Eve Air Mobility Third Quarter 2023 Results November 07, 2023 eveairmobility.com

Eve Holding, Inc. Third Quarter 2023 Financial highlights Eve is a pre-operational company dedicated to the development of an eVTOL (electric Vertical Takeoff and Landing) aircraft and the Urban Air Mobility (UAM) ecosystem that includes the aircraft development, air traffic management systems and services and support solutions. Eve is not yet producing revenue; we do not expect meaningful revenues during the development phase of our aircraft, and financial results should be mostly related to costs associated with the program development. Eve reported a net loss of $31.2 million in 3Q23 versus $36.7 million in 3Q22. Setting aside non-recurring warrant-related expenses connected to Eve’s PIPE investments and the merger with Zanite (SPAC transaction) of $17.4 million incurred in 3Q22, net loss was then $19.3 million. The higher recurring net losses in 3Q23 compared to the same period of 2022 were mostly driven by higher Research & Development (R&D) expenses, which are costs and activities necessary to advance the eVTOL design, including the Master Service Agreement (MSA) with Embraer, as well as higher recurring Selling, General & Administrative (SG&A) expenses. Higher R&D and recurring SG&A expenses during the quarter were partly offset by financial investment income and FX gains of $4.4 million in the 3Q23 versus a gain of $2.0 million in the 3Q22, due to the current environment of higher interest rates translating into increased interest income on Eve’s cash position in 2023 compared to 2022. R&D expenses were $28.6 million in 3Q23, doubling the $14.3 million in 3Q22. Our R&D costs are primarily driven by the MSA with Embraer that performs several developmental activities for Eve. These efforts continue to intensify as the design of Eve’s eVTOL matures, including internal design, engineering, and program development and testing infrastructure. SG&A expenses in 3Q22 were $6.8 million and included non-recurring expenses, such as Directors & Officers Insurance, expenses related to warrant issuance, as well as legal and audit third-party consulting payments. When excluding these one-off charges of $1.9 million, SG&A expenses increased from c.$4.9 million in 3Q22 to $5.0 million in 3Q23. This is mostly due to the higher number of direct employees at Eve, who perform critical corporate and administrative functions, such as strategy, sales, legal, supply chain and finance activities. Lastly, R&D and SG&A labor expenses were also positively impacted by the c.8% appreciation of the Brazilian Real vs. the U.S. dollar, as most of our costs are incurred in Brazil. R&D expenses in the 9M23 reached $72.0 million, vs. $33.8 million in 9M22, while SG&A increased from $12.4 million in the 9M22 (excluding $11.5 million in non-recurring and transaction-related expenses) to $17.8 million in the 9M23. Like the quarterly numbers, higher accumulated costs and expenses are driven by higher R&D activities necessary to progress the eVTOL design, including the MSA, and an increase in SG&A expenses. Including personnel contracted through the MSA with Embraer and its subsidiaries, Eve employs approximately 760 full-time equivalent professionals in the development of its eVTOL and other elements of the UAM ecosystem such as Service and Operations Solutions and Urban Air Traffic Management, versus approximately 460 in 3Q22. Eve’s total cash consumption in 3Q23 was $22.4 million, versus $17.3 million in 3Q22. In the nine months until September 2023, cash consumption was $70.2 million, vs. $39.1 million in 9M22. R&D associated with Eve’s aircraft development and SG&A expenses mentioned above were the main contributors to the higher cash consumption during the quarter. At the end of 3Q23, Eve’s cash, cash equivalents, financial investments, and related-party loan with Embraer, totaled $256.4 million. This is down just $12.7 million in the quarter, reflecting the withdrawal of the first tranche of the two credit lines from Brazil’s National Development Bank (BNDES) that had been approved in December 2022. Eve received R$57.0 million (US$11.7 million, using the Sept. 30, 2023, exchange rate) of the total available funds of R$490.0 million (US$97.9 million) from BNDES. Both lines offer attractive terms and conditions that are aligned with Eve’s early-stage development, with long-term maturity and amortization grace period and will support Eve as it continues to advance its eVTOL program. With that, Eve’s 3Q23 total liquidity – including still-undrawn portions of the BNDES credit lines is now at $342.5 million. We expect to continue drawing from these facilities through the end of 2024, which will help Eve better manage cash position and optimize our capital structure as well as capital deployment towards the development of our eVTOL program.

Key Financial Indicators USD MILLIONS 3Q23 2Q23 3Q22 9M23 9M22 INCOME STATEMENT Research and Development (28.6) (21.8) (14.3) (72.0) (33.8) Selling, General and Administrative (5.0) (6.6) (6.8) (17.8) (23.9) New Warrants / Change in fair value of derivative liabilities (0.9) (6.8) (17.1) (9.8) (98.6) Financial investment income / Other financial gain/(loss), net 4.4 4.1 2.0 12.8 3.0 Net Earnings (Loss) (31.2) (31.4) (36.7) (88.4) (154.0) CASH FLOW Net Cash Used in Operating Activities (22.4) (27.7) (16.8) (70.0) (38.7) Net Additions to PP&E (0.0) (0.1) (0.4) (0.2) (0.4) Free Cash Flow* (22.4) (27.8) (17.3) (70.2) (39.1) Net Cash Provided by Financing Activities 11.0 (0.3) 15.0 10.7 352.7 3Q23 2Q23 3Q22 BALANCE SHEET Other Assets 3.6 2.5 3.4 Total Payables 34.8 27.6 21.9 Cash, Equivalents and Investments, Beginning of Period** 269.0 294.6 330.8 Cash, Equivalents and Investments, End of Period** 256.4 269.0 329.9 Total Debt 11.3 - - Total liquidity including BNDES Standby Facility*(1) 342.8 370.7 329.9 * Free Cash Flow and total liquidity are non-GAAP meaures ** Includes Related Party Loans but does not include BNDES standby facility of $86.1 million (1) Includes Cash and Cash equivalents of up to 90 days + investments above 90 days (including related party) + undrawn BNDES standby facility of $86.1 million Milestones Checklist Eve continues to advance its eVTOL (electric Vertical Take Off and Landing) development and testing phase and make strides toward key program milestones. • Selection of primary suppliers Following the selection of suppliers of flight-critical components – electric motors, energy management systems and propellers that was announced in 2Q23, Eve continues to make steady progress in the selection of additional important component suppliers for flight control, avionics, flight actuators and thermal-management systems. Embraer will supply Eve’s flight control computer (FCC) and systems, with its fly-by-wire capabilities. Besides designing, developing, and manufacturing the flight-control hardware and systems, Embraer will also provide support for certification at ANAC, FAA, EASA, among other airworthiness authorities with which Eve intends to certify its eVTOL aircraft. Garmin will supply the G3000® Integrated Flight Deck for Eve’s eVTOL which features large-format, light weight, high-resolution glass displays integrating seamlessly with Eve’s vehicle management and flight control systems. Tailored for the needs of eVTOL aircraft, the flight deck’s intuitive touchscreen interface reduces pilot workload by providing direct access to a full suite of avionics capabilities including an integrated flight management system, NAV/COM radios, transponder, audio management and access to a breadth of applications including checklists, charts, synoptics, and full-featured maps. Liebherr will develop electromechanical actuators (EMA) for the fly-by-wire flight controls of Eve's eVTOL. Liebherr is well known for their expertise in the manufacturing of precision gears and dependable actuation, crucial for this type of technology. The actuators will be powered by the aircraft’s electrical system and the technology will ensure high performance, configurability and easier maintenance. Intergalactic will provide the thermal management system which will maintain an optimal temperature range for equipment including batteries and other electronic components. The system will also help ensure a comfortable temperature inside the cabin of the aircraft. Our supplier selection remains on track. Each of the suppliers were not only selected for the development and certification phase, but also for full aircraft series production. Along with supplying the various systems and parts, each of the supplier agreements include long-term aftermarket support to our operators in the different equipment.

We continue to work to select best-in-class providers of other components, such as airframe, cabin transparencies, external lighting, interior, among others, and expect to complete the technical and commercial selection of all suppliers in the upcoming months. • Aircraft systems architecture definition With the suppliers of propulsion, battery and propellers defined – and known requisites and specifications of each of these components (i.e., weight, power, size, required sub-systems…), we concluded the final architecture of our eVTOL and announced it during the Paris Air Show in 2Q23. Our aircraft features a Lift + Cruise configuration, which we believe to be the most efficient for urban missions. The latest concept includes an electric pusher powered by dual electric motors that provide propulsion redundancy, while ensuring high performance and safety and offering numerous advantages including lower cost of operation, fewer parts, optimized structures and systems, our eVTOL has been developed to offer efficient thrust with a low sound profile. • Initiate first prototype assembly We had previously received the necessary tooling to be used in the manufacturing process of the wings, as well as their root and tip liners. We also completed the first carbon-fiber laminate material for our first full-scale prototype in August. We now also have the internal structural wing components – such as ribs and spars. The ribs form the “skeleton” of the wings, giving it an efficient aerodynamic shape, while the spars attach the wings to the fuselage, respectively. These are designed to be robust, lightweight, flexible, and function to support the wings and the inherent in-flight stresses they will experience. Also, we started to assemble the first harness – a complex system of wires and electrical cables that is used to connect electrical and electronic components to flight surfaces and sensors. Lastly, we now also have the first structure to support the fuselage of our full-scale prototype. We will continue to work on the assembly of the first prototype during the remainder of 2023 and first half of 2024 as we receive additional parts and components from suppliers and commence the integration of the multiple systems.

• Initiate test campaign (2024) We continue to expect to have the first full-scale prototype ready for the test campaign in 2024. With that, we maintain our plans on obtaining certification and making the first commercial deliveries of our eVTOL (Entry into Service, EIS) in 2026. • Trial software for Urban Air Traffic Management (Urban ATM) Throughout 2023, we plan to conclude the development of the next release of Eve’s Urban ATM Software to test and deploy for trials with potential customers. • Total cash consumption With intensifying design efforts, suppliers’ selection, and the initial construction of our first full-scale representative prototype, Eve expects a total cash consumption between $130 and $150 million primarily in the eVTOL development program as well as Selling, General and Administrative (SG&A) expenses in 2023. This compares to $59.9 million invested in the program in 2022 and $70.2 million in 9M23. Given Eve’s constant focus on cost control, synergies with Embraer and longer payment terms, we now anticipate our 2023 total cash consumption to be closer to the low end of the expected range of $130 to $150 million. Moreover, it is possible that some supplier payments will now occur in 2024 given Eve’s continuous effort to preserve cash, shifting cash outflow and payments to the right from 4Q23 to 1Q24 onwards. Lastly, we will continue to select suppliers and receive equipment during the remainder of 2023 and first half of 2024 that will trigger additional cash consumption in the coming months. We continue to expect sequentially higher investments and expenses in the quarters ahead due to intensifying engineering engagement as well as potential supplier payments. The additional program activities will require an increase in the number of engineering hours – via our MSA with Embraer as well as direct Eve personnel, and the acquisition of raw materials and parts/components to continue building our full-scale prototype. We also are intensifying the testing phase with numerous rigs, systems for the different individual components and aerodynamic drag in wind tunnel sessions. We are confident that our current liquidity is sufficient to fund our operations, design and certification efforts well into 2025. eVTOL Development Program During 3Q23 we initiated the Joint-Definition Phase (JDP) of our development program. This is a crucial milestone in our eVTOL project timeline. It is during this phase that our technical team engages with their counterparts at our suppliers to perform a comprehensive analysis to ensure all the system interfaces are fully defined and the aircraft components will operate flawlessly with each other. This phase is critical to the project's success by ensuring that all parties involved have a clear understanding of the project's goals and requirements. This phase also aligns the mechanical and software interfaces of the multiple components and subsystems and assures that equipment from different suppliers will work seamlessly within the specifications of our eVTOL design and performance criteria. Our team continues to conduct tests to refine our aerodynamic design and computer models in wind tunnels. The latest tests performed in August/September 2023 were used to calibrate the wing-rotor and rotor-rotor interface models, with powered rotors for the first time. Further tests are scheduled for later this month to better Cash-consumption estimates are calculated using an expected exchange rate of R$5.20/US$1 for the full year of 2023

assess characteristics of the cruise phase of the flight and on the vertical-to-cruise / cruise-to-vertical transition phases of the flight. In the meantime, we continue to deploy our truck-mounted rig to perform different evaluations of our rotor configuration. Such tests validate the phenomenon associated with airflow over the rotors while the vehicle is in transition and cruise modes. One of the test rigs focuses specifically on sound emissions that combine different ground speeds, incident angles and different rpm (revolutions per minute). Separately, our propeller rig tests different composite designs for an optimal combination of lift, sound emission and energy consumption. Eve and DHL partner to design a supply chain concept for eVTOL support On August 9, Eve announced it signed a Memorandum of Understanding (MOU) with DHL Supply Chain, a global leader in warehousing and distribution, to conduct a study of key demands and supply chain characteristics for its eVTOL operation. The primary goal of the partnership is to explore and understand best practices for supplying operators and service centers with spare parts and inputs, with an emphasis on batteries and the specific requirements concerning transport, storage and disposal of those devices. Other aspects reviewed will include modes of transportation, frequency, and delivery plan, required logistics partners, potential locations for advanced inventories, physical and technological infrastructure requirements and contingency plans. The logistics study from Eve and DHL will encompass the distribution of parts and materials required for repairs and maintenance. Another crucial aspect to be considered is battery logistics, which holds significant importance in this business model. In this regard, DHL’s expertise in handling batteries from various industries will be leveraged. The companies will also evaluate supply chain management for general supplies to vertiports, optimizing the business processes. Eve and Moviation signed letter of intent for first eVTOL Urban ATM agreement in South Korea Eve and Moviation, South Korea’s first Urban Air Mobility (UAM) service provider, announced the signature of a Letter of Intent to purchase Eve’s Urban ATM solution. The software solution will be a key enabler to the implementation and scalability of Urban Air Mobility (UAM) and provides critical traffic management services that will play an essential role in enabling the global UAM market to scale. The agreement comes as Eve’s Urban ATM (Air Traffic Management) concept has been adopted as part of Korea’s K-UAM Grand Challenge, a phased demonstration program in which Urban Air Mobility (UAM) vehicle safety and traffic management function tests suitable for urban conditions and environments are integrated and operated to support the commercialization of UAM in 2025. From before take-off to after landing, the urban air environment will count on integrated systems, services and technologies being developed by Eve to enable the safe launch of an efficient and predictable ecosystem to support eVTOL operations alongside many other airspace users. In the future, the advancement of infrastructure and regulation will rely on these network management services to enable autonomous flight.

Eve is creating a new air-traffic-management (ATM) solution, specifically designed to help safely scale the UAM industry. This software is intended to perform at the same safety level as Embraer’s existing ATM software – provided by its subsidiary, Atech – and expected to be a strategic asset to support the growth of the entire UAM ecosystem. Eve has engaged Atech, Embraer’s Air Traffic Control technology and system integration company, to support the development of the Urban ATM software solution. Eve is leveraging Atech’s experience in developing aviation-grade products from the ATM systems in Brazil. The company is also continuing to collaborate with regulators, customers air navigation service providers, fleet operators, vertiport developers, airports and other UAM ecosystems stakeholders globally to advance concepts and develop technology to support initial operation and scaling of UAM operations from an ATM perspective. We plan to launch a trial software of our UATM solution later this year. Visual and Sound Perception Study Eve is working towards a new concept for UAM where eVTOLs — that will be quieter than many aircraft in the urban environment, will connect people across cities and suburbs. eVTOLs will need to operate close to communities, introducing new types of sights and sounds. For Eve, it is essential to understand community perceptions when seeing and hearing this new mode of transportation from different locations around the city. We believe that by informing communities about eVTOL operations and learning about perceptions of this new technology, we’ll be able to optimize the eVTOL design and flight operations. Data regarding perceptions of eVTOL sights and sounds are not widely available. That is why we are partnering with the Royal Netherlands Aerospace Centre (NLR) to gather data that will inform efforts to improve the community experience of UAM operations. NLR has deep expertise in conducting sound and perception studies. During August, we conducted studies in Orlando and New York City to analyze the perception of potential passengers and residents of these cities. The study considered two scenarios: a busier area with higher background noise and another with lower background noise, the latter closer to residential neighborhoods. The intent was to understand how people respond to the eVTOL visual and sound footprint by correlating sound level and characteristics with annoyance perception and acceptance. The study used cutting-edge tools to simulate the experience by employing virtual reality and auralization. This visual and sound perception study is another key initiative of Eve´s design strategy. We are co-creating solutions with real people so that we can fulfill future users’ expectations and make UAM accessible. Human-Machine Interface Summit In the quarter, Eve also hosted its first Human-Machine Interface (HMI) Summit, an event focused to collect customer feedback on the company’s eVTOL flight deck environment and interfaces. Held at the company’s offices in Brazil, Eve’s HMI Summit was developed in collaboration with customers from various locations around the world. Attendees included nearly 20 operators of a diverse range of vehicles including fixed-wing, rotary-wing and drones. Eve’s Engineering and Services and Operations Solutions teams led discussion on a variety of topics ranging from flight controls, avionics, electrical systems, propulsion to interior design. The group also discussed operations manuals and Eve’s agnostic services and operations solutions and Urban ATM offerings. The HMI Summit provided a great forum to not only share Eve’s approach, but to get invaluable feedback from experienced pilots on the interfaces, ergonomics and capabilities being designed into the aircraft.

Backlog, order pipeline Services & Operations Solutions Eve is replicating elements of Embraer’s proven business model, namely the design, manufacturing, and sale of aircraft. In addition, it also provides MRO (Maintenance, Repair and Overhaul) services on an agnostic basis worldwide. With that, Eve is uniquely positioned to serve its customers by leveraging Embraer’s global presence with local support and has secured contracts for Services & Operations Solutions across the world with 7 customers. Combined, these customers have placed LOIs for a total of 825 of our eVTOLs. These contracts include MRO, training, battery services, data integration and spare parts solutions, as well as component repair. These functions will be enhanced by an August 2023 MoU (Memorandum of Understanding) signed with DHL Supply Chain to optimize supply chain to service centers. The MoU will also focus on batteries and the specific requirements for transporting, storing, and disposing of those devices. These Service & Operations Solutions contracts are estimated to bring revenues of $540 million during the first five years vehicle operation and because of our agnostic approach to the maintenance business, Service & Operations Support revenues could precede the first delivery of our eVTOL. Lastly, and in addition to eVTOL sales and Service and Operations solutions, Eve is also engaged in developing software for Urban Air Traffic Management (Urban ATM) and has signed Letters of Intent from 10 customers globally. eVTOL orders Currently, Eve’s order pipeline totals 2,850 units with a total backlog value of approximately $8.6 billion. Our initial order pipeline is based on non-binding letters of intent (LOI) and therefore subject to change, consistent with common aviation practices. Eve’s current client base is comprised of 28 customers, with no client representing more than 14% of the total order book, including options. The order book is further diversified by the industries in which these customers operate, with airlines representing 36%, helicopter operators 24%, ride platforms 19%, lessors 15%, and the remaining LOIs are from a defense contract between BAE Systems and Embraer. Lastly, Eve has received LOI’s from clients in 14 different countries spread over five continents across the globe. The Americas is home to close to two thirds of Eve’s backlog (North is 44% and South 17%), while Europe represents 19% of the LOIs, and Asia 12%.

Rather than relying on traditional combustion engines, eVTOL aircraft are designed to use electric motors, providing an alternative means of transportation in urban markets that do not produce carbon emissions. Eve’s design uses a conventional fixed wing and empennage, rotors and a pusher, giving it a practical and intuitive lift-plus-cruise design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly at the same time. With an expected range of 60 miles (approx. 100 kilometers), Eve’s aircraft have the potential to not only offer a sustainable and affordable commute, but also to reduce sound levels compared to current conventional helicopters. Its human-centered design ensures the comfort of passengers, the pilot and the community by minimizing sound. The all-electric aircraft features dedicated rotors for vertical flight and a fixed wing to fly on cruise, with no components required to change position during flight. It will be piloted at launch but evolving towards uncrewed operations in the future. Eve received initial funds from Brazil’s National Development Bank to support eVTOL development During the third quarter, Eve received its first disbursement of funds from two credit lines from Brazil’s National Development Bank (BNDES). The company received approximately R$58.7 million (US$11.7 million) of the total available funds of R$490.0 million (US$97.9 million). The credit lines, approved in December 2022, were awarded to support the company’s eVTOL development program and will be received in 2023 and 2024 as Eve continues to advance its eVTOL development program. Both lines offer attractive terms and conditions that are aligned with Eve’s early-stage development including a long-term maturity and amortization grace period. The first credit line is part of the BNDES Climate Fund (Fundo Nacional Sobre Mudança Climática). This program is designed to provide financing to support businesses and projects that help mitigate climate change and reduce carbon emissions, with urban mobility as one of its nine sub-programs. The Climate Fund helps with the funding of entrepreneurial projects, the acquisition of machinery and equipment, as well as the development of technologies to reduce carbon and greenhouse-gas emissions. In addition to urban mobility, the Climate Fund also focuses on sustainable cities and climate change, efficient machinery and equipment, renewable energy, solid residue, charcoal, native forestry, carbon management and services, and innovative projects. The second line of credit is from Innovation Finance (Financiamento a Empreendimentos de Inovação), a program designed to provide long-term funding for disruptive industrial projects that generate social benefits, such as urban mobility, energy generation, education and sewage, among others.

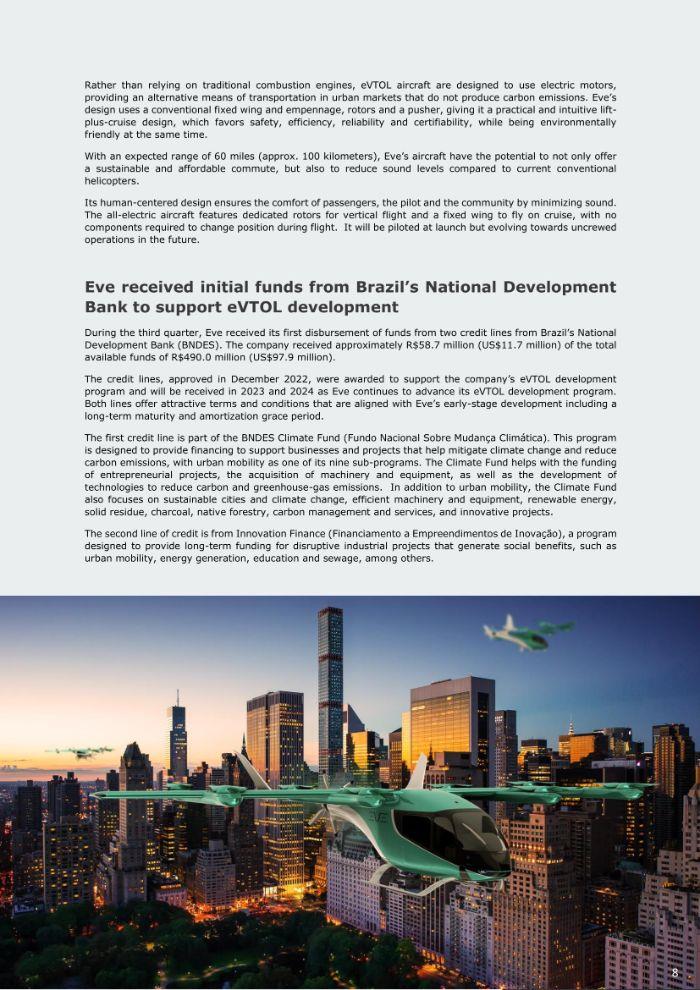

Financial Performance Income statement Unaudited (US dollars, except where noted) Balance sheet Unaudited (US dollars, except where noted) 8 Three Months Ended Nine Months Ended September 30, September 30, 2023 2022 2023 2022 Operating expenses Research and development $ 28,642,065 $ 14,298,925 $ 71,991,658 $ 33,830,890 Selling, general and administrative 5,034,782 6,845,045 17,822,207 23,892,011 New Warrants expenses - 17,424,230 - 104,776,230 Loss from operations (33,676,847 ) (38,568,200 ) (89,813,865 ) (162,499,131 ) (Loss)/gain from change in fair value of derivative liabilities (853,575 ) 285,000 (9,832,500 ) 6,127,500 Financial investment income 2,802,189 1,492,292 9,039,037 2,380,240 Other financial gain, net 1,616,035 536,562 3,789,856 635,180 Loss before income taxes (30,112,198 ) (36,254,346 ) (86,817,472 ) (153,356,211 ) Income tax expense (1,097,647 ) (490,376 ) (1,574,382 ) (620,084 ) Net loss $ (31,209,845 ) $ (36,744,722 ) $ (88,391,854 ) $ (153,976,295 ) Weighted-average number of shares outstanding – basic and diluted 275,887,223 272,040,343 275,671,199 247,010,044 Net loss per share basic and diluted $ (0.11 ) $ (0.14 ) $ (0.32 ) $ (0.62 ) September 30, December 31, 2023 2022 ASSETS Current assets Cash and cash equivalents $ 10,097,318 $ 49,146,063 Financial investments 164,448,485 178,781,549 Related party receivables 1,624,098 203,712 Related party loan receivable 81,805,950 82,650,375 Other current assets 1,586,393 1,425,507 Total current assets 259,562,244 312,207,206 Property, plant & equipment, net 477,928 451,586 Right-of-use assets, net 534,733 216,636 Other non-current assets 976,467 - Total non-current assets 1,989,128 668,222 Total assets $ 261,551,372 $ 312,875,428 LIABILITIES AND EQUITY Current liabilities Accounts payable $ 1,832,288 $ 2,097,097 Related party payables 20,267,182 12,625,243 Derivative financial instruments 13,395,000 3,562,500 Other current payables 10,664,611 6,648,171 Total current liabilities 46,159,081 24,933,011 Long-term debt 11,319,690 - Other non-current payables 2,027,786 1,020,074 Total non-current liabilities 13,347,476 1,020,074 Total liabilities 59,506,557 25,953,085 Equity Common stock, $0.001 par value 269,209 269,094 Additional paid-in capital 507,175,781 503,661,571 Accumulated deficit (305,400,175 ) (217,008,322 ) Total equity 202,044,815 286,922,343 Total liabilities and equity $ 261,551,372 $ 312,875,428

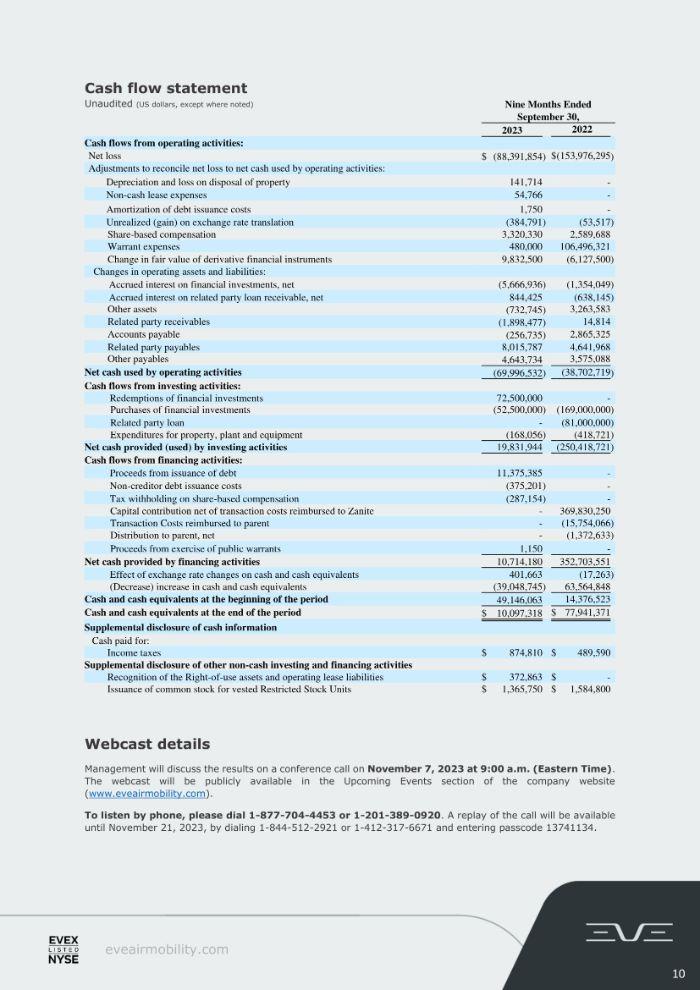

Cash flow statement Unaudited (US dollars, except where noted) Webcast details Management will discuss the results on a conference call on November 7, 2023 at 9:00 a.m. (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-877-704-4453 or 1-201-389-0920. A replay of the call will be available until November 21, 2023, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 13741134. Nine Months Ended September 30, 2023 2022 Cash flows from operating activities: Net loss $ (88,391,854 ) $ (153,976,295 ) Adjustments to reconcile net loss to net cash used by operating activities: Depreciation and loss on disposal of property 141,714 - Non-cash lease expenses 54,766 - Amortization of debt issuance costs 1,750 - Unrealized (gain) on exchange rate translation (384,791 ) (53,517 ) Share-based compensation 3,320,330 2,589,688 Warrant expenses 480,000 106,496,321 Change in fair value of derivative financial instruments 9,832,500 (6,127,500 ) Changes in operating assets and liabilities: Accrued interest on financial investments, net (5,666,936 ) (1,354,049 ) Accrued interest on related party loan receivable, net 844,425 (638,145 ) Other assets (732,745 ) 3,263,583 Related party receivables (1,898,477 ) 14,814 Accounts payable (256,735 ) 2,865,325 Related party payables 8,015,787 4,641,968 Other payables 4,643,734 3,575,088 Net cash used by operating activities (69,996,532 ) (38,702,719 ) Cash flows from investing activities: Redemptions of financial investments 72,500,000 - Purchases of financial investments (52,500,000 ) (169,000,000 ) Related party loan - (81,000,000 ) Expenditures for property, plant and equipment (168,056 ) (418,721 ) Net cash provided (used) by investing activities 19,831,944 (250,418,721 ) Cash flows from financing activities: Proceeds from issuance of debt 11,375,385 - Non-creditor debt issuance costs (375,201 ) - Tax withholding on share-based compensation (287,154 ) - Capital contribution net of transaction costs reimbursed to Zanite - 369,830,250 Transaction Costs reimbursed to parent - (15,754,066 ) Distribution to parent, net - (1,372,633 ) Proceeds from exercise of public warrants 1,150 - Net cash provided by financing activities 10,714,180 352,703,551 Effect of exchange rate changes on cash and cash equivalents 401,663 (17,263 ) (Decrease) increase in cash and cash equivalents (39,048,745 ) 63,564,848 Cash and cash equivalents at the beginning of the period 49,146,063 14,376,523 Cash and cash equivalents at the end of the period $ 10,097,318 $ 77,941,371 Supplemental disclosure of cash information Cash paid for: Income taxes $ 874,810 $ 489,590 Supplemental disclosure of other non-cash investing and financing activities Recognition of the Right-of-use assets and operating lease liabilities $ 372,863 $ - Issuance of common stock for vested Restricted Stock Units $ 1,365,750 $ 1,584,800

Upcoming Events Eve senior management is scheduled to attend the following investor events: Embraer Investor Day – New York, NY (Nov. 16) UBS Industrials Summit – Palm Bech, FL (Nov. 28-30) BofA Space, Transportation and Aviation Research Summit (STARS 2023) – Virtual (Dec. 13) TD Cowen Raymond Aerospace/Defense & Industrials Conference – Washington, D.C. (Feb. 13-14, 2024) Raymond James & Associates’ Institutional Investors Conference – Orlando, FL (Mar. 3-6, 2024) Glossary of Commonly-Used Terms ACMI – Aircraft, Crew, Maintenance and Insurance AL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência de Aviação Civil ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures for the development of expansion of the telecommunications infrastructure COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Environment Impact Statement / Entry Into Service Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after-sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. Embraer holds 238,5million Eve shares, or 87% of our equity. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation Agency GAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Condition LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Progressive Down Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) – Accrued expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air Mobility UAS – Unmanned Aircraft Systems UATM – Urban Air Traffic Management

About Eve Holding, Inc. Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global services and support network and a unique air traffic management solution. Since May 10, 2022, Eve is listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”. Forward Looking Statements Certain statements contained in this release are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words or expressions. All statements, other than statements of historical facts, are forward-looking statements, including, but not limited to, statements about the company’s plans, objectives, expectations, outlooks, projections, intentions, estimates, and other statements of future events or conditions, including with respect to all companies or entities named within. These forward-looking statements are based on the company’s current objectives, beliefs and expectations, and they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth herein as well as in Part I, Item 1A. Risk Factors and Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations of the company’s most recent Annual Report on Form 10-K, Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors of the company’s most recent Quarterly Report on Form 10-Q, and other risks and uncertainties listed from time to time in the company’s other filings with the Securities and Exchange Commission. Additionally, there may be other factors of which the company is not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. The company does not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements. other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement. Investor Relations: Lucio Aldworth Caio Pinez [email protected] https://ir.eveairmobility.com/ Media: [email protected]