received LOIs from clients in 13 different countries spread over five continents around the globe. The Americas is home to close to two thirds of Eve’s backlog (North America is 44% and South America 17%), while Europe represents 18% of the LOIs, and Asia 9%. Total orders by region*Middle EastAfricaUndisclosedRather than relying on traditional combustion engines, eVTOL aircraft are designed to use electric motors, providing an alternative means of transportation in urban markets that does not produce carbon emissions. Eve’s design uses a conventional fixed wing and empennage, rotors and a pusher, giving it a practical and intuitive lift- plus-cruise design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly.With an expected range of 60 miles (approximately 100 kilometers), Eve’s aircraft have the potential to not only offer a sustainable and affordable commute, but also reduce sound levels compared to current conventional helicopters.

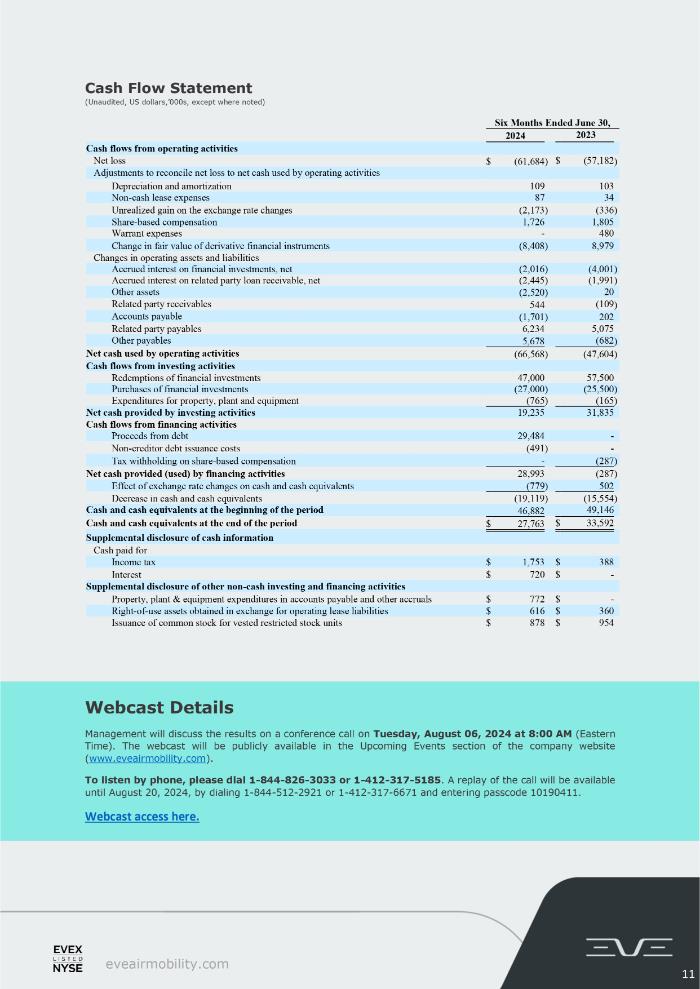

Financial Performance Income Statement (Unaudited, US dollars,’000s, except where noted)Three Months Ended June 30, Six Months Ended June 30, 2024 2023 2024 2023 Operating expenses Research and development expenses $ 36,317 $ 21,821 $ 63,772 $ 43,350 Selling, general and administrative expenses 5,400 6,633 11,877 12,787 Loss from operations (41,717) (28,454) (75,649) (56,137) Gain/(loss) from the change in fair value of derivative liabilities 2,066 (6,784) 8,408 (8,979) Financial investment income 1,996 2,982 4,332 6,237 Related party loan interest income 1,222 1,001 2,445 1,991 Interest expense (613) - (1,025) - Other gain, net 1,053 148 823 182 Loss before income taxes (35,993) (31,107) (60,666) (56,705) Income tax expense 395 303 1,018 477 Net loss $ (36,388) $ (31,410) $ (61,684) $ (57,182) Weighted-average number of shares outstanding – basic and diluted 276,355 275,632 276,309 275,563 Net loss per share –basic and diluted $ (0.13) $ (0.11) $ (0.22) $ (0.21) Balance Sheet (Unaudited, US dollars,’000s, except where noted) June 30, December 31, 2024 2023 ASSETS Current assets Cash and cash equivalents $ 27,763 $ 46,882 Financial investments 93,234 111,218 Related party receivables - 191 Related party loan receivable 85,486 83,042 Other current assets 3,875 889 Total current assets 210,359 242,221 Non-current assets Property, plant & equipment, net 1,235 547 Right-of-use assets, net 1,037 508 Deferred income tax, net 1,714 1,714 Other non-current assets 212 348 Total non-current assets 4,198 3,118 Total assets $ 214,557 $ 245,339 LIABILITIES AND EQUITY Current liabilities Accounts payable $ 2,822 $ 4,571 Related party payables 25,750 20,208 Derivative financial instruments 5,558 13,965 Other current payables 20,203 13,245 Total current liabilities 54,333 51,989 Non-current liabilities Long-term debt 52,603 25,764 Other non-current payables 2,528 2,535 Total non-current liabilities 55,132 28,299 Total liabilities 109,465 80,288 Commitments and contingencies Equity Common stock, $0.001 par value 270 269 Additional paid-in capital 511,174 509,448 Accumulated deficit (406,351) (344,667) Total equity 105,093 165,051 Total liabilities and equity $ 214,557 $ 245,339 eveairmobility.com 10

Cash Flow Statement (Unaudited, US dollars,’000s, except where noted) Six Months Ended June 30, 2024 2023 Cash flows from operating activities Net loss $ (61,684) $ (57,182) Adjustments to reconcile net loss to net cash used by operating activities Depreciation and amortization 109 103 Non-cash lease expenses 87 34 Unrealized gain on the exchange rate changes (2,173) (336) Share-based compensation 1,726 1,805 Warrant expenses - 480 Change in fair value of derivative financial instruments (8,408) 8,979 Changes in operating assets and liabilities Accrued interest on financial investments, net (2,016) (4,001) Accrued interest on related party loan receivable, net (2,445) (1,991) Other assets (2,520) 20 Related party receivables 544 (109) Accounts payable (1,701) 202 Related party payables 6,234 5,075 Other payables 5,678 (682) Net cash used by operating activities (66,568) (47,604) Cash flows from investing activities Redemptions of financial investments 47,000 57,500 Purchases of financial investments (27,000) (25,500) Expenditures for property, plant and equipment (765) (165) Net cash provided by investing activities 19,235 31,835 Cash flows from financing activities Proceeds from debt 29,484 - Non-creditor debt issuance costs (491) - Tax withholding on share-based compensation - (287) Net cash provided (used) by financing activities 28,993 (287) Effect of exchange rate changes on cash and cash equivalents (779) 502 Decrease in cash and cash equivalents (19,119) (15,554) Cash and cash equivalents at the beginning of the period 46,882 49,146 Cash and cash equivalents at the end of the period $ 27,763 $ 33,592 Supplemental disclosure of cash information Cash paid for Income tax $ 1,753 $ 388 Interest $ 720 $ - Supplemental disclosure of other non-cash investing and financing activities Property, plant & equipment expenditures in accounts payable and other accruals $ 772 $ - Right-of-use assets obtained in exchange for operating lease liabilities $ 616 $ 360 Issuance of common stock for vested restricted stock units $ 878 $ 954 Webcast DetailsManagement will discuss the results on a conference call on Tuesday, August 06, 2024 at 8:00 AM (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-844-826-3033 or 1-412-317-5185. A replay of the call will be available until August 20, 2024, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 10190411. Webcast access here.eveairmobility.com11

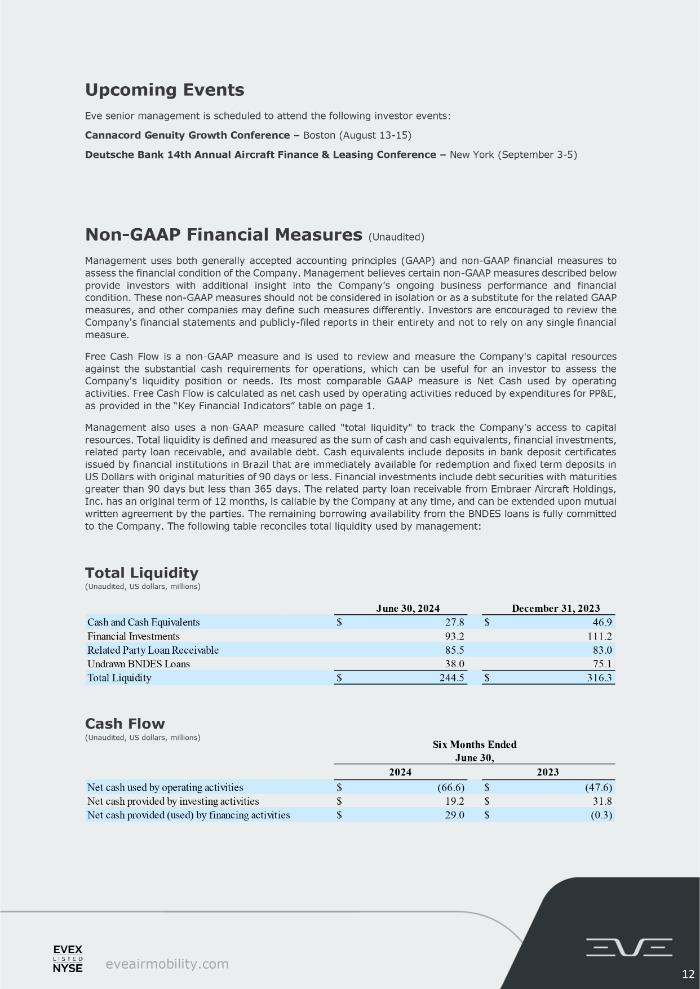

Upcoming Events Eve senior management is scheduled to attend the following investor events: Cannacord Genuity Growth Conference – Boston (August 13-15) Deutsche Bank 14th Annual Aircraft Finance & Leasing Conference – New York (September 3-5)Non-GAAP Financial Measures (Unaudited) Management uses both generally accepted accounting principles (GAAP) and non-GAAP financial measures to assess the financial condition of the Company. Management believes certain non-GAAP measures described below provide investors with additional insight into the Company’s ongoing business performance and financial condition. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. Investors are encouraged to review the Company's financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. Free Cash Flow is a non-GAAP measure and is used to review and measure the Company's capital resources against the substantial cash requirements for operations, which can be useful for an investor to assess the Company's liquidity position or needs. Its most comparable GAAP measure is Net Cash used by operating activities. Free Cash Flow is calculated as net cash used by operating activities reduced by expenditures for PP&E, as provided in the “Key Financial Indicators” table on page 1. Management also uses a non-GAAP measure called "total liquidity" to track the Company’s access to capital resources. Total liquidity is defined and measured as the sum of cash and cash equivalents, financial investments, related party loan receivable, and available debt. Cash equivalents include deposits in bank deposit certificates issued by financial institutions in Brazil that are immediately available for redemption and fixed term deposits in US Dollars with original maturities of 90 days or less. Financial investments include debt securities with maturities greater than 90 days but less than 365 days. The related party loan receivable from Embraer Aircraft Holdings, Inc. has an original term of 12 months, is callable by the Company at any time, and can be extended upon mutual written agreement by the parties. The remaining borrowing availability from the BNDES loans is fully committed to the Company. The following table reconciles total liquidity used by management:Total Liquidity(Unaudited, US dollars, millions) June 30, 2024 December 31, 2023 Cash and Cash Equivalents $ 27.8 $ 46.9 Financial Investments 93.2 111.2 Related Party Loan Receivable 85.5 83.0 Undrawn BNDES Loans 38.0 75.1 Total Liquidity $ 244.5 $ 316.3 Cash Flow (Unaudited, US dollars, millions) Six Months Ended June 30, 2024 2023 Net cash used by operating activities $ (66.6) $ (47.6) Net cash provided by investing activities $ 19.2 $ 31.8 Net cash provided (used) by financing activities $ 29.0 $ (0.3)eveairmobility.com12

Glossary ACMI – Aircraft, Crew, Maintenance and Insurance AL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência Nacional de Aviação Civil (National Agency of Civil Aviation) ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Entry Into Service / Environment Impact Statement Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation AdministrationGAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Conditions LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Pre-Delivery Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) –Expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air MobilityUAS – Unmanned Aircraft Systems UATM – Urban Air Traffic ManagementAbout Eve Holding, Inc.Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global services and support network and a unique air traffic management solution. Since May 10, 2022, Eve has been listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”. The information on, or accessible through, any website referenced herein is not incorporated by reference into, and is not a part of, this release.eveairmobility.com13

Forward Looking Statements Certain statements contained in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words or expressions. All statements, other than statements of historical facts, are forward-looking statements, including, but not limited to, statements about the company’s plans, objectives, expectations, outlooks, projections, intentions, estimates, and other statements of future events or conditions, including with respect to all companies or entities named within. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of the company’s most recent Annual Report on Form 10-K, Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors of the company’s most recent Quarterly Report on Form 10-Q, and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware of that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements, other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.Investor Relations:Lucio Aldworth Caio Pinez Matt [email protected] https://ir.eveairmobility.com/Media:[email protected]