Eve Air Mobility First Quarter 2024 Results May 07, 2024

Eve Holding, Inc. First Quarter 2024 Financial Highlights Eve Air Mobility is an aerospace company dedicated to the development of an eVTOL (electric Vertical Takeoff and Landing) aircraft and the Urban Air Mobility (UAM) ecosystem that includes the aircraft development, Service & Operations Solutions and an Urban Air Traffic Management (Urban ATM) system. Eve is pre-revenue; we do not expect meaningful revenues, if any, during the development phase of our aircraft, and we expect financial results to be mostly related to costs associated with the program’s development during this period. Eve reported a net loss of $25.3 million in 1Q24 versus $25.8 million in 1Q23. Net loss decreased despite higher Research & Development (R&D) – costs and activities necessary to advance in the development of our suite of products and solutions for UAM, and Selling, General & Administrative (SG&A) expenses. R&D expenses were $27.5 million in 1Q24, versus $21.5 million in 1Q23 and are primarily driven by the Master Services Agreement (MSA) with Embraer that performs several developmental activities for Eve. These efforts continue to intensify as the development of the eVTOL progresses, including the purchase of parts, assembly of our first full-scale prototype, and continued engineering, program development and testing infrastructure.SG&A, in the meantime, rose to $6.5 million in 1Q24, from $6.2 million in 1Q23, as a result primarily of an increase in Eve’s headcount as well as industrialization and other costs associated with the Brazilian eVTOL site (Taubate facility). At the same time, Eve incurred lower other expenses in 1Q24 vs. 1Q23. The increase in R&D and SG&A expenses was partly offset by a $6.3 million gain in 1Q24 related to the fair value of derivatives (due to marking to market of Eve’s warrants), vs. a $2.2 million loss in 1Q23. Eve’s total cash used by operations and capital expenditures in 1Q24 was $35.9 million, versus $19.9 million in 1Q23. R&D expenses associated with Eve’s aircraft development were the main contributors to the higher cash consumption during the quarter. Key Financial Indicators

Milestones Checklist Eve continues to advance its eVTOL development and testing phase and make strides toward key program milestones. The main achievement is the quick progress in the assembly of our first full-scale prototype. Up until now, Eve focused on solidifying our eVTOL development program with the selection of all flight-critical component suppliers, defining the final architecture and commencing the assembly of our first full-scale eVTOL prototype. Additionally, Eve secured Service & Operations Solutions contracts with customers that improve our revenue visibility as we enter into service aided by the Embraer heritage and global network.Lastly, we continue to advance on Vector – our Urban Air Traffic Management (UATM) solution. The software will be used to help safely scale UAM globally. Selection of eVTOL suppliers mostly concluded Following the selection of suppliers of flight-critical components – electric motors, energy management systems, propellers, thermal management systems, actuators, sensors, avionics, pilot controls, etc., Eve is finalizing the supplier’s selection with expected upcoming announcements on the electrical distribution system, currency converters, skids and landing gear, cabin interior and doors, lighting, and transparencies, among others. The latest addition to our roster is KAI (Korea Airspace Industries), who will provide the pylons in our eVTOL. These are key components of the airframe that provide support for the electric power units and eight lift propellers.Earlier in the year, Eve named Aciturri to supply wing skin, spars and leading/trailing edges of the wing and Crouzet for pilot control – or joystick, and FACC for the horizontal and vertical tail. In total, Eve has already selected and contracted the vast majority of flight-critical component suppliers of our eVTOL. Definition of Certification Basis and Means of Compliance The certification basis definition is progressing with Brazil’s Civil Aviation Authority (ANAC) – Eve's primary certification authority, who completed the public commenting phase on March 15, 2024. The agency will now compile all comments to align requirements with comments made by the public, industry, other certifying authorities and Eve. We expect ANAC to publish the final certification basis in 2024, in a timing consistent with the evolution of the program. The certification basis defines the requirements to be complied with in order to receive the Type Certification (TC) by the authorities, including the safety level of eVTOL aircraft. The public commenting process allows for the general public to contribute to this definition, adding to the work pilots, engineers, regulatory experts, and representatives from Eve perform with the certification authority. The basis also includes requirements for the flight envelope to ensure stability and controllability of the vehicle in normal operation and the impacts of potential system failures in these vehicle characteristics. Additionally, it specifies how events such as bird and lightning strikes and other external interference must be considered. This will establish the first set of airworthiness criteria for eVTOLs in Brazil and follows Eve’s application for TC in 2022. It is a standard process for developing a new certification basis and is an important milestone in the project. The next step will be for Eve and ANAC to define the Means of Compliance that specify in which manner the company will show that each requirement is complied with. These can include analysis, simulations, and tests, among others, which are being carefully addressed considering the flight profile of the five prototypes available for Eve’s certification campaign. Once received, EVE will seek validation of the TC issued by ANAC by other authorities. The company formalized the validation with the U.S. Federal Aviation Administration (FAA) in 2023, which enables Eve to actively work with the FAA during the certification process with ANAC, pursuing the simultaneous issuance of each authority’s

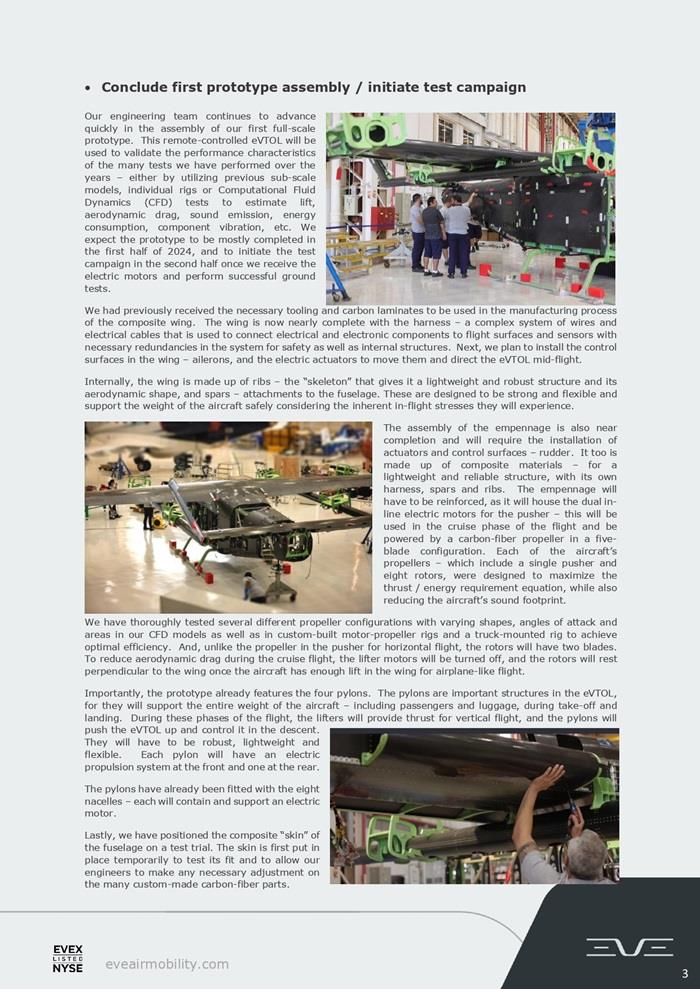

Conclude first prototype assembly / initiate test campaign Our engineering team continues to advance quickly in the assembly of our first full-scale prototype. This remote-controlled eVTOL will be used to validate the performance characteristics of the many tests we have performed over the years – either by utilizing previous sub-scale models, individual rigs or Computational Fluid Dynamics (CFD) tests to estimate lift, aerodynamic drag, sound emission, energy consumption, component vibration, etc. We expect the prototype to be mostly completed in the first half of 2024, and to initiate the test campaign in the second half once we receive the electric motors and perform successful ground tests. We had previously received the necessary tooling and carbon laminates to be used in the manufacturing process of the composite wing. The wing is now nearly complete with the harness – a complex system of wires and electrical cables that is used to connect electrical and electronic components to flight surfaces and sensors with necessary redundancies in the system for safety as well as internal structures. Next, we plan to install the control surfaces in the wing – ailerons, and the electric actuators to move them and direct the eVTOL mid-flight. Internally, the wing is made up of ribs – the “skeleton” that gives it a lightweight and robust structure and its aerodynamic shape, and spars – attachments to the fuselage. These are designed to be strong and flexible and support the weight of the aircraft safely considering the inherent in-flight stresses they will experience.The assembly of the empennage is also near completion and will require the installation of actuators and control surfaces – rudder. It too is made up of composite materials – for a lightweight and reliable structure, with its own harness, spars and ribs. The empennage will have to be reinforced, as it will house the dual in-line electric motors for the pusher – this will be used in the cruise phase of the flight and be powered by a carbon-fiber propeller in a five-blade configuration. Each of the aircraft’s propellers – which include a single pusher and eight rotors, were designed to maximize the thrust / energy requirement equation, while also reducing the aircraft’s sound footprint. We have thoroughly tested several different propeller configurations with varying shapes, angles of attack and areas in our CFD models as well as in custom-built motor-propeller rigs and a truck-mounted rig to achieve optimal efficiency. And, unlike the propeller in the pusher for horizontal flight, the rotors will have two blades. To reduce aerodynamic drag during the cruise flight, the lifter motors will be turned off, and the rotors will rest perpendicular to the wing once the aircraft has enough lift in the wing for airplane-like flight. Importantly, the prototype already features the four pylons. The pylons are important structures in the eVTOL, for they will support the entire weight of the aircraft – including passengers and luggage, during take-off and landing. During these phases of the flight, the lifters will provide thrust for vertical flight, and the pylons will push the eVTOL up and control it in the descent. They will have to be robust, lightweight and flexible. Each pylon will have an electric propulsion system at the front and one at the rear. The pylons have already been fitted with the eight nacelles – each will contain and support an electric motor.Lastly, we have positioned the composite “skin” of the fuselage on a test trial. The skin is first put in place temporarily to test its fit and to allow our engineers to make any necessary adjustment on the many custom-made carbon-fiber parts.

Once adjustments are made – and all internal electric and electronic structures are in place, the skin will be permanently installed. The aircraft will have similar dimensions to popular helicopters that also have a capacity for four passengers. With a wingspan of 50ft (15.2m), 11ft (3.3m) cabin length, it was designed to fit in most of the currently available helipads. We plan to build up to five additional prototypes with all the redundancies, systems and physical characteristics that will be present in the commercial versions of our aircraft. These will be extensively tested and used to accumulate hours to be counted towards our certification campaign. We expect to initiate our first prototype tests in the second half of 2024 and intensify our flight test campaign with the additional prototypes in 2025. Eve’s eVTOL aircraft utilizes a lift+cruise configuration with eight dedicated propellers for vertical flight and fixed wings to fly on cruise, with no change in the position of these components during flight. Our concept includes an electric pusher powered by dual electric motors that provide propulsion redundancy to ensure the highest levels of performance and safety. While offering numerous advantages such as lower cost of operation, fewer parts, optimized structures and systems, it has been developed to offer efficient thrust with low sound.

Initiate configuration of eVTOL factory Last year, we selected a former Embraer site in the city of Taubaté, São Paulo – Brazil, to house our first production site, with total expected output of up to 480 units/year. We are planning on expanding the site’s capacity on a modular basis, with four equally-sized modules with capacity for 120 units/year, for a disciplined and capital-efficient investment approach and intend to start preparing the facility to accommodate our initial production efforts throughout the year. While this will require specialized tooling and equipment for the manufacturing process of eVTOLs, as well as some civil construction and upgrade of facilities for aircraft and equipment tests, the building itself is complete and already operational. This should translate into relatively quick and inexpensive upgrade efforts. Operating cash consumption With intensifying program development efforts, continued supplier selection, assembly of our prototypes, and necessary investments in the production site, Eve expects a total cash consumption between $130 and $170 million in 2024. This compares to $59.9 million invested in the program in 2022 and $94.7 million in 2023. As of 1Q24, Eve has deployed $35.9 million in the program. The additional program activities will require an increase in the number of engineering hours – via our MSA with Embraer as well as direct Eve personnel, and the acquisition of raw materials and parts/components for our prototypes. Additionally, we will increase engagement with selected suppliers and receive equipment during the remainder of 2024 – this will trigger additional cash consumption in the coming months. While we continue to expect sequentially higher investments and expenses in the quarters ahead due to intensifying engineering engagement as well as potential supplier payments, we are confident that our current liquidity is sufficient to fund our operations, design and certification efforts through 2025.

Latest Highlights Eve Air Mobility and AirX Inc. Sign Letter of Intent for up to 50 eVTOLs, Service Support and Urban ATM Software On April 17, Eve announced it had signed a letter of intent with AirX Inc., Japan’s largest public helicopter air charter service, for up to 10 firm and up to 40 optional electric vertical takeoff and landing (eVTOL) aircraft. The order will support the continued development and scaling of innovative transportation operations in Japan. AirX is a pioneer of advanced air mobility in Japan and a digital platform company offering a total solution of charter services to the Japanese public via AIROS Skyview. AirX announced the launch of the Greater Tokyo Area’s first eVTOL test field, the UAM Centre. This innovative initiative builds on AirX's rich history of offering unique aerial experiences through AIROS Skyview since 2015, marking a significant milestone in the company’s journey towards sustainable and accessible urban air mobility (UAM). The UAM Centre is set to revolutionize air travel in the Tokyo metropolitan area, showcasing the company’s commitment to innovation and the future of transportation. The Asia-Pacific region is an important market for Eve Air Mobility. The company continues to build diverse relationships and work with its customers and potential customers to bring a new mode of transportation to help ease traffic congestion in the region. In addition to Japan, Eve is already working closely with customers and operators in Australia, India and South Korea among other locations. As the company works with local partners, its goal is to collaboratively build UAM ecosystems with its operating partners in each of the intended launch communities and is sharing information insights as discussions continue. Eve Air Mobility Names KAI as Supplier for eVTOL Pylons On April 14, Eve named Korea Aerospace Industries Ltd. (KAI), as supplier for its electric vertical takeoff and landing aircraft’s pylons. Pylons are a key component of the airframe that provide support for the aircraft’s electric power units and eight lift propellers. During the past 30 years, KAI has supplied major aerostructure components to global aircraft manufacturers, including Embraer for its E-Jet E2 model. The agreement marks KAI’s formal entry into the advanced air mobility (AAM) market. Last year, KAI CEO Goo Young Kang designated space and future air mobility as the company’s core future businesses through its 2050 vision declaration. KAI recently announced a significant investment in production infrastructure with the goal of growing its market share in the rapidly growing AAM market going forward. KAI is the latest supplier for Eve’s eVTOL to be named by Eve. In February, Eve named Aciturri (wing skin, spars and leading/trailing edges of the wing) and Crouzet (pilot controls) as suppliers. In January, Eve announced that Thales would supply sensors and a computer, while Honeywell would supply guidance, navigation and external lighting. RECARO Aircraft Seating was selected to supply the eVTOL’s seats and FACC will supply the horizontal and vertical tail including the rudder and elevator. In 2023, Eve selected Garmin to supply the aircraft’s avionics, Liebherr-Aerospace to supply the flight controls actuators and Intergalactic to provide the thermal management system. The company also named Nidec Aerospace, LLC, a joint venture between Nidec and Embraer, to provide the electric propulsion system, BAE Systems to provide the energy storage system and Duc Hélice Propellers to supply the rotors and propeller.

Eve Air Mobility Presents Vector and Provides Updates on the Urban ATM Software Development On March 19, Eve released at the Airspace World in Geneva the name of its Urban Air Traffic Management (Urban ATM) software and provided updates on the solution’s development. Vector will be an agnostic software solution designed to safely address the unique air traffic and network management challenges of current and future Advanced Air Mobility (AAM) operations, focusing on fleet and vertiport operators, and future service providers for AAM, including Air Navigation Service Providers (ANSPs). The company is advancing towards an operational version of the software which customers can test and trial to help progress the market. Vector will allow eVTOLs to be integrated with other aircraft flying in low-level urban airspace from day 1 of operations and provide the automation needed to enable Urban Air Mobility (UAM) market scalability. To date, Eve has 16 customers for the solution, including fleet operators, vertiports and airspace and flow management providers. With Vector, eVTOL operators will make their operations more efficient; vertiports will manage resource availability with all operation stakeholders involved and ANSPs and Providers of Services (PSU) for UAM will optimize the airspace and air traffic network for all users.

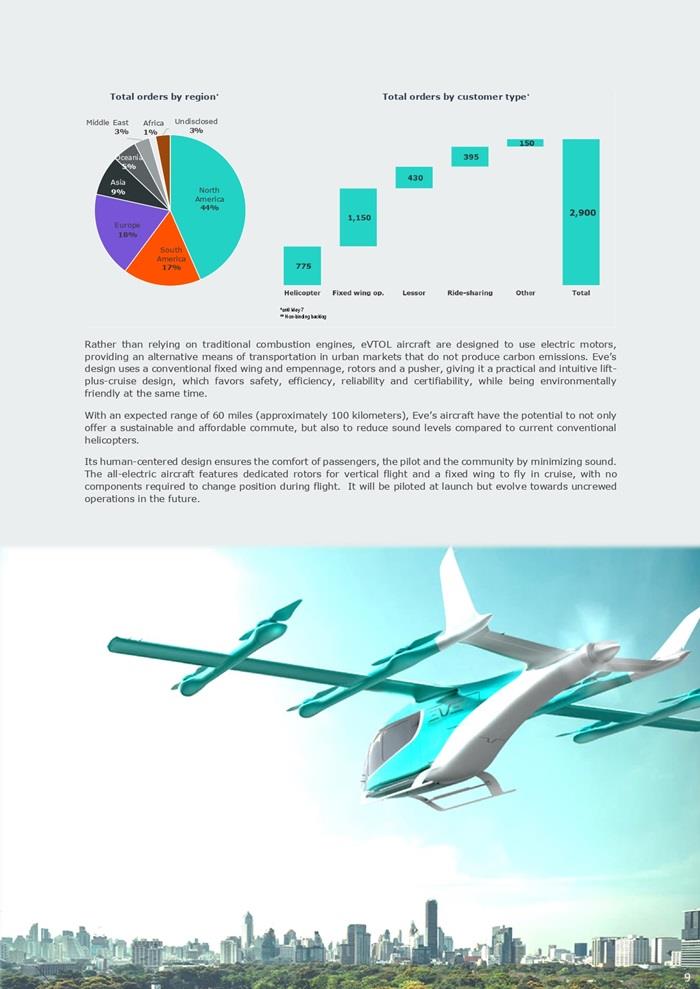

In November 2023, Eve partnered with Flexjet to conduct a simulation to validate and refine Vector’s capabilities under real-scenario conditions and better understand the software's commercial viability and applications. The simulation took place in the UK and involved 18 flights across eight aerodromes, exercising 26 different routes with alternative landing locations to test the standby flight plan functionality. The team also tested delays at departure and destination with impacts on incoming flights, flight cancellations due to airspace and weather constraints, and in-flight emergencies, including alternative landing location requests. The Eve-Flexjet simulation found gaps between current ATM systems and those required to support UAM operations from Day 1, such as the lack of integration between fleet and vertiport operator systems to coordinate eVTOL flights safely and efficiently. Therefore, Eve is prioritizing the development of services that address these gaps, including integrated flight planning with airspace and vertiport resource availability, management of alternate landing locations built into the flight planning to support the endurance limitations of electric aircraft, and conformance management to inform stakeholders when flights deviate from their plan and may affect other flights. As Vector matures, Eve continues to pursue additional opportunities to trial the solution with its customers and partners. Testing it in real-world scenarios is the best way to ensure the services provide optimal value. The company expects this year to advance towards an operational version of the software which customers can test and trial to help advance the market and prepare the UAM ecosystem for initial operations. Watch Vector’s video here. Backlog, Order Pipeline Services & Operations Solutions Eve is replicating elements of Embraer’s proven business model, namely the design, manufacturing, and sale of aircraft. In addition, Eve will also provide Maintenance, Repair and Overhaul (MRO) services on an agnostic basis worldwide. With that, Eve is uniquely positioned to serve its customers by leveraging Embraer’s global presence with local support and has secured non-binding contracts for Services & Operations Solutions across the world with 12 customers. Combined, these customers have placed Letters of Intent (LOI) for approximately 1,000 of our eVTOLs. These contracts include MRO, training, battery services, data integration and spare parts solutions, as well as component repair. These functions will be enhanced by a Memorandum of Understanding (MOU) signed with DHL Supply Chain to optimize supply chain to service centers. The MOU will also focus on batteries and the specific requirements for transporting, storing, and disposing of those devices. These non-binding Service & Operations Solutions contracts are estimated to bring potential revenues of $935 million during the first five years of the vehicle operation and because of our agnostic approach to the maintenance business, Service & Operations Solutions revenues could precede the first delivery of our eVTOL. Lastly, and in addition to eVTOL sales and Service and Operations solutions, Eve is also engaged in developing Vector, and has signed LOIs from 16 customers globally. eVTOL Orders Currently, Eve’s order pipeline totals 2,900 units with a total non-binding backlog value of approximately $14.5 billion. This value is now based on a list price methodology, versus the reference price previously used, and is a common practice in the aviation industry incorporating different internal and external factors to define a more standard price practiced in the sector. Eve will not disclose specific deal prices and will use the list price as a reference for future transaction values. Our initial order pipeline is based on non-binding LOIs and therefore subject to change, consistent with common aviation practices. Eve’s current client base is comprised of 30 customers, with no client representing more than 14% of the total order book, including options. The order book is further diversified by the industries in which these customers operate, with airlines representing 40%, helicopter operators 27%, lessors 15% and ride-sharing platforms 14%. Lastly, Eve has received LOIs from clients in 13 different countries spread over five continents across the globe. The Americas is home to close to two thirds of Eve’s backlog (North America is 44% and South America 17%), while Europe represents 18% of the LOIs, and Asia 9%.

Rather than relying on traditional combustion engines, eVTOL aircraft are designed to use electric motors, providing an alternative means of transportation in urban markets that do not produce carbon emissions. Eve’s design uses a conventional fixed wing and empennage, rotors and a pusher, giving it a practical and intuitive lift-plus-cruise design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly at the same time.

With an expected range of 60 miles (approximately 100 kilometers), Eve’s aircraft have the potential to not only offer a sustainable and affordable commute, but also to reduce sound levels compared to current conventional helicopters. Its human-centered design ensures the comfort of passengers, the pilot and the community by minimizing sound. The all-electric aircraft features dedicated rotors for vertical flight and a fixed wing to fly in cruise, with no components required to change position during flight. It will be piloted at launch but evolve towards uncrewed operations in the future.

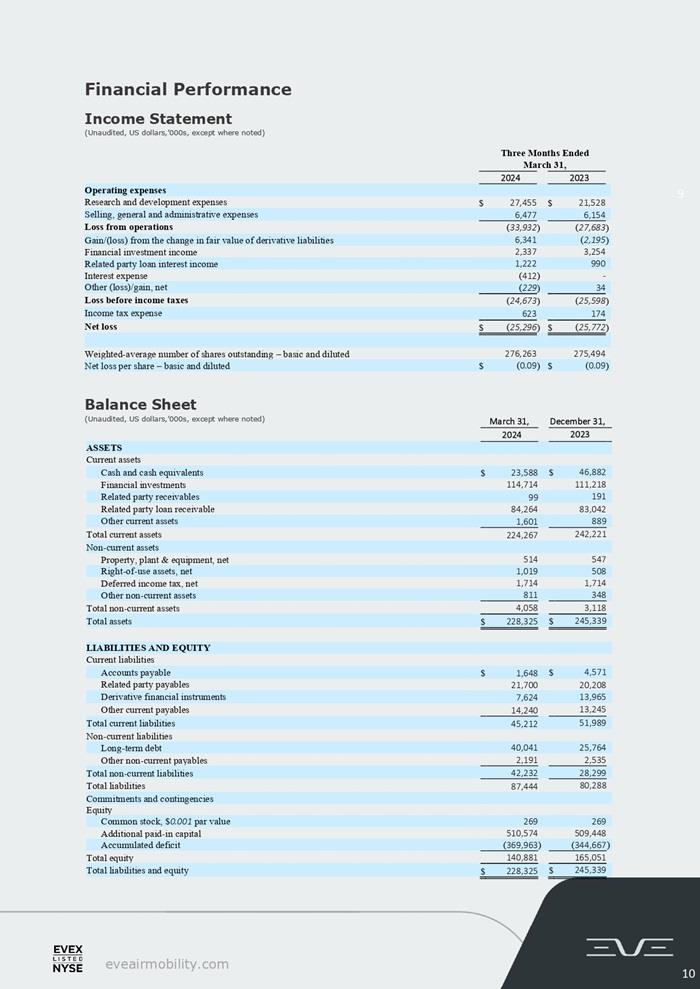

Financial Performance

Income Statement (Unaudited, US dollars,’000s, except where noted)

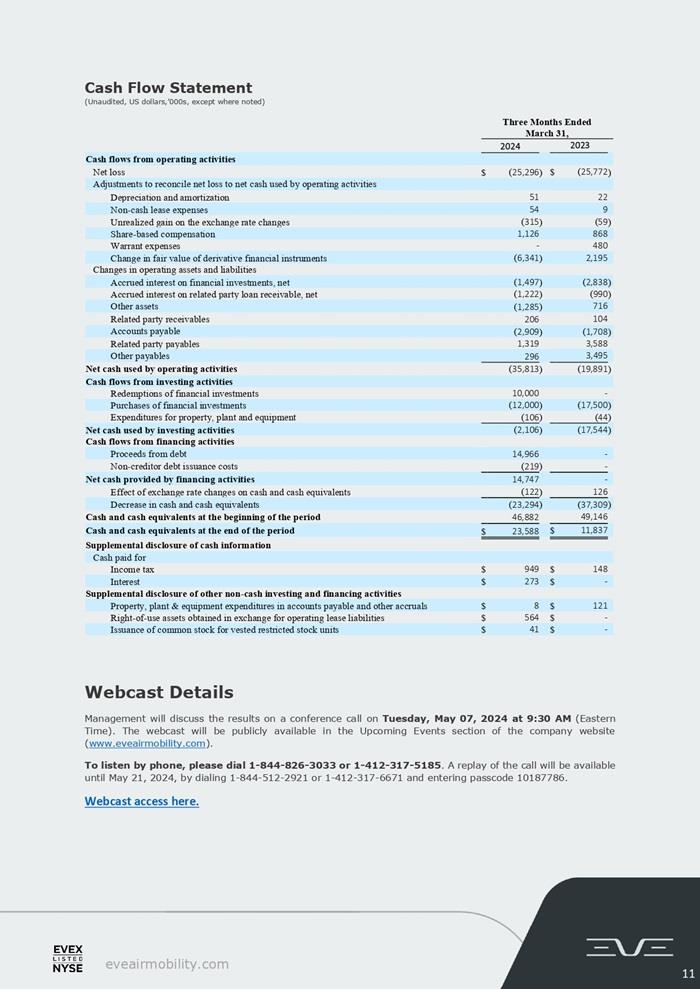

Cash Flow Statement (Unaudited, US dollars,’000s, except where noted) Webcast Details Management will discuss the results on a conference call on Tuesday, May 07, 2024 at 9:30 AM (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-844-826-3033 or 1-412-317-5185. A replay of the call will be available until May 21, 2024, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 10187786. Webcast access here.

Upcoming Events

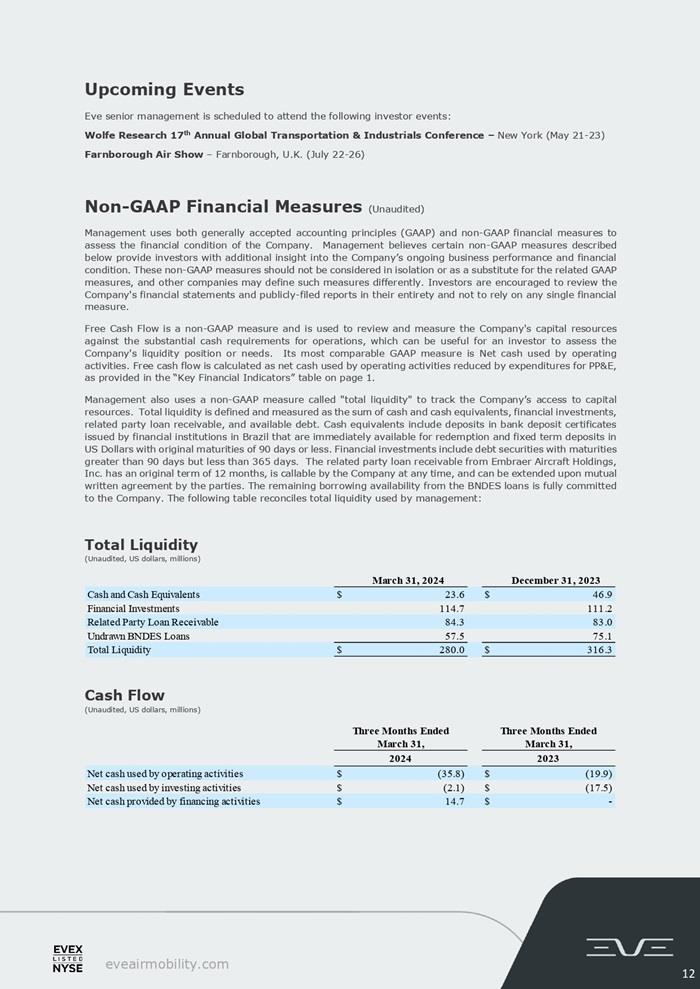

Eve senior management is scheduled to attend the following investor events: Wolfe Research 17th Annual Global Transportation & Industrials Conference – New York (May 21-23) Farnborough Air Show – Farnborough, U.K. (July 22-26) Non-GAAP Financial Measures (Unaudited) Management uses both generally accepted accounting principles (GAAP) and non-GAAP financial measures to assess the financial condition of the Company. Management believes certain non-GAAP measures described below provide investors with additional insight into the Company’s ongoing business performance and financial condition. These non-GAAP measures should not be considered in isolation or as a substitute for the related GAAP measures, and other companies may define such measures differently. Investors are encouraged to review the Company's financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure.

Free Cash Flow is a non-GAAP liquidity measure and is used to review and measure the Company's capital resources against the substantial cash requirements for operations, which can be useful for an investor to assess the Company's liquidity position or needs. Its most comparable GAAP measure is Net cash used by operating activities. Free cash flow is calculated as net cash used by operating activities reduced by expenditures for PP&E, as provided in the “Key Financial Indictors” table on page 1. Management also uses a non-GAAP measure called "total liquidity" to track the Company’s access to capital resources. Total liquidity is defined and measured as the sum of cash and cash equivalents, financial investments, related party loan receivable, and available debt. Cash equivalents include deposits in bank deposit certificates issued by financial institutions in Brazil that are immediately available for redemption and fixed term deposits in US Dollars with original maturities of 90 days or less. Financial investments include debt securities with maturities greater than 90 days but less than 365 days. The related party loan receivable from Embraer Aircraft Holdings, Inc. has an original term of 12 months, is callable by the Company at any time, and can be extended upon mutual written agreement by the parties. The remaining borrowing availability from the BNDES loans is fully committed to the Company. The following table reconciles total liquidity used by management: Total Liquidity (Unaudited, US dollars, millions)

Glossary ACMI – Aircraft, Crew, Maintenance and InsuranceAL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência Nacional de Aviação Civil (National Agency of Civil Aviation) ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Entry Into Service / Environment Impact Statement Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation Administration GAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Condition LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Pre-Delivery Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) –Expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air Mobility UAS – Unmanned Aircraft Systems UATM – Urban Air Traffic Management About Eve Holding, Inc. Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global services and support network and a unique air traffic management solution. Since May 10, 2022, Eve has been listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”.

Forward Looking Statements Certain statements contained in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words or expressions. All statements, other than statements of historical facts, are forward-looking statements, including, but not limited to, statements about the company’s plans, objectives, expectations, outlooks, projections, intentions, estimates, and other statements of future events or conditions, including with respect to all companies or entities named within. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of the company’s most recent Annual Report on Form 10-K, Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors of the company’s most recent Quarterly Report on Form 10-Q, and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware of that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements, other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. Investor Relations: Lucio Aldworth Caio Pinez Matt Walters [email protected] https://ir.eveairmobility.com/ Media: [email protected]