U.S. SECURITIES AND EXCHANGE COMMISSION

|

Washington, D.C. 20549 |

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to Rule 14a-12

Eve Holding, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (Check the appropriate box):

☒ No fee required

☐ Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(4) and 0-11

Eve Holding, Inc.

1400 General Aviation Drive

Melbourne, FL 32935

April 9, 2024

Dear Stockholder:

You are cordially invited to attend Eve Holding, Inc.’s 2024 Annual Meeting of Stockholders on Thursday, May 23, 2024, at 10:00 a.m., Eastern Time. The 2024 Annual Meeting of Stockholders will be held in a virtual format online at https://www.cstproxy.com/eveholding/2024.

The matters to be acted on at the 2024 Annual Meeting of Stockholders are described in the enclosed notice and proxy statement.

Your vote is important to us. Even if you plan on attending the 2024 Annual Meeting of Stockholders, we encourage you to vote your shares in advance to ensure that your vote will be represented at the meeting. To vote in advance of the meeting, you may vote online, as instructed in the attached proxy statement, or by completing, signing and returning the proxy card that is provided. You may revoke your proxy at any time before your shares are voted at the 2024 Annual Meeting of Stockholders. See the attached proxy statement for more detailed information.

We look forward to receiving your proxy and we appreciate your support of Eve Holding.

| Sincerely, | |

| /s/ Johann Christian Jean Charles Bordais | |

| Johann Christian Jean Charles Bordais | |

| Chief Executive Officer |

Eve Holding, Inc.

1400 General Aviation Drive

Melbourne, FL 32935

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 23, 2024

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Eve Holding, Inc. (the “Company”) to be held on Thursday, May 23, 2024, at 10:00 a.m., Eastern Time, online at https://www.cstproxy.com/eveholding/2024.

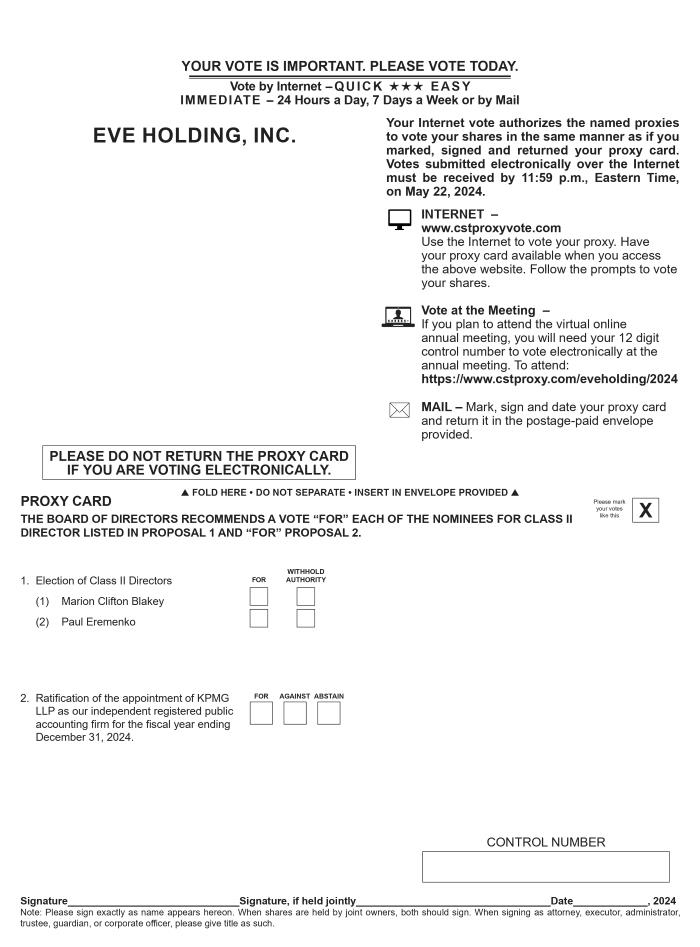

At the Annual Meeting, stockholders will be invited to consider and vote upon the following matters:

- Election of two Class II directors to serve for a three-year term of office expiring at the 2027 annual meeting of stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, disqualification or removal;

- Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

- Any other matter that properly comes before the Annual Meeting.

The foregoing items of business are more fully described in the proxy statement accompanying this Notice of Annual Meeting of Stockholders.

The board of directors has fixed the close of business on April 3, 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination during ordinary business hours for 10 days prior to the Annual Meeting at our principal executive office at 1400 General Aviation Drive, Melbourne, FL 32935. Your vote is very important to the Company and all proxies are being solicited by the board of directors. So, whether or not you plan on attending the Annual Meeting, we encourage you to submit your proxy as soon as possible (i) by accessing https://www.cstproxy.com/eveholding/2024 or (ii) by signing, dating and returning a proxy card or instruction form provided to you. By submitting your proxy promptly, you will save the Company the expense of further proxy solicitation. Please note that all votes cast online must be cast prior to 11:59 p.m., Eastern Time, on May 22, 2024.

| By Order of the Board of Directors, | |

| /s/ Simone Galvão de Oliveira | |

| Simone Galvão de Oliveira | |

| Secretary |

April 9, 2024

Melbourne, Florida

Eve Holding, Inc.

1400 General Aviation Drive

Melbourne, FL 32935

PROXY STATEMENT

Unless the context otherwise requires, all references in this proxy statement to “we,” “us,” “our” or “Company” refer to Eve Holding, Inc. and its subsidiaries following the business combination between Zanite Acquisition Corp. (“Zanite”) and EVE UAM, LLC that was consummated on May 9, 2022 (the “business combination”), as applicable.

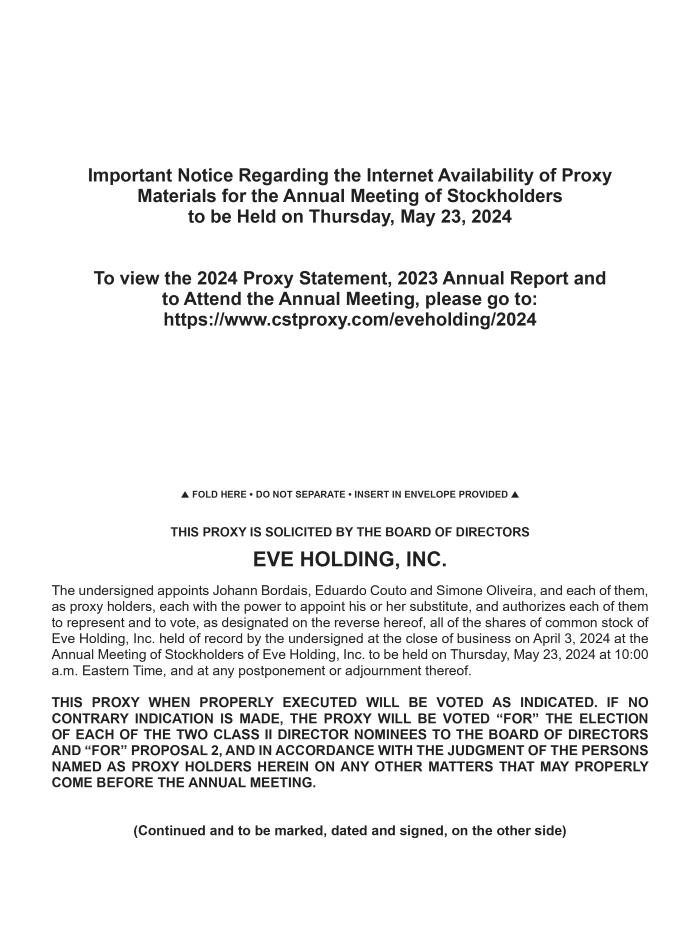

Internet Availability of Proxy Materials

We are furnishing our proxy materials to stockholders of Eve Holding, Inc. in connection with the solicitation of proxies for use at the 2024 Annual Meeting of Stockholders of the Company (the “Annual Meeting”) to be held on Thursday, May 23, 2024, at 10:00 a.m., Eastern Time, online at https://www.cstproxy.com/eveholding/2024. This solicitation of proxies is made on behalf of our board of directors (the “Board”).

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we are furnishing our proxy materials, including this proxy statement and our annual report, to our stockholders primarily via the Internet. On or about April 9, 2024, we began mailing to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) that contains instructions on how to access our proxy materials on the Internet. The Notice also contains instructions on how to vote via the Internet. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be Held on Thursday, May 23, 2024

This proxy statement and our 2023 Annual Report on Form 10-K are available free of charge at https://www.cstproxy.com/eveholding/2024.

What Are You Voting On?

You will be asked to vote on the following proposals at the Annual Meeting:

- Election of two Class II directors to serve for a three-year term of office expiring at the 2027 annual meeting of stockholders and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, disqualification or removal;

- Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and

- Any other matter that properly comes before the Annual Meeting.

Who Can Vote?

At the close of business on April 3, 2024 (the “Record Date”), there were 269,365,708 shares of our common stock, par value $0.001 per share (“Common Stock”), issued and outstanding. Only holders of record of our Common Stock as of the close of business on the Record Date are entitled to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter. In addition to holders of record of Common Stock, beneficial owners of shares of Common Stock held in “street name” as of the Record Date can vote by following the instructions provided by your broker, bank, trust, or other street name holders.

Difference Between a Stockholder of Record and a “Street Name” Holder

If your shares are registered directly in your name, you are considered the stockholder of record with respect to those shares.

If your shares are held in a stock brokerage account or by a bank, trust or other nominee, then the broker, bank, trust or other nominee is considered to be the stockholder of record with respect to those shares. However, you are still considered to be the beneficial owner of those shares, and your shares are said to be held in “street name.” Street name holders generally cannot submit a proxy or vote their shares directly and must instead instruct the broker, bank, trust or other nominee how to vote their shares using the methods described below under the heading “Voting Your Shares.”

Quorum

The presence of a majority of the outstanding Common Stock issued and outstanding and entitled to vote constitutes a quorum. A quorum is required in order to hold and conduct business at the Annual Meeting. Your shares are counted as present at the Annual Meeting if you:

- Are present in person at the virtual Annual Meeting; or

- Have properly submitted a proxy card online or by mail.

If you submit your proxy, regardless of whether you abstain from voting on one or more matters, your shares will be counted as present at the Annual Meeting for the purpose of determining a quorum. If your shares are held in “street name,” your shares are counted as present for purposes of determining a quorum if your broker, bank, trust, or other nominee submits a proxy covering your shares. Your broker, bank, trust or other nominee is entitled to submit a proxy covering your shares as to certain “routine” matters, even if you have not instructed your broker, bank, trust or other nominee on how to vote on those matters. Please see below under “Broker Non-Votes.”

Voting Your Shares

The Annual Meeting will be held entirely online. You may vote in person by attending the virtual Annual Meeting or by submitting a proxy. The method of voting by proxy differs (1) depending on whether you are viewing this proxy statement on the Internet or receiving a paper copy and (2) for shares held as a record holder and shares held in “street name.”

If you are a record holder, you may vote by submitting a proxy online by following the instructions on the website referred to in the proxy card and/or the Notice mailed to you.

Alternatively, if you received a paper copy of your proxy card, you may vote your shares by submitting a proxy online by following the instructions on the proxy card, or by completing, dating, and signing the proxy card that was included with this proxy statement and promptly returning it in the pre-addressed, postage-paid envelope provided to you.

If your shares are held in “street name,” your broker, bank or other holder of your shares will provide you with instructions that you must follow to have your shares voted.

Deadline for Submitting Your Proxy on the Internet

Internet voting will close at 11:59 p.m., Eastern Time, on May 22, 2024. Stockholders who submit a proxy through the Internet should be aware that they may incur costs to access the Internet, such as usage charges from Internet service providers and that these costs must be borne by the stockholder. Stockholders who submit a proxy by Internet need not return a proxy card or the voting instruction form forwarded by your broker, bank, trust, or other nominee by mail.

YOUR VOTE IS VERY IMPORTANT. Please submit your vote in advance even if you plan to attend the Annual Meeting.

Voting at the Annual Meeting

If you plan to attend the Annual Meeting, you may vote during the virtual meeting. Please note that if your shares are held in “street name” and you wish to vote during the meeting, you must obtain a proxy issued in your name from your broker, bank, or other holder of your shares. Even if you intend to attend the Annual Meeting, we encourage you to submit your proxy or voting instructions to vote your shares in advance of the Annual Meeting. Please see the important instructions and requirements below under “Attendance at the Annual Meeting.”

Changing Your Vote

As a stockholder of record, if you vote by proxy, you may revoke that proxy at any time before it is voted at the Annual Meeting. Stockholders of record may revoke a proxy prior to the Annual Meeting by (i) delivering a written notice of revocation to the attention of the Secretary, Eve Holding, Inc., at our principal executive office at 1400 General Aviation Drive, Melbourne, FL 32935, (ii) duly submitting a later-dated proxy over the Internet or by mail, or (iii) attending the virtual Annual Meeting and voting during the meeting. Attendance at the Annual Meeting will not, by itself, revoke a proxy.

If your shares are held in the name of a broker, bank, trust or other nominee, you may change your voting instructions by following the instructions of your broker, bank, trust, or other nominee.

If You Receive More Than One Proxy Card

If you receive more than one proxy card, it means you hold shares that are registered in more than one account. To ensure that all of your shares are voted, sign and return each proxy card or, if you submit a proxy by the Internet, submit one proxy for each proxy card you receive.

How Your Shares Will Be Voted

Shares represented by proxies that are properly executed and returned, and not revoked, will be voted as specified. YOUR VOTE IS VERY IMPORTANT.

If You Do Not Specify How You Want Your Shares Voted

If you are the record holder of your shares and submit your proxy without specifying how your shares are to be voted, your shares will be voted as follows:

- FOR the election of each of the two nominees for Class II directors; and

- FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

In addition, the proxy holders named in the proxy are authorized to vote in their discretion on any other matters that may properly come before the Annual Meeting and at any postponement or adjournment thereof. The board of directors knows of no other items of business that will be presented for consideration at the Annual Meeting other than those described in this proxy statement.

Broker Non-Votes

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner has not received voting instructions from the beneficial owner and does not have discretionary authority to vote the shares. If you hold your shares in street name and do not provide voting instructions to your broker or other nominee, your shares will be considered to be broker non-votes and will not be voted on any proposal on which your broker or other nominee does not have discretionary authority to vote. Shares that constitute broker non-votes will be counted as present at the Annual Meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. Brokers generally have discretionary authority to vote on the ratification of the selection of KPMG LLP as our independent registered public accounting firm. Brokers do not have discretionary authority, however, to vote on the director elections.

Votes Required

The following table summarizes the voting requirements and the effects of broker non-votes and “withhold” votes or abstentions on each of the proposals to be voted on at the Annual Meeting:

|

|

Proposals |

Required Vote |

Effect of Broker Non-Votes |

Effect of Withhold Votes or Abstentions |

|||

|

1. |

Election of Directors |

Plurality of votes cast for each nominee |

None |

None |

|||

|

2. |

Ratification of Independent Registered Public Accounting Firm |

Majority of the shares present and entitled to vote |

None |

Against |

Inspector of Election

All votes will be tabulated by the inspector of election appointed for the Annual Meeting, who will separately tabulate affirmative and negative votes, abstentions, and broker non-votes.

Solicitation of Proxies

We will bear the cost of soliciting proxies. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding shares of our Common Stock in their names that are beneficially owned by others to forward to those beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding the solicitation materials to the beneficial owners. Original solicitation of proxies may be supplemented by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or other employees. No additional compensation will be paid to our directors, officers, or other employees for such services.

Attendance at the Annual Meeting

You may attend the Annual Meeting, as well as vote and submit questions during the Annual Meeting, by visiting https://www.cstproxy.com/eveholding/2024. You will need your unique control number, which appears in the proxy card, Notice or voting instructions that accompanied the proxy materials. In the event that you do not have a control number, please contact your broker, bank, or other nominee as soon as possible so that you can be provided with a control number and gain access to the meeting.

Our board of directors currently consists of seven members. In accordance with our second amended and restated certificate of incorporation (“Certificate of Incorporation”), our board of directors is divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of stockholders, with the other classes continuing for the remainder of their respective three-year terms. Our board of directors is designated as follows:

- The Class I directors are María Cordón and Sergio Pedreiro, and their terms will expire at the 2026 annual meeting of stockholders;

- The Class II directors are Marion Clifton Blakey and Paul Eremenko, and their terms will expire at the Annual Meeting; and

- The Class III directors are Luis Carlos Affonso, Michael Amalfitano and Gerard J. DeMuro, and their terms will expire at the 2025 annual meeting of stockholders.

At each annual meeting of stockholders, upon the expiration of the term of a class of directors, each director in the class, or the successor to each such director in the class, is elected to serve from the time of election and qualification until the third annual meeting following his or her election and until his or her successor is duly elected and qualified, in accordance with our Certificate of Incorporation. Any increase or decrease in the number of directors are distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors.

Class II Director Nominees for Election – Term Expiring 2027

The current term of the Class II directors will expire at the Annual Meeting. Our board of directors nominated each of Marion Clifton Blakey and Paul Eremenko for election at the Annual Meeting as a Class II director to hold office until the annual meeting of stockholders to be held in 2027 and until his or her successor is duly elected and qualified or until his or her earlier death, resignation, disqualification, or removal. The nominees have consented to serve a term as Class II directors if elected. Should any of the nominees become unable to serve for any reason prior to the Annual Meeting, subject to the terms of the Stockholders Agreement (as defined herein), the board of directors may designate a substitute nominee, in which event the persons named in the enclosed proxy will vote for the election of such substitute nominee. See “Certain Relationships and Related Person Transactions – Stockholders Agreement” for additional information regarding the Stockholders Agreement.

Set forth below are biographies of each of the Class II directors standing for election at the Annual Meeting:

Marion Clifton Blakey

Marion Clifton Blakey, 76, has served on the Board since 2022. Ms. Blakey currently serves as a non-executive director for several corporations and organizations, having retired from Rolls-Royce North America Inc. (RRNA) in 2018 as President and Chief Executive Officer. In this role, Ms. Blakey also served as Chairman of the Board of Rolls-Royce North America Holdings Inc. In her three years at Rolls-Royce, she helped shepherd a major investment in the Indianapolis site, oversaw the opening of a new California R&T facility while streamlining Rolls-Royce North America operations and creating an environment conducive to growing the Rolls-Royce business base. Prior to joining Rolls-Royce, Ms. Blakey was President and Chief Executive Officer of the Aerospace Industries Association (AIA) for eight years, representing more than 270 member companies. From 2002 to 2007, Ms. Blakey was Administrator of the Federal Aviation Administration (FAA) where she operated the world’s largest air traffic control system and managed 44,000 employees and a $14 billion budget. Prior to 2002, she held several senior positions including Chairman of the National Transportation Safety Board (NTSB) and Administrator of the U.S. Department of Transportation’s National Highway Traffic Safety Administration (NHTSA), as well as ran her own consulting firm focusing on transportation and infrastructure issues. Ms. Blakey’s board positions include: director Sun Country Airlines, former director Aerojet Rocketdyne, former director of New Vista Acquisition Corporation (Nasdaq: NVSA); former Trustee of Noblis, a science, technology and strategy organization, where she served as Chairman until 2020; former member of the National Air and Space Museum’s Advisory Board, where she chaired the Advancement Committee; and member of the advisory boards of Radia, Inc.; and Sunrise Transportation Holdings. She recently served on the Board of Alaska Airlines Group (NYSE: ALK); Cobham plc, Aireon, and NASA’s National Advisory Council. Ms. Blakey has received numerous honorary degrees and awards, including the National Aeronautic Association’s 2011 Henderson Trophy, Aviation Week & Space Technology’s 2013 Laureate Award, and the National Aeronautic Association’s 2013 Wright Brothers Memorial Trophy, and most recently, the Carol B. Hallett Award from the U. S. Chamber of Commerce and the L.Welch Pogue Award from Aviation Week and Space Technology and the International Aviation Club. Ms. Blakey received her bachelor’s degree with honors in international studies from Mary Washington College of the University of Virginia and has completed graduate work at Johns Hopkins University, School of Advanced International Studies. Ms. Blakey brings to the board extensive executive leadership experience, expertise with respect to aviation regulation and air traffic management and experience serving on the boards of directors of several companies.

Paul Eremenko

Paul Eremenko, 44, has served on the Board since 2022. Mr. Eremenko is currently the Chairman and CEO of Universal Hydrogen Co., positions he has held since the company’s founding in early 2020. He also serves as an advisor to New Vista Capital since 2021. Prior to co-founding Universal Hydrogen Co., Mr. Eremenko was Senior Vice President and Chief Technology Officer of United Technologies Corporation from 2018 to 2019. Before that, Mr. Eremenko was Chief Technology Officer of Airbus SE (“Airbus”). Mr. Eremenko joined Airbus as the founding CEO of Acubed in 2015, its Silicon Valley innovation center, and also served on the investment committee of Airbus Ventures. While at Airbus, Mr. Eremenko was Chairman of APWORKS GmbH, an aerospace additive manufacturing company. From 2013 to 2015, Mr. Eremenko served as Director of Engineering at Google’s Advanced Technology and Projects organization, and prior to that at Motorola Mobility. Before Motorola and Google, Mr. Eremenko was at DARPA, the Defense Advanced Research Projects Agency, first as a Program Manager, and later as the Deputy Director and Acting Director of the Tactical Technology Office, the agency’s large systems and platforms office. For his work at DARPA, Mr. Eremenko was awarded the Distinguished Public Service Medal by the Office of the Secretary of Defense. Mr. Eremenko earned his undergraduate and Master’s degrees in aeronautics from Massachusetts Institute of Technology (MIT) and California Institute of Technology (Caltech), respectively. Mr. Eremenko also holds a J.D. from Georgetown University and is a private pilot. Mr. Eremenko brings to the board extensive experience in the aerospace manufacturing and engineering industries, as well as executive leadership experience in the aerospace industry.

Required Vote

Each director will be elected by a plurality of the votes cast by the shares present in person, or represented by proxy, and entitled to vote.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE IN FAVOR OF THE ABOVE NOMINEES FOR ELECTION AS CLASS II DIRECTORS TO THE BOARD.

Class I and III Directors Continuing in Office

Set forth below are biographies of the other directors continuing in office:

María Cordón

María Cordón, 41, has served on the Board since 2023. Ms. Cordón has served in various roles at ACCIONA, S.A., the holding entity of the ACCIONA Group, global leader in the provision of sustainable and regenerative renewable energy and infrastructure solutions, since September 2008, and currently serves as Director of the Strategy & Corporate Development department. She also serves as a member of the Supervisory Board and of the Strategy and Technology Committee at Nordex SE, a leading wind turbine manufacturer listed on the Frankfurt Stock Exchange. Ms. Cordón participated in the ESADE program for board members in 2021-2022 and was selected as part of the 2023 edition of the Women to Watch Program, an initiative led by PwC. Prior to ACCIONA, she began her professional career working in the Investment Banking Division at Goldman Sachs (London and Madrid). Ms. Cordón received her bachelor’s degree with distinction in Business Administration from Universidad Pontificia Comillas (ICADE). Ms. Cordón brings to the board experience and expertise in sustainability, the social and environmental externalities of businesses and regenerative solutions.

Sergio Pedreiro

Sergio Pedreiro, 58, has served on the Board since 2022. Mr. Pedreiro has more than 20 years of experience in international finance and business administration across a diverse array of industries. Mr. Pedreiro is the former Chief Operating Officer of Revlon, Inc. (“Revlon”), a position he held from January 2020 until November 2020. Before joining Revlon, Mr. Pedreiro was the Chief Executive Officer of Estre Ambiental Inc., a leading waste management company in Latin America, from May 2015 to December 2019. From April 2014 to December 2018, Mr. Pedreiro was an associate partner of BTG Pactual in the Private Equity group. Before joining BTG Pactual, Mr. Pedreiro was the Chief Financial Officer of Coty Inc. (NYSE: COTY), the global beauty company with $5 billion in annual revenues. Mr. Pedreiro was Coty’s Chief Financial Officer from February 2009 to March 2014 and led the company’s initial public offering in mid-2013 which raised approximately $1 billion in proceeds. From January 2002 to December 2008, Mr. Pedreiro was the Chief Financial Officer of America Latina Logística SA, which listed on the Brazilian stock exchange (B3) in 2004 to become the largest publicly traded cargo railroad in Brazil. From 2016 to 2017, Mr. Pedreiro served on the board of directors of Advanced Disposal Inc., a U.S.-based waste management company with $1.4 billion in annual revenues which conducted its initial public offering during Mr. Pedreiro’s time on the board. Mr. Pedreiro currently serves as a director and chair of the audit committee of Ashland Inc. Mr. Pedreiro began his career as a business consultant at McKinsey & Company in Brazil. Mr. Pedreiro received his B.S. in Aeronautical Engineering from Instituto Tecnológico de Aeronáutica in Brazil, and also holds an M.B.A. degree from Stanford University. Mr. Pedreiro brings to the board extensive experience in international finance and business administration, which includes leadership positions as a senior executive and board member of various publicly traded companies.

Luis Carlos Affonso

Luis Carlos Affonso, 63, has served on the Board since 2022. Mr. Affonso joined Embraer S.A.(“Embraer”) 41 years ago as an aeronautical engineer, in January 1983, and currently leads the Embraer Engineering and Technology Development for Commercial, Executive, Defense and Services Business Units. In 1995, after serving in different positions with increasing responsibilities, he became Embraer’s Vice President of Engineering and Chief Engineer at age 34. Since then, in different roles, he led the launch and development of all civilian – commercial and executive – Embraer new airplane platforms. As Engineering Vice President, he was in charge of the ERJ145 Regional Jet development and certification, which happened on time in 1996, and allowed for the company turnaround after privatization. Mr. Affonso also led the creation of the Program Management function at Embraer as currently constituted, which is today considered one of Embraer’s main competitive advantages. Consequently, in 1997 he became the first head of the newly created Program Management organization and was the reporting person for all such Program Directors.

Mr. Affonso also served as the E-Jets Program Vice President since its inception until entry into service in 2004 and 2005, strongly advancing Embraer’s position in the airline market. The E-Jets are the most successful Embraer product to date and one of the most successful commercial airplanes in aviation history. Mr. Affonso was President and CEO of Embraer Executive Jets from 2005 to 2011, in which he was responsible for developing the program as an independent business segment within Embraer, including by overseeing the development of business and product strategies, as well as marketing, sales and customer support initiatives for the segment. Embraer significantly expanded in this market under Mr. Affonso’s leadership, including the launch of six new products—Phenoms 100/300, Legacy 450/500/650 and Lineage 1000—creating a worldwide sales and service support network and increasing sales revenues from US$250 million to US$1.250 billion. From 2011 to 2017, Mr. Affonso served as Chief Operating Officer (“COO”) of Embraer’s Commercial Aviation business, leading current and future programs including market intelligence, customer support and services, as well as overseeing the final manufacturing assembly line and the development of the successful E-Jets Second Generation (E2) airplanes. During his tenure as COO of Commercial Aviation, the presence and results of customer support and services for this segment significantly expanded. In 2019, the Project Management Institute named the E-Jets E2 project that Mr. Affonso oversaw as the 2019 Project of the Year. From 2017 to 2020, Mr. Affonso was Senior Vice President of Corporate Strategy, Innovation and Digital Transformation at Embraer. During this period, EmbraerX, a company dedicated to disruptive innovation, was founded, ultimately leading to the conceptualization and creation of EVE UAM, LLC. Mr. Affonso also created Embraer’s innovation and strategic governance system, which focuses on developing strategies that aim to drive and manage innovation across the company. This program helped to create the strategies that are fueling Embraer’s turnaround after the COVID-19 pandemic.

Mr. Affonso was a member of the board of directors of Brazilian General Aviation Association, the General Aviation Manufactures Association in the US, OGMA - Industria Aeronautica de Portugal and EmbraerPrev, the Embraer employees’ pension fund. Mr. Affonso currently serves a member of the Innovation Committee at Vale SA (NYSE: VALE), one of the biggest mining companies in the world. Mr. Affonso is also a member of the Superior Board of Directors of ANPEI, National Association of Innovative Companies Research and Development, an organization devoted to fostering innovation in the aerospace industry. Mr. Affonso has a Master’s degree in International Business Administration from Fundação Instituto de Administração (FIA) and graduated from the aeronautical engineering program at Instituto Tecnológico de Aeronáutica (ITA), in São José dos Campos, Brazil. Mr. Affonso has also completed executive programs in management and strategy at the University of Michigan Ross School of Business and MIT Sloan School of Management. Mr. Affonso brings to the board extensive experience in the aviation industry and in growing and developing new and existing businesses.

Michael Amalfitano

Michael Amalfitano, 63, has served on the Board since 2022. Mr. Amalfitano has served as the President and CEO of Embraer Executive Jets since 2017, leading the company’s global business with annual revenues in excess of $1.75 billion and an active fleet of more than 1,700 aircraft with over 1,100 customers worldwide. A long-standing industry veteran, Mr. Amalfitano has 40+ years of executive leadership experience in business aviation and financial services. He is a voting member of the Embraer Executive Leadership Management Board. Prior to joining Embraer, Mr. Amalfitano served as Executive Vice President, Senior Managing Director of Business Aviation at Stonebriar Commercial Finance. Mr. Amalfitano also led as Managing Director, Executive Head of Global Corporate Aircraft Finance at Bank of America Merrill Lynch for over 22 years, following a decade-long tenure in sales management at GE Capital.

Mr. Amalfitano is also the Past Chairman of the General Aviation Manufacturer’s Association (GAMA), and currently serves on their Executive, Finance, Investment, and Strategic Committees, following his previous role as Chairman of the Communications Committee, following his previous role as Chairman of the Communications Committee. Additionally, Mr. Amalfitano is also the Immediate Past Chairman of the National Business Aviation Association (NBAA) Advisory Council, served as a member of the NBAA Board of Directors, and is currently a member of the Advisory Council and Leadership Council. He is also a member of the Board of Trustees at Embry-Riddle Aeronautical University (ERAU) and serves on their Finance and Investment Committees.

Past board positions include former four-term OEM President of the International Aircraft Dealers Association (IADA), Chairman of the Associate Members Advisory Council for the National Aircraft Resellers Association (NARA), and former two-term President of the National Aircraft Finance Association (NAFA).

Mr. Amalfitano holds a B.A. in Economics and a Master’s in Financial Management from Fairfield University in Fairfield, Connecticut. He has written numerous articles for aviation industry publications and is an active speaker and panelist at business aviation summits, forums, virtual podcasts & webinars, and thought leadership conferences throughout the industry.

Gerard J. DeMuro

Gerard J. DeMuro, 68, has served on the Board since 2023. Mr. DeMuro served as the Co-Chief Executive Officer of the Company from September 2021 to September 2023, and was instrumental in Eve’s SPAC transaction, taking the company to a very successful NYSE listing that raised approximately $400 million from multiple strategic financial investors. He then served as the Executive Vice President of Corporate Development of the Company until January 2024. He also serves as an independent director of Mercury Systems, Inc. He previously served as an independent director of Zanite. Prior to joining Zanite, Mr. DeMuro served as President and Chief Executive Officer of BAE Systems, Inc. from 2014 to 2020, where he was responsible for the leadership and governance of one of the largest U.S. aerospace and defense contractors, with global sales in excess of $11 billion and more than 33,000 employees globally. Throughout this period, Mr. DeMuro also served as an Executive Director on the BAE Systems, Inc. board of directors and as a member of the board of directors and executive committee of BAE Systems, plc.

Prior to BAE, he held the position of Executive Vice President and Corporate Vice President at General Dynamics Corporation (NYSE: GD), where he directed strategic development and operational performance of the $11.7 billion revenue generating Information Systems and Technology Group, leading 44,000 employees and 6,000 open contracts, and providing products and services to defense and commercial customers worldwide. He joined General Dynamics as President, C4 Systems after General Dynamics acquired GTE Government Systems.

Mr. DeMuro earned his M.B.A. from Fairleigh Dickinson University, and his B.A. from the University of Pittsburgh. Mr. DeMuro brings to the board extensive experience in the defense and aviation industries, including executive and operational experience with public and private companies.

Board Diversity Matrix

(as of April 9, 2024)

|

Total Number of Directors |

|

7 |

|

|

Female |

Male |

|

Gender Identity |

|

|

|

Directors |

2 |

5 |

|

Demographic Background |

|

|

|

African American or Black |

|

|

|

Alaskan Native or Native American |

|

|

|

Asian |

|

|

|

Hispanic or Latinx |

|

1 |

|

Native Hawaiian or Pacific Islander |

|

|

|

White |

2 |

2 |

|

Two or More Races or Ethnicities |

|

|

|

LGBTQ+ |

|

|

|

Did Not Disclose Demographic Background |

|

2 |

General Information About the Board of Directors

Director Attendance at Board, Committee and Annual Meetings

Our board of directors held 11 meetings during the fiscal year ended December 31, 2023. Each incumbent director serving during fiscal 2023 attended at least 75% of the aggregate of all meetings of the board of directors and all meetings of committees of which such director was a member during the period for which such director served. Our Corporate Governance Guidelines provide that directors are expected to attend the Company’s annual meeting of stockholders.

Director Independence

Under the New York Stock Exchange’s (“NYSE”) listing standards, we qualify for and avail ourselves of the controlled company exemptions under the corporate governance rules of the NYSE, including certain requirements relating to compensation committees and nominating and corporate governance committees. See “Committees of the Board of Directors” below for additional information.

As a controlled company, we are not required to have a majority of “independent directors” on our board of directors, as defined under the rules of the NYSE. Nevertheless, we undertook a review of the independence of our board of directors and have determined that each of Marion Clifton Blakey, María Cordón, Paul Eremenko and Sergio Pedreiro qualifies as “independent” as defined under the applicable NYSE rules.

Composition of the Board of Directors

Our business and affairs are managed under the direction of our board of directors. The Certificate of Incorporation and amended and restated bylaws (“Bylaws”) provide that our board of directors shall consist of at least one but not more than 15 members, and the number of directors may be increased or decreased from time to time by a resolution of the board. Our board currently consists of seven directors: Luis Carlos Affonso, Michael Amalfitano, Marion Clifton Blakey, Paul Eremenko and Sergio Pedreiro, who were nominated by Embraer Aircraft Holding, Inc. (“EAH”); Gerard J. DeMuro, who was designated by Zanite Sponsor LLC (the “Sponsor”); and María Cordón, who was designated by Acciona Logistica pursuant to the terms of the Acciona Strategic Warrant Agreement. For additional information, see “Certain Relationships and Related Person Transactions – Strategic Warrant Agreement.”

Board Leadership Structure

Our Corporate Governance Guidelines provide that the roles of Chairperson of the Board and Chief Executive Officer may be either separate or combined. Our board exercises its discretion in combining or separating these positions as it deems appropriate in the best interests of the Company, subject to the requirements of the Stockholders Agreement, dated as of May 9, 2022, by and among the Company, Embraer Aircraft Holding, Inc. and Zanite Sponsor LLC, as may be amended from time to time.

Currently, our board is chaired by Luis Carlos Affonso and our Chief Executive Officer is Johann Christian Jean Charles Bordais. As a general policy, we believe separation of the positions of chairperson and Chief Executive Officer, or having a lead independent director, reinforces the independence of the board of directors from management, creates an environment that encourages objective oversight of management’s performance and enhances the effectiveness of the board as a whole.

Board’s Role in Risk Oversight

Our management is responsible for identifying risks facing our Company, including strategic, financial, operational and regulatory risks, implementing risk management policies and procedures and managing our day-to-day risk exposure.

The Audit Committee discusses guidelines and policies governing the process by which senior management of the Company and the relevant departments of the Company, including the internal audit function, assess and manage the Company’s exposure to risk, as well as the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

In addition, the board of directors is regularly presented with information at its regularly scheduled and special meetings regarding risks facing our Company, and management provides more frequent, informal communications to the board of directors between regularly scheduled meetings which are designed to give the board of directors regular updates about our business. The board of directors considers this information and provides feedback, makes recommendations, and, as appropriate, authorizes or directs management to address particular exposures to risk.

Committees of the Board of Directors

Our board of directors directs the management of our business and affairs, as provided by Delaware law, and conducts its business through meetings of the board of directors and standing committees. We have a standing audit committee and a standing compensation committee, each of which operates under a written charter. As of the date of this proxy statement, we do not have a standing nominating and corporate governance committee, as we have availed ourselves of the controlled company exemptions from these requirements under the NYSE rules. Instead, such functions are performed by the board of directors. Our board may from time to time establish other committees.

Audit Committee

Our Audit Committee consists of Sergio Pedreiro, Marion Clifton Blakey and María Cordón, with Sergio Pedreiro serving as the chair of the committee. Each member of the Audit Committee qualifies as an independent director under the NYSE corporate governance standards and the independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, each member of the Audit Committee is financially literate, as such qualification is interpreted by the board of directors in its business judgment. Our board of directors has also determined that Sergio Pedreiro qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K.

The Audit Committee’s responsibilities include, among other things:

- appointing, compensating, retaining, evaluating, terminating and overseeing our independent registered public accounting firm;

- discussing with our independent registered public accounting firm their independence from management;

- reviewing with our independent registered public accounting firm the scope and results of their audit;

- pre-approving all audit and permissible non-audit services to be performed by our independent registered public accounting firm;

- overseeing the financial reporting process and discussing with management and our independent registered public accounting firm the interim and annual financial statements that we file with the SEC;

- reviewing and monitoring our accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements;

- overseeing the policies and procedures in the Company’s Related Person Transactions Policy and reviewing proposed transactions requiring approval or ratification in accordance with such policy; and

- establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters.

Our board of directors adopted a written charter for the Audit Committee, which is available on our website, www.eveairmobility.com.

Compensation Committee

Our Compensation Committee consists of Sergio Pedreiro, Marion Clifton Blakey, Paul Eremenko and Gerard J. DeMuro, with Marion Clifton Blakey serving as the chair of the committee. As permitted by the controlled company exemptions under the NYSE corporate governance rules, our Compensation Committee is not composed entirely of independent directors; our board of directors determined that one member, Mr. DeMuro, is not independent.

The Compensation Committee’s responsibilities include, among other things:

- reviewing the goals and objectives of the Company’s executive compensation plans, and recommending that the Board amend, these goals and objectives if the Committee deems it appropriate;

- evaluating annually the performance of the Chief Executive Officer and the other executive officers, including in light of the goals and objectives of the Company’s executive compensation plans, and, either as a Committee or together with the other non-executive directors (as directed by the Board), recommending that the Board determine and approve the Chief Executive Officer’s and other executive officer’s compensation level based on this evaluation

- reviewing compensation arrangements for the Company’s employees to evaluate whether incentive and other forms of pay encourage unnecessary or excessive risk taking;

- reviewing and recommending that the Board approve, to the extent it deems necessary or as required by applicable law, the terms of any compensation “clawback” or similar policy or agreement between the Company and its executive officers or other employees for recovering incentive-based compensation; and

- reviewing and assessing on an annual basis the performance of the Compensation Committee.

Our board of directors adopted a written charter for the Compensation Committee, which is available on our website, www.eveairmobility.com.

Director Compensation

The following table provides the compensation paid to the non-employee directors of the Company with respect to the year ended December 31, 2023.

|

Name |

Fees earned or paid in cash ($) (1) |

Stock Awards ($) (2) |

All other compensation ($) |

Total ($) |

||||

|---|---|---|---|---|---|---|---|---|

|

Marion Clifton Blakey |

68,333 |

137,250 |

- |

205,583 |

||||

|

María Cordón |

55,000 |

183,457 |

(3) |

- |

238,457 |

|||

|

Paul Eremenko |

60,000 |

137,250 |

- |

197,250 |

||||

|

Sergio Pedreiro |

70,417 |

137,250 |

- |

207,667 |

||||

|

Luis Carlos Affonso(4) |

- |

- |

- |

- |

||||

|

Michael Amalfitano(4) |

- |

- |

- |

- |

||||

|

Kenneth C. Ricci(4)(5) |

- |

- |

- |

- |

| (1) | Each independent director receives an annual cash retainer of $60,000, payable $5,000 per month, prorated for the time served on the board. In addition to the annual cash retainer, the amount in this column includes committee chair fees. |

| (2) |

Under the 2022 Plan, the independent directors receive an annual equity grant of restricted stock units. The amounts shown represent the grant date fair value of the awards computed in accordance with FASB ASC Topic 718, which was $9.15 per share. The number of restricted stock units granted was calculated assuming a price per share equal to $10, resulting in the grant of 15,000 restricted stock units. |

| (3) |

Ms. Cordón received a prorated equity grant of restricted stock units in respect of the partial year of service in the year of her appointment to the board. The amount shown represents the grant date fair value of the prorated equity grant computed in accordance with FASB ASC Topic 718, which was $6.91 per share, plus the annual grant of restricted stock units described above. |

| (4) |

Director does not receive any compensation from the Company for their service on the Board. |

| (5) |

Resigned from the board effective as of October 31, 2023. |

Each independent director of the Company receives an annual cash retainer of $60,000, payable $5,000 per month, and will receive an annual equity grant of restricted stock units with a fair market value of $150,000 as of the date of the grant, vesting on the first anniversary of the grant.

In 2023, the Board approved a revision to the vesting policy for the directors’ annual equity grants to align vesting with market practices. As such, the annual equity grant now vests on the first anniversary of the grant date, rather than the third anniversary of the grant date, and previous director equity grants were amended to conform to this change. In addition, in July 2023, the Board approved the payment of annual committee chair fees. The Chairperson of the Audit Committee receives an additional annual cash retainer of $25,000 and the Chairperson of the Compensation Committee receives an additional annual cash retainer of $20,000. For 2023, the annual committee chair fees were prorated from the date of Board approval.

Director Stock Ownership Policy

Our Director Stock Ownership Policy requires

non-employee directors to own shares of our Common Stock equal in value to five

times the annual cash retainer paid to directors within five years of joining

our Board. Our Director Stock Ownership Policy is available on our website,

www.eveairmobility.com.

Code of Conduct

Our board has adopted a code of conduct that applies to all of our executive officers, directors, and employees, including our principal executive officers, principal financial officer, principal accounting officer or controller or persons performing similar functions. The code of conduct is available on our website, www.eveairmobility.com. We intend to make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of conduct on our website rather than by filing a Current Report on Form 8-K.

Communications with the Board of Directors

Stockholders of the Company and other interested parties wishing to communicate with the board or an individual director may send a written communication to the board or such director at the following address:

c/o Eve Holding, Inc.

1400 General Aviation Drive

Melbourne, FL 32935

Attn: Secretary

The Secretary will review each communication and will forward such communication to the board of directors or to any individual director to whom the communication is addressed unless the communication contains advertisements or solicitations or is unduly hostile, threatening or similarly inappropriate, in which case the Secretary shall discard the communication or inform the proper authorities, as may be appropriate.

The Audit Committee is responsible for the appointment, compensation, retention, and oversight of the Company’s independent auditors. In connection with this responsibility, the Audit Committee evaluates and monitors the auditors’ qualifications, performance, and independence. This responsibility includes a review and evaluation of the independent auditors. The Audit Committee approves all audit engagement fees and terms associated with the retention of the independent auditors.

As a matter of good corporate governance, the board of directors is requesting our stockholders to ratify the Audit Committee’s selection of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. KPMG LLP has served as our independent registered public accounting firm since May 2022. The Audit Committee and the board of directors believe that the continued retention of KPMG LLP as our independent auditors is in the best interests of the Company. The Audit Committee carefully considered the selection of KPMG LLP as our independent auditors. The Audit Committee charter requires the Audit Committee to periodically consider whether the independent audit firm should be rotated. In addition to evaluating rotation of the independent auditors, the Audit Committee oversees the selection of the new lead audit partner, and the Audit Committee chair participates directly in the selection of the new lead audit partner.

If the stockholders do not ratify the selection, the Audit Committee will reconsider its selection. Even if the selection is ratified, the Audit Committee, in its discretion, may direct the appointment of a different independent registered public accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and our stockholders.

Representatives from KPMG LLP are expected to be present at the Annual Meeting and will have an opportunity to make a statement at the Annual Meeting if they desire to do so and are expected to be available to respond to appropriate questions at the Annual Meeting.

Required Vote

Approval by the affirmative vote of the holders of a majority of the shares of Common Stock present in person, or represented by proxy, and entitled to vote at the Annual Meeting is required to ratify the selection of KPMG LLP.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE IN FAVOR OF THE RATIFICATION OF THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

Fees Billed by the Principal Accountant

The following table sets forth all fees billed for professional audit services and other services rendered by KPMG LLP for the years ended December 31, 2023 and December 31, 2022:

| 2023 | 2022 (3) | ||||

|---|---|---|---|---|---|

| Audit Fees (1) | $ | 541,529 | $ | 1,368,038 | |

| Audit-Related Fees | $ | — | $ | — | |

| Tax Fees | — | — | |||

| All Other Fees (2) | — | $ | 899,235 | ||

| Total | $ | $541,529 | $ | 2,267,273 |

| (1) | Audit Fees consist of fees for professional services rendered in connection with the audit of our annual consolidated financial statements, the review of the interim condensed consolidated financial statements included in quarterly reports, statutory audits of subsidiaries, and services rendered in connection with SEC registration statements and services that are normally provided by KPMG LLP, such as comfort letters, in connection with statutory and regulatory filings or engagements. |

| (2) |

Other Fees relate to non-tax related advisory services. |

| (3) |

The fees reported for 2022 have been adjusted to reflect actual amounts invoiced for the year. |

Audit Committee Pre-Approval Policy

Our Audit Committee is responsible for approving all audit, audit-related and certain other services specified in its charter. The Audit Committee reviews and, in its sole discretion, approves in advance the independent auditors’ annual engagement letter, including the proposed fees contained therein, as well as all audit and all permitted non-audit engagements and relationships between the Company and the independent auditor (which approval should be made after receiving input from the Company’s management, if desired). Approval of audit and permitted non-audit services will be made by the Audit Committee or as otherwise provided for in a pre-approval policy, if any, approved by the Audit Committee.

The audit committee reviewed and discussed the audited consolidated financial statements for the fiscal year ended December 31, 2023, with our management and with our independent registered public accounting firm, KPMG LLP. In addition, the Audit Committee discussed with KPMG LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. The Audit Committee also discussed with KPMG LLP the written disclosures and the independence letter from KPMG LLP required by the applicable requirements of the PCAOB.

Based on the Audit Committee’s review of the audited consolidated financial statements and the review and discussions described in the preceding paragraph, the Audit Committee recommended to the board of directors that the audited consolidated financial statements for the fiscal year ended December 31, 2023, be included in the Company’s Annual Report on Form 10-K.

Audit Committee

Sergio Pedreiro (Chair)

Marion Clifton Blakey

María Cordón

The above Audit Committee Report is not soliciting material, is not deemed filed with the SEC and is not incorporated by reference in any of our filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act whether made before or after the date of this proxy statement and irrespective of any general incorporation language in any such filings.

The following table sets forth information regarding beneficial ownership of our Common Stock as of April 3, 2024, by:

- Each person, or group of affiliated persons, known by us to beneficially own more than 5% of our Common Stock;

- Each of our directors;

- Each of our named executive officers (“NEOs”); and

- All of our current executive officers and directors as a group.

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days. In computing the number of shares beneficially owned by a person or entity and the percentage ownership of that person or entity in the table below, all shares subject to options or warrants held by such person or entity were deemed outstanding if such securities are currently exercisable, or exercisable within 60 days. These shares were not deemed outstanding, however, for the purpose of computing the percentage ownership of any other person or entity.

Except as described in the footnotes below and subject to applicable community property laws and similar laws, the Company believes that each person listed below has sole voting and investment power with respect to such shares.

|

Name and Address of Beneficial Owner (1) |

|

Number of Shares of Common Stock |

Percentage of Shares of Common Stock |

|

|

5% Holders |

|

|

||

|

Embraer Aircraft Holding, Inc.(2) |

238,899,599 |

88.5% |

||

|

Directors and Named Executive Officers |

|

|

||

|

Johann Bordais |

— |

— |

||

|

Gerard J. DeMuro(3) |

451,917 |

* |

||

|

André Duarte Stein (4) |

— |

— |

||

|

Eduardo Couto |

— |

— |

||

|

Luis Carlos Affonso |

— |

— |

||

|

Michael Amalfitano(5) |

9,676 |

* |

||

|

Marion Clifton Blakey |

15,000 |

— |

||

|

María Cordón |

6,687 |

— |

||

|

Paul Eremenko |

15,000 |

— |

||

|

Sergio Pedreiro |

15,000 |

— |

||

|

All Company directors and executive officers as a group (9 individuals) |

513,280 |

1.9% |

*Less than one percent

| (1) | Unless otherwise noted, the business address of each of those listed in the table above is c/o Eve Holding, Inc., 1400 General Aviation Drive, Melbourne, Florida 32935. |

| (2) |

Includes 399,589 shares which Embraer Aircraft Holding, Inc. is obligated to purchase from a counterparty pursuant to a put option agreement (which is expected to be consummated within 30 days). Embraer Aircraft Holding, Inc. is controlled by Embraer S.A. The address of the principal business office of Embraer Aircraft Holding, Inc. is 276 S.W. 34th Street Fort Lauderdale, Florida, 33315. The address of the principal business office of Embraer S.A. is Avenida Dra. Ruth Cardoso, 8501, 30th floor (part), Pinheiros, São Paulo, SP, 05425-070, Brazil. |

| (3) |

Comprised of (i) 150,000 shares of Class B Common Stock, which converted into shares of Common Stock upon the Closing on a one-for-one basis, (ii) 61,917 shares of Common Stock underlying the private placement warrants received from Zanite Sponsor. LLC in a pro-rata distribution of its securities to its members upon the Closing, which warrants became exercisable 30 days following the Closing, and (iii) 140,000 shares of Common Stock issued to Mr. DeMuro at the Closing pursuant to the terms of his Employment Agreement. |

| (4) |

Mr. Stein, former co-Chief Executive Officer and Chief Strategy Officer, resigned, effective November 1, 2023. |

| (5) |

Consists of shares held in a joint account with Mr. Amalfitano’s wife. |

|

Plan Category |

Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(2) |

|

|

(a) |

(b) |

(c) |

|

Equity compensation plans approved by security holders: |

2,543,561 |

— |

14,229,160 |

|

Equity compensation plans not approved by security holders: |

— |

— |

— |

|

Total |

2,543,561 |

— |

14,229,160 |

| (1) | The amount set forth in this column consists of 0 stock options and stock appreciation rights, 0 restricted stock awards and 2,543,561 restricted stock units granted under the Eve Holding, Inc. 2022 Stock Incentive Plan. Restricted stock awards and restricted stock units are not reflected in the weighted exercise price in column (b) as these awards do not have an exercise price. |

| (2) | The amount set forth in this column reflects the number of securities remaining available for issuance under the Eve Holding, Inc. 2022 Stock Incentive Plan. This reserve will automatically increase on January 1st of each calendar year, prior to the tenth anniversary of the effective date of the Eve Holding, Inc. 2022 Stock Incentive Plan, by an amount equal to the lesser of (i) 3% of the number of shares of Common Stock issued and outstanding on December 31st of the preceding year and (ii) an amount determined by the plan administrator. |

For a description of the material features of the Eve Holding, Inc. 2022 Stock Incentive Plan, please refer to the section entitled “Executive Compensation — Equity Compensation,” below.

Biographical information for each of our current executive officers is set forth below, other than Mr. DeMuro, whose biographical information is set forth under “Class I and III Directors Continuing in Office.”

Johann Christian Jean Charles Bordais

Johann Christian Jean Charles Bordais, 51, has served as the Chief Executive Officer of the Company since September 2023. Previously, Mr. Bordais led Embraer’s Services & Support business since its foundation in 2016. Mr. Bordais was pivotal in transforming the unit into Embraer’s fastest-growing and most profitable business unit.

During his tenure at Embraer Services & Support, Mr. Bordais transformed Embraer’s aftersales business model, globalizing its solutions and guaranteeing customer satisfaction through innovation and integrated products, and providing a broad portfolio of solutions to customers in Commercial Aviation, Executive Jets and Defense, with more than 2,300 people dedicated to supporting customers and their more than 5,700 aircraft worldwide. From 2018 to August 2023, Mr. Bordais was also the president of the board of directors for OGMA in Portugal, a company that provides agnostic maintenance, repair and overhaul services for civil and military airplanes and engines. For 13 years, Mr. Bordais was responsible for Embraer’s Services & Support office in Paris, managing after-sales and operations for commercial aircraft customers in Europe, Africa, the Middle East and Central Asia. Prior to his move to Europe, Mr. Bordais was the Senior Manager for Aircraft Sales Support & Contract Administration and Manager of the Customer Order Desk.

Prior to leading Embraer’s Services & Support business, Mr. Bordais was responsible for Customer Relationship Management, Technical & Maintenance Support, Materials, Flight Operations, Flight Operations Engineering & Support, Technical Services & Training, and Solutions Business Development & Analytics. Additionally, Mr. Bordais oversaw the Customer Care Center in São José dos Campos and Embraer’s global network of Authorized Aircraft Service Centers.

Before joining Embraer, Mr. Bordais worked at Raytheon/Beechcraft’s authorized maintenance, repair and overhaul (MRO) facility in Paris and at an aircraft engine spare parts company in Dallas, Texas.

Eduardo Couto

Eduardo Couto, 41, has served as the Chief Financial Officer of the Company since 2021. Previously, Mr. Couto had been an employee of Embraer for seven years and, during such time, led key finance areas including Treasury, Insurance, Cash Management, Investor Relations, M&A and Sales Finance globally. Prior to his experience at Embraer, Mr. Couto worked as a leading sell-side analyst for Morgan Stanley and Goldman Sachs for more than seven years, focusing on Latin American Transportation and Infrastructure companies. Mr. Couto was also a Portfolio Manager at Santander Asset Management for four years. Mr. Couto earned his B.S. in Electronic Engineering from the Aeronautical Institute of Technology (ITA), and also holds the Chartered Financial Analyst (CFA) designation.

This section sets forth the compensation of our NEOs for the fiscal year ended December 31, 2023. For the fiscal year ended December 31, 2023, Johann Christian Jean Charles Bordais, Eduardo Couto, André Duarte Stein and Gerard J. DeMuro served as our principal executive officers. No other executive officer exceeded the total compensation threshold for inclusion in the “Summary Compensation Table,” below.

Summary Compensation Table for 2023

The following table summarizes the total compensation paid to or earned by our NEOs in fiscal year 2023, 2022 and 2021.

|

Name and Principal Position |

Year |

Salary ($)(1) |

Bonus ($)(1) |

Stock Awards ($)(2) |

Option Awards ($) |

Non-Equity Incentive |

Change In Pension |

All Other Compensation ($)(1)(4) |

Total ($)(1) |

||||||||

|

Johann Christian Jean Charles Bordais |

2023 |

135,465 |

— |

2,838,268 |

— |

117,511 |

— |

8,493 |

3,099,737 |

||||||||

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Eduardo Couto(5) |

2023 |

344,615 |

— |

3,874,585 |

— |

396,054 |

— |

— |

4,615,254 |

||||||||

|

Chief Financial Officer |

2022 |

297,233 |

154,874 |

— |

— |

298,585 |

— |

30,336 |

781,028 |

||||||||

|

|

2021 |

99,584 |

3,006 |

— |

— |

68,293 |

— |

6,808 |

177,691 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Gerard J. DeMuro |

2023 |

438,462 |

— |

— |

— |

19,234 |

— |

— |

457,696 |

||||||||

|

Former Co-Chief Executive Officer |

2022 |

400,000 |

— |

3,848,800 |

— |

17,333 |

— |

— |

4,266,133 |

||||||||

|

2021 |

113,846 |

— |

— |

— |

8,360 |

— |

— |

122,206 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

André Duarte Stein, |

2023 |

199,563 |

— |

6,063,894, |

— |

12,617 |

— |

2,625 |

6,278,699 |

||||||||

|

Former Co-Chief Executive Officer |

2022 |

187,545 |

154,874 |

— |

— |

266,869 |

— |

4,587 |

613,875 |

||||||||

|

2021 |

61,210 |

9,036 |

— |

— |

57,556 |

— |

1,959 |

129,761 |

| (1) | Amounts converted from Brazilian reais to U.S. dollars using a conversion rate of 4.9841 to $1.00, representing the average exchange rate during the year ended December 31, 2023. | |

| (2) | The amounts reported in this column represent the grant date value of the awards granted during the years presented, determined in accordance with FASB ASC Topic 718. For more information relating to these awards, see the section entitled “Overview of our 2023 Executive Compensation Program—Long-Term Incentive Award,” below. | |

| (3) | The amounts reported in this column represent the annual performance-based cash bonus earned by the NEO with respect to fiscal year performance. For more information relating to these bonuses, see the section entitled “Overview of our 2023 Executive Compensation Program—Annual Cash Incentive Plan,” below. Amounts previously disclosed in this column represented bonus amounts paid during the applicable fiscal year and have been updated to reflect the bonus amounts earned in respect of the applicable fiscal year. | |

| (4) | The amounts reported in this column represent the retirement plan matching contribution paid by the Company for the NEO and home office stipends. | |

| (5) | Amounts for 2021 reflect the compensation attributable to Mr. Couto for the portion of the fiscal year in which he served as the Chief Financial Officer of the Company. Prior to assuming the role of Chief Financial Officer of the Company, in March of 2021, Mr. Couto received a long-term incentive award grant of Embraer shares with a grant date fair market value of $44,484 to vest on the third anniversary of the grant date, subject to partial acceleration upon a qualifying termination of employment. | |

Overview of Our 2023 Executive Compensation Program

Bordais Employment Agreement

On September 29, 2023, Johann Christian Jean Charles Bordais entered into an employment agreement with the Company and its Brazilian subsidiary pursuant to which Mr. Bordais serves as the Company’s Chief Executive Officer. The employment agreement provides for payment of an annual base salary in an amount 1,800,000 BRL and Mr. Bordais will be eligible to receive an annual cash bonus of up to 1,500,000 BRL and periodic grants of restricted stock units pursuant to the Eve Holding, Inc. 2022 Stock Incentive Plan (the “2022 Plan”). Under the terms of his employment agreement, he also received a one-time equity grant. Mr. Bordais’ employment agreement also contains covenants to restrict competitive activity post-employment with the Company.

If Mr. Bordais’ employment is terminated by the Company without cause or by Mr. Bordais for good reason, with the execution of a general release of claims, he will be entitled to severance in the amount of one times his base salary and any additional severance payments required to be paid under Brazilian labor laws.

DeMuro Employment and Separation Agreement

On September 14, 2021, Gerard DeMuro entered into an employment agreement with EAH pursuant to which Mr. DeMuro served as Eve’s Co-Chief Executive Officer. The employment agreement provided for payment of an annual base salary in an amount no less than $400,000. Under the terms of his employment agreement, he also received a one-time equity grant. Mr. DeMuro’s employment agreement also contained standard covenants to restrict competitive activity post-employment with the Company. Effective September 1, 2023, in connection with Mr. Bordais’ appointment to the role of the Company’s Chief Executive Officer, Mr. DeMuro transitioned to the role of Executive Vice President of Corporate Development of the Company on a temporary basis.

On January 15, 2024, in connection with Mr. DeMuro’s resignation from such transitional role, the Company entered into a separation agreement with Mr. DeMuro (the “Separation Agreement”). Mr. DeMuro’s last day of employment with the Company was January 2, 2024. Pursuant to the terms of his Separation Agreement, Mr. DeMuro is entitled to receive six months of benefits continuation in exchange for a customary release of claims against the Company and complying with his obligations under the Separation Agreement.

Annual Cash Incentive Plan

Our NEOs are entitled to receive an annual cash incentive bonus based on achievement of individual and Company goals. Each of our NEO’s annual cash incentive bonuses is determined by multiplying the NEO’s applicable annual base salary by the NEO’s applicable short-term incentive target and the level at which the goals were achieved.

Long-Term Incentive Award

Upon commencement of employment, each NEO received an initial grant of restricted stock units subject to the achievement of service and performance vesting conditions. The Company also makes periodic grants of restricted stock units to its NEOs.

Pursuant to the terms of his employment agreement, Mr. DeMuro received an initial grant of 140,000 fully vested shares and was granted 200,000 restricted stock units, the vesting of which was subject to the achievement of service and performance vesting conditions, pursuant to the 2022 Plan. Mr. DeMuro’s service on the Board will continue to satisfy any service requirements under such award.

2022 Plan

The 2022 Plan was adopted by the board and approved by its stockholders on May 9, 2022. The 2022 Plan permits the grant of options, stock appreciation rights, restricted stock, restricted stock units, stock bonuses, other stock-based awards and cash awards. The aggregate number of shares of the Company’s Common Stock that may be issued under the 2022 Plan is 16,802,821 shares, subject to adjustment as provided therein.

The board of directors has the authority to administer the 2022 Plan with respect to awards made to our executive officers, non-employee directors and all other eligible individuals.

Retirement Benefits

All employees are eligible to participate in a retirement plan with matching contributions. Our NEOs are eligible to participate in this plan on the same basis as our other employees. The matching contributions earned by the NEOs in fiscal year 2023 is shown in the “Summary Compensation Table” under “All Other Compensation.”

We do not sponsor or maintain any nonqualified deferred compensation or defined benefit pension plans for, nor have we issued any equity grants or awards to our NEOs.

Outstanding Equity Awards at 2023 Fiscal Year-End

The following table shows all outstanding equity awards held by NEOs as of December 31, 2023.

|

|

Stock Awards (1) |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Name |

Number of shares or units of stock that have not vested (#) |

Market value of shares or of units of stock that have not vested ($)(7) |

Equity incentive plan awards: Number of unearned shares, units, or other rights that have not vested (#)(8) |

Equity incentive plan awards: Market or payout value of unearned shares, units or other rights that have not vested ($)(9) |

||||

|

Johann Christian Jean Charles Bordais(2) |

17,181 |

125,765 |

326,435 |

2,389,504 |

||||

|

Eduardo Couto |

12,735(3) |

93,220 |

241,965(3) |

1,771,183 |

||||

|

|

36,000(4) |

263,520 |

- |

- |

||||

|

Gerard J. DeMuro(5) |

100,000 |

732,000 |

- |

- |

||||

|

André Duarte Stein(6) |

- |

- |

- |

- |

||||

| (1) | This table provides information pertaining to restricted stock units held by our NEOs as of December 31, 2023. |

|

| (2) | The restricted stock units were granted on October 30, 2023, pursuant to the 2022 Plan and vest subject to the achievement of service and performance conditions. The 17,181 restricted stock units that vest solely on the passage of time will vest in one installment on September 1, 2026, subject to Mr. Bordais continued service through the vesting date. |

|

| (3) | The restricted stock units were granted on January 27, 2023, pursuant to the 2022 Plan and vest subject to the achievement of service and performance conditions. The 12,735 restricted stock units that vest solely on the passage of time will vest in one installment on May 9, 2025, subject to Mr. Couto’s continued service through the vesting date. |

|

| (4) | The restricted stock units granted on May 5, 2023, pursuant to the 2022 Plan and vest in one installment on the third anniversary of the grant date, subject to Mr. Couto’s continued service through the vesting date. |

|