Eve Air Mobility Fourth Quarter and FY 2022 Results March 16, 2023 eveairmobility.com

Eve Holding, Inc. Fourth Quarter and FY 2022 2022 in review The year of 2022 was particularly eventful for Eve as we accomplished several milestones on our journey to shape the global Urban Air Mobility (UAM) ecosystem, listed the company in the public market, and brought several new partners to our project. Eve is the first company to graduate from EmbraerX – after having unveiled our first eVTOL (electric Vertical Take Off and Landing) solution in May 2018. As a separate company, Eve now has the resources, agility and autonomy to continue pursuing innovations to be a protagonist in the UAM market. During last year, Eve debuted in the New York Stock Exchange (NYSE) as a public company under the symbol EVEX with a de-SPAC transaction that raised net proceeds of approximately $355 million, including PIPE investors and an additional strategic investment by United Airlines Ventures. Also, we secured two distinct credit lines with Brazil’s National Development Bank – the BNDES, for an additional $92.5 million. With our total liquidity now in excess of $400 million, we feel comfortable that our financial position is sufficient to fund our Research & Development (R&D) requirements as well as operations well into 2025 given the cost advantages we enjoy through our strategic partnership with Embraer. Our engineers continue to refine our eVTOL design as the program matures. We are leveraging Embraer’s proven development practices, testing subsystems through various methodologies to validate Proofs of Concept (POC’s) and advance towards full-scale prototype of our commercial vehicle for the certification process. Our agile, model-based approach allows us to validate components and airframe features independently or on a systems-basis allowing us to vary configurations as new solutions are identified in a quick and efficient manner. The goal is to develop a safe and reliable eVTOL solution with the most affordable operation and maintenance cost profile, which we believe will be achieved through our Lift + Cruise design configuration. We have initiated the certification process of our eVTOL with Brazil’s aviation authority – ANAC, and we expect the validation process for the Type Certification (TC) in Brazil to be followed by the FAA (United States Federal Aviation Authority) targeting a dual certification and entry into services in 2026. In parallel, we are in discussions with EASA in Europe and other certification authorities. The Brazilian authorities have a long history of collaboration through bi-lateral agreements with other certification authorities – whereby other certification authorities globally accept and validate the majority of work done by ANAC, typically with reduced additional tests. We believe this combination puts Eve on a clear path to global certification, particularly when combined with our expertise in certification, simple design solutions and undivided attention from the Brazilian authorities. We continued to conduct simulations with conventional helicopters to test potential applications and use cases of our eVTOL in real urban areas – the most recent ones were a pilot project operated by Blade India with four daily flights from the Bangalore international airport to the city’s business center as well as two weeks of flight simulations in Chicago with the participation of multiple partners including airlines, rotorcraft operators, infrastructure companies and local authorities. After a similar simulation in Rio de Janeiro, we continue to gather market intelligence that will be critical for the proper design of the UAM ecosystem and necessary infrastructure to help scale the business globally and offer a safe and comfortable passenger experience. Additionally, we are advancing in the selection of the industrial and development partners of critical technologies and components such as battery, propulsion, avionics, manufacturing, among others that we expect to conclude throughout this year. Some of our partners are also investors in Eve, which provides strong alignment with our interests to develop the UAM market and our aircraft. Moreover, they bring strategic know-how to support the development of specific components of our aircraft and our suite of products and services for UAM. The result of Eve’s strengths is the largest and most diversified backlog (by number of customers and regions) in the industry today. In total, we have non-binding LOIs (Letter of Intent) for 2,770 aircraft, from 26 different customers spread over 12 countries and different markets. We believe this preliminary pipeline offers strong long-term revenue visibility and will help Eve to smooth cash-flow consumption in the years to come as we start to convert the existing letters of intention into firm orders and collect pre-delivery payments (PDP). We believe Eve has the right partners and development team, which coupled with strong liquidity provide the foundation for success in the design, certification and support of eVTOLs and the UAM market in the years ahead. Gerard (Jerry) DeMuro André Stein Co-CEO Co-CEO

Upcoming Milestones During 2022, Eve’s senior management established the necessary structures and processes to support our operations and concluded important financial transactions to fund our eVTOL development efforts. Now with funding secured for the next few years, Eve will continue to accelerate program development with ambitious targets for 2023 and 2024: • Selection of primary suppliers We intend to define the suppliers of the most critical components of our aircraft (e.g., battery, propulsion, etc.) in the first semester of 2023. When completed, we will be able to refine and validate our expectations for total aircraft production and operating costs. • Aircraft systems architecture definition With defined suppliers and known specifications of each of the critical components, we will finalize the configuration of our aircraft. • First prototype We plan to begin assembly of the first commercially representative prototype, to be used in our test and certification campaign, during the second half of 2023. • Initiate test campaign Test and certification campaign should commence once the prototype is fully assembled and operational, which is currently planned for 2024. • Trial software for Urban Air Traffic Management (Urban ATM) Throughout 2023, we plan to conclude the development of the next release of Eve’s Urban ATM Software to test and deploy for trials with potential customers. • Total cash consumption With intensifying design efforts and the initial build of our first commercially representative prototype, Eve expects to allocate between $130 and $150 million towards the development program as well as Selling, General and Administrative (SG&A) expenses in 2023. The additional program activities will require an increase in the number of engineering hours – via our Master Service Agreement (MSA) with Embraer as well as direct Eve personnel, and the acquisition of raw materials and parts/components to build our full-scale prototype. We feel comfortable that our current liquidity is sufficient to fund our operations, design and certification efforts into 2025. Financial highlights Eve is a pre-operational company dedicated to the development of an eVTOL (Eletric Vertical Takeoff and Landing Vehicle) and the Urban Air Mobility (UAM) ecosystem that includes the vehicle development, air traffic management systems and services and support. Eve doesn’t expect meaningful revenues during the development phase of its vehicle and its financial results are mostly related to costs associated with the program development. Eve reported a net loss of $20.1 million in 4Q22 versus $8.3 million in 4Q21. For 2022, net loss was $174.0 million, compared with net loss of $18.3 million reported in 2021. Setting aside non-recurring, non-cash expenses of (1) $104.8 million associated with warrant expenses and (2) $6.2 million related to transaction costs and the business combination with Zanite Acquisition Corp. – the higher net losses in 2022, compared to 2021, were driven by higher Research & Development (R&D) expenses and costs activities necessary to progress the eVTOL design, including the Master Service Agreement (MSA) with Embraer and an increase in Selling, General & Administrative (SG&A) expenses. R&D expenses were $18.0 million in 4Q22, compared with $6.6 million in 4Q21. For 2022, R&D reached $51.9 million or almost four times the $13.3 million invested in the program in 2021. Our R&D efforts are primarily driven by the MSA with Embraer that performs several developmental works for Eve, which reached $38.6 million in 2022. These efforts intensified in the last year as the design of Eve’s eVTOL advances, as did Eve’s internal design and development structure. SG&A expenses increased from $1.6 in the 4Q21 to $9.0 million in the 4Q22 and from $4.9 million in 2021 to $32.9 million in 2022, mainly due to the growth in the number of direct employees at Eve, who perform critical corporate functions including program management, strategy, sales and finance activities. Cash-consumption estimates are calculated using an expected exchange rate of R$5.20/US$1 for the full year of 2023.

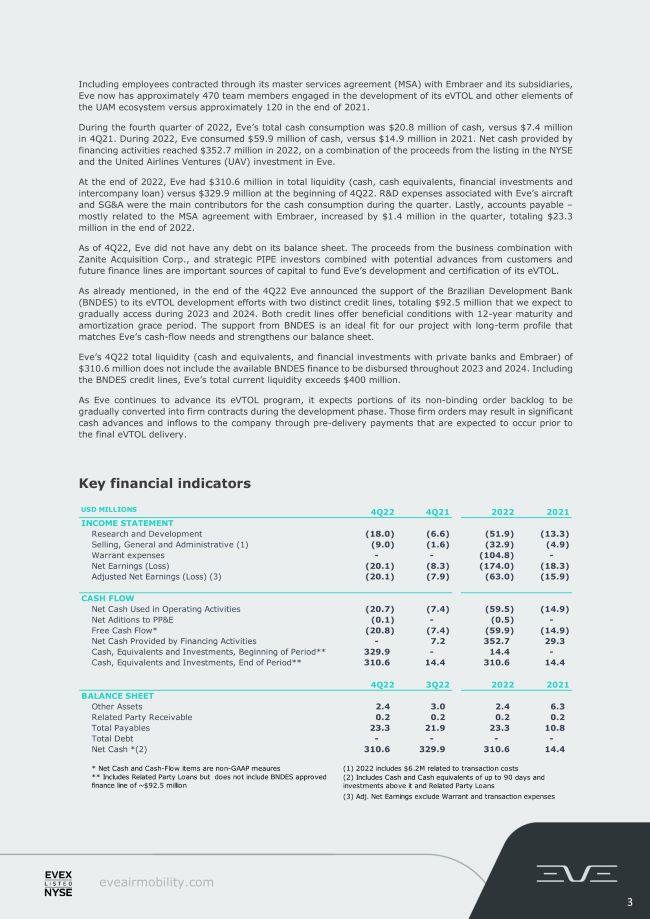

Including employees contracted through its master services agreement (MSA) with Embraer and its subsidiaries, Eve now has approximately 470 team members engaged in the development of its eVTOL and other elements of the UAM ecosystem versus approximately 120 in the end of 2021. During the fourth quarter of 2022, Eve’s total cash consumption was $20.8 million of cash, versus $7.4 million in 4Q21. During 2022, Eve consumed $59.9 million of cash, versus $14.9 million in 2021. Net cash provided by financing activities reached $352.7 million in 2022, on a combination of the proceeds from the listing in the NYSE and the United Airlines Ventures (UAV) investment in Eve. At the end of 2022, Eve had $310.6 million in total liquidity (cash, cash equivalents, financial investments and intercompany loan) versus $329.9 million at the beginning of 4Q22. R&D expenses associated with Eve’s aircraft and SG&A were the main contributors for the cash consumption during the quarter. Lastly, accounts payable – mostly related to the MSA agreement with Embraer, increased by $1.4 million in the quarter, totaling $23.3 million in the end of 2022. As of 4Q22, Eve did not have any debt on its balance sheet. The proceeds from the business combination with Zanite Acquisition Corp., and strategic PIPE investors combined with potential advances from customers and future finance lines are important sources of capital to fund Eve’s development and certification of its eVTOL. As already mentioned, in the end of the 4Q22 Eve announced the support of the Brazilian Development Bank (BNDES) to its eVTOL development efforts with two distinct credit lines, totaling $92.5 million that we expect to gradually access during 2023 and 2024. Both credit lines offer beneficial conditions with 12-year maturity and amortization grace period. The support from BNDES is an ideal fit for our project with long-term profile that matches Eve’s cash-flow needs and strengthens our balance sheet. Eve’s 4Q22 total liquidity (cash and equivalents, and financial investments with private banks and Embraer) of $310.6 million does not include the available BNDES finance to be disbursed throughout 2023 and 2024. Including the BNDES credit lines, Eve’s total current liquidity exceeds $400 million. As Eve continues to advance its eVTOL program, it expects portions of its non-binding order backlog to be gradually converted into firm contracts during the development phase. Those firm orders may result in significant cash advances and inflows to the company through pre-delivery payments that are expected to occur prior to the final eVTOL delivery. Key financial indicators USD MILLIONS 4Q22 4Q21 2022 2021 INCOME STATEMENT Research and Development (18.0) (6.6) (51.9) (13.3) Selling, General and Administrative (1) (9.0) (1.6) (32.9) (4.9) Warrant expenses - - (104.8) - Net Earnings (Loss) (20.1) (8.3) (174.0) (18.3) Adjusted Net Earnings (Loss) (3) (20.1) (7.9) (63.0) (15.9) CASH FLOW Net Cash Used in Operating Activities (20.7) (7.4) (59.5) (14.9) Net Aditions to PP&E (0.1) - (0.5) - Free Cash Flow* (20.8) (7.4) (59.9) (14.9) Net Cash Provided by Financing Activities - 7.2 352.7 29.3 Cash, Equivalents and Investments, Beginning of Period** 329.9 - 14.4 - Cash, Equivalents and Investments, End of Period** 310.6 14.4 310.6 14.4 4Q22 3Q22 2022 2021 BALANCE SHEET Other Assets 2.4 3.0 2.4 6.3 Related Party Receivable 0.2 0.2 0.2 0.2 Total Payables 23.3 21.9 23.3 10.8 Total Debt - - - - Net Cash * (2) 310.6 329.9 310.6 14.4 * Net Cash and Cash-Flow items are non-GAAP meaures (1) 2022 includes $6.2M related to transaction costs** Includes Related Party Loans but does not include BNDES approved finance line of ~$92.5 million(3) Adj. Net Earnings exclude Warrant and transaction expenses

Eve’s program development With respect to engineering and development advancements, Eve continues to refine aircraft simulations with detailed component, sub-system and system specifications from a short list of potential suppliers. With this more detailed information, our engineers can increase the fidelity of our models, increasing confidence levels and precision in the expected outcomes of different potential performance scenarios. The findings are fed into our flight simulator to fine-tune the flight-control laws, aircraft performance envelope and our fly-by-wire system for piloted tests. We also continue to mature the analysis of the transition between the hover and cruise phases of the flight with enhanced computational fluid dynamics (CFD) calculations to continue evolving the flight profile and loads calculations. These tests yield more details as to the expected controllability of the aircraft during flight and under different weather conditions (air pressure, temperature, prevailing winds, etc.), and passenger loads and component performance. In parallel, our engineers continue to advance the technical knowledge of our eVTOL through the application of a dedicated motor and propeller rig for high-performance, low-noise operation. Our engineers continue to develop other rigs to test other systems as well – such as batteries and rotors, all of which allow for more robust and frequent test applications. Our partnership with Atech (Embraer subsidiary focused on developing Air Traffic Management solutions) completed the Conception and Systems Design phase for our Urban ATM software. This defined the system requirement with a feasibility study of our Urban ATM solutions, and included full technical analysis, life-cycle development cost estimates, certification (if necessary), systems deployment, model construction, simulation and prototyping. We are developing our Urban ATM solution to assist in the management of aircraft flow within controlled airspaces and improve efficiency in operations and in vertiports. The goal is to reduce wait times and aircraft energy consumption by optimizing flight plans and integrating flight paths of different aircraft. An early version of our system was tested in our September simulation in Chicago. New Urban Air Traffic Management agreements During the fourth quarter of 2022, Eve announced additional agreements for the sale of our Urban Air Traffic Management (UATM) solution: In October, the company signed a LOI with Skyway to provide Eve’s UATM software solution, ensuring the traffic management for future Urban Air Mobility (UAM) solutions supports the needs and growth of the industry. This new collaboration reinforces Eve’s and Skyway’s commitment to safely integrating and scaling global UAM operations.

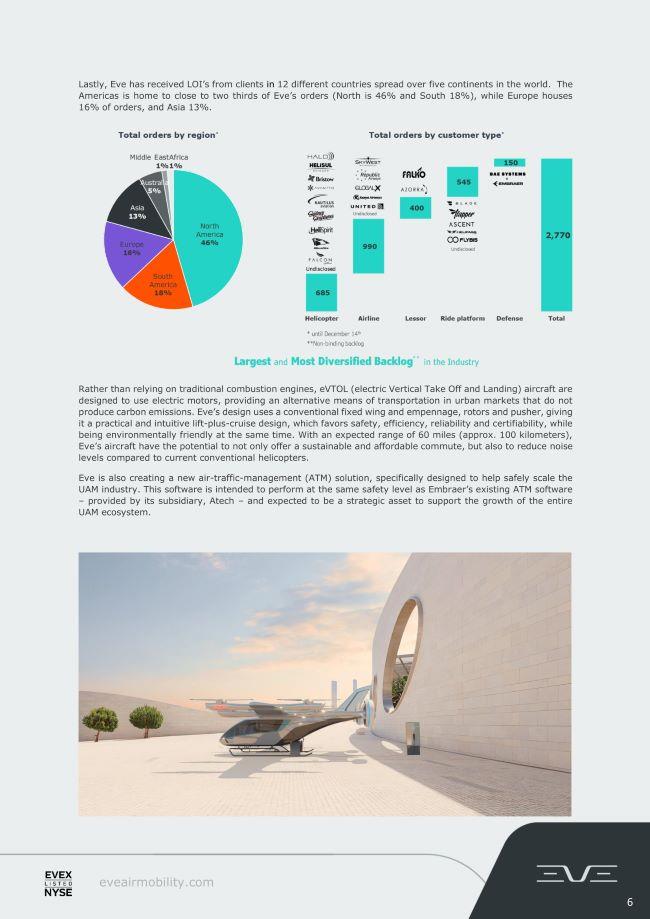

In November, Eve signed a LOI with Bluenest, a company powered by Globalvia dedicated to innovation in advanced air mobility with a focus on vertiport infrastructure, to supply Eve’s UATM software solution in support of future Vertiport Automation Systems. As part of the agreement, the companies will jointly study the use of the software for UAM operations by developing an operational model in specific regions and missions according to Bluenest’s needs. Bluenest enters a selected group of partners to better improve their UAM operations. In December, Eve Air Mobility signed a LOI with Volatus to supply a vertiport automation solution that will support traffic management of future electric vertical take-off and landing (eVTOL) vehicles. Eve’s UATM software solution will be used to improve the capacity and efficiency of Volatus’ vertiports. This new collaboration reinforces a shared commitment to safely integrating and scaling global UAM operations. Eve’s UATM software is an agnostic solution that will enable the integration of all airspace users in the urban environment. This is critical to support the safety, efficiency, and improvement of the entire UAM ecosystem, including fleet and vertiport operators. Eve’s further development of its UATM customer base demonstrates its commitment to safe and successful vertiport operations and the full ecosystem necessary for a robust UAM market. New eVTOL orders During the fourth quarter of 2022 Eve signed non-binding LOIs for a total of up to 110 eVTOL vehicles, 70 of which to an undisclosed client. Also in December, Eve signed a LOI with FlyBIS, an advanced air mobility start-up based in Caxias do Sul, in southern Brazil, to collaborate on the development of eVTOL operations in Brazil and South America. Based on the agreement, FlyBIS will also purchase up to 40 of Eve’s eVTOL vehicles. FlyBIS has become a promising option for air mobility in South Brazil in the short term and is set to help change and improve the way future generations will move. After starting operations in Brazil’s southern states, FlyBIS plans to expand operations to neighboring countries and contribute to the implementation and development of Eve’s air mobility ecosystem. FlyBIS is backed by Brave Aviation whose current fleet includes Embraer Phenom 100 as well as other aircraft. Backlog, order pipeline Currently, Eve’s order pipeline totals 2,770 units with a total backlog value of approximately $8.3 billion. Our initial order pipeline is based on non-binding letters of intent (LOI) and therefore subject to change, consistent with common aviation practices. Eve’s current client base is comprised of 26 customers. No client represents more than 14% of the total order book, including options. The order book is further diversified by the industries in which these customers operate, with airlines representing 35%, helicopter operators 25%, ride platforms 20%, lessors 14%, and the remaining orders are from a defense contract between BAE and Embraer.

Lastly, Eve has received LOI’s from clients in 12 different countries spread over five continents in the world. The Americas is home to close to two thirds of Eve’s orders (North is 46% and South 18%), while Europe houses 16% of orders, and Asia 13%. Rather than relying on traditional combustion engines, eVTOL (electric Vertical Take Off and Landing) aircraft are designed to use electric motors, providing an alternative means of transportation in urban markets that do not produce carbon emissions. Eve’s design uses a conventional fixed wing and empennage, rotors and pusher, giving it a practical and intuitive lift-plus-cruise design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly at the same time. With an expected range of 60 miles (approx. 100 kilometers), Eve’s aircraft have the potential to not only offer a sustainable and affordable commute, but also to reduce noise levels compared to current conventional helicopters. Eve is also creating a new air-traffic-management (ATM) solution, specifically designed to help safely scale the UAM industry. This software is intended to perform at the same safety level as Embraer’s existing ATM software – provided by its subsidiary, Atech – and expected to be a strategic asset to support the growth of the entire UAM ecosystem.

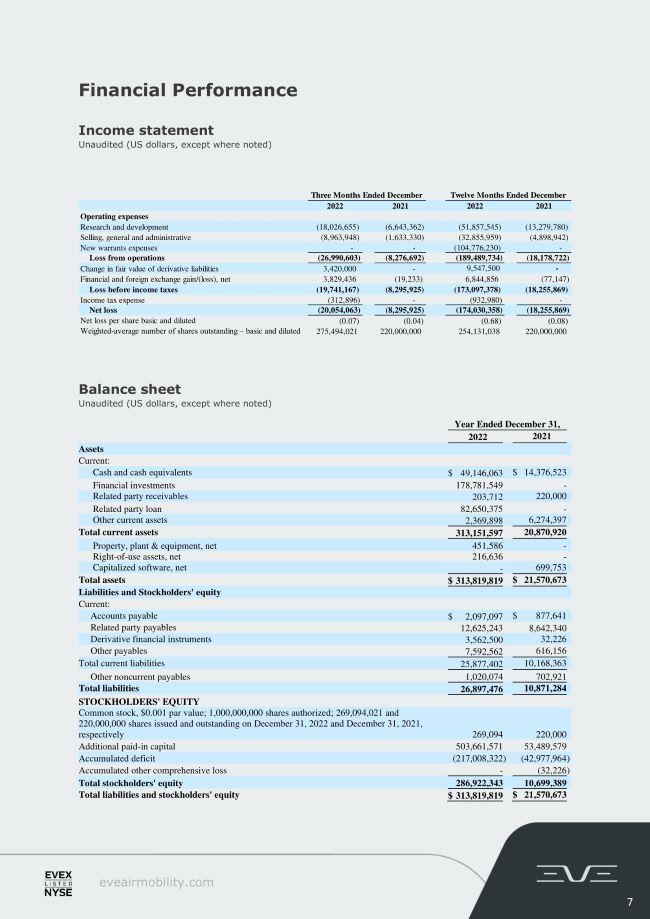

Financial Performance Income statement Unaudited (US dollars, except where noted) Three Months Ended December Twelve Months Ended December Operating expenses Research and development (18,026,655) (6,643,362) (51,857,545) (13,279,780) Selling, general and administrative (8,963,948) (1,633,330) (32,855,959) (4,898,942) New warrants expenses - - (104,776,230) - Loss from operations (26,990,603) (8,276,692) (189,489,734) (18,178,722) Change in fair value of derivative liabilities 3,420,000 - 9,547,500 - Financial and foreign exchange gain/(loss), net 3,829,436 (19,233) 6,844,856 (77,147) Loss before income taxes (19,741,167) (8,295,925) (173,097,378) (18,255,869) Income tax expense (312,896) - (932,980) - Net loss (20,054,063) (8,295,925) (174,030,358) (18,255,869) Net loss per share basic and diluted (0.07) (0.04) (0.68) (0.08) Weighted-average number of shares outstanding – basic and diluted 275,494,021 220,000,000 254,131,038 220,000,000 Balance sheet Unaudited (US dollars, except where noted) Year Ended December 31, 2022 2021 Assets Current: Cash and cash equivalents $ 49,146,063 $ 14,376,523 Financial investments 178,781,549 - Related party receivables 203,712 220,000 Related party loan 82,650,375 - Other current assets 2,369,898 6,274,397 Total current assets 313,151,597 20,870,920 Property, plant & equipment, net 451,586 - Right-of-use assets, net 216,636 - Capitalized software, net - 699,753 Total assets $ 313,819,819 $ 21,570,673 Liabilities and Stockholders' equity Current: Accounts payable $ 2,097,097 $ 877,641 Related party payables 12,625,243 8,642,340 Derivative financial instruments 3,562,500 32,226 Other payables 7,592,562 616,156 Total current liabilities 25,877,402 10,168,363 Other noncurrent payables 1,020,074 702,921 Total liabilities 26,897,476 10,871,284 STOCKHOLDERS' EQUITY Common stock, $0.001 par value; 1,000,000,000 shares authorized; 269,094,021 and 220,000,000 shares issued and outstanding on December 31, 2022 and December 31, 2021, respectively 269,094 220,000 Additional paid-in capital 503,661,571 53,489,579 Accumulated deficit (217,008,322 ) (42,977,964 ) Accumulated other comprehensive loss - (32,226 ) Total stockholders' equity 286,922,343 10,699,389 Total liabilities and stockholders' equity $ 313,819,819 $ 21,570,673

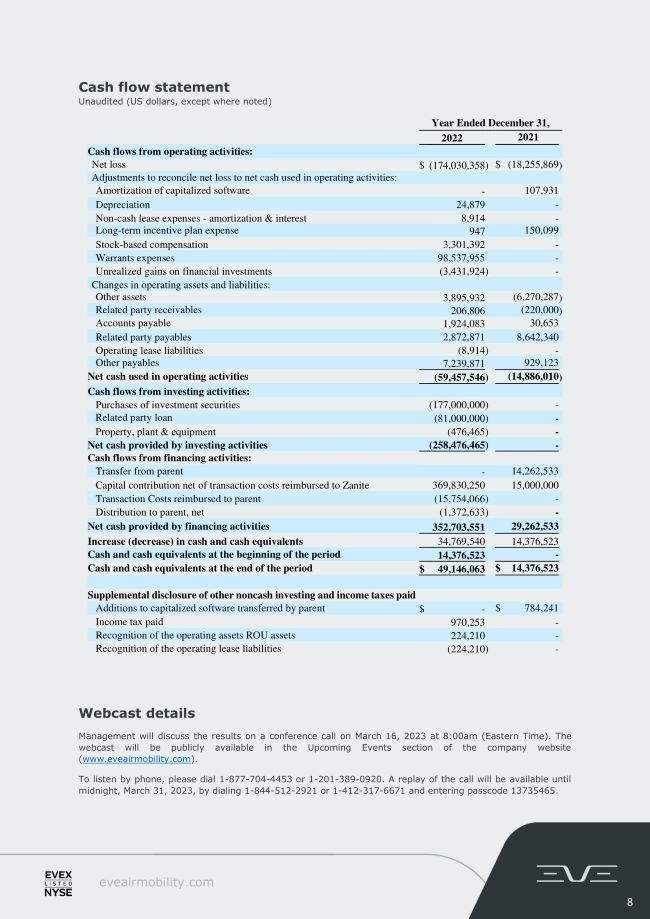

Cash flow statement Unaudited (US dollars, except where noted) Year Ended December 31, 2022 2021 Cash flows from operating activities: Net loss $ (174,030,358 ) $ (18,255,869 ) Adjustments to reconcile net loss to net cash used in operating activities: Amortization of capitalized software - 107,931 Depreciation 24,879 - Non-cash lease expenses - amortization & interest 8,914 - Long-term incentive plan expense 947 150,099 Stock-based compensation 3,301,392 - Warrants expenses 98,537,955 - Unrealized gains on financial investments (3,431,924 ) - Changes in operating assets and liabilities: Other assets 3,895,932 (6,270,287 ) Related party receivables 206,806 (220,000 ) Accounts payable 1,924,083 30,653 Related party payables 2,872,871 8,642,340 Operating lease liabilities (8,914 ) - Other payables 7,239,871 929,123 Net cash used in operating activities (59,457,546 ) (14,886,010 ) Cash flows from investing activities: Purchases of investment securities (177,000,000 ) - Related party loan (81,000,000 ) - Property, plant & equipment (476,465 ) - Net cash provided by investing activities (258,476,465 ) - Cash flows from financing activities: Transfer from parent - 14,262,533 Capital contribution net of transaction costs reimbursed to Zanite 369,830,250 15,000,000 Transaction Costs reimbursed to parent (15,754,066 ) - Distribution to parent, net (1,372,633 ) - Net cash provided by financing activities 352,703,551 29,262,533 Increase (decrease) in cash and cash equivalents 34,769,540 14,376,523 Cash and cash equivalents at the beginning of the period 14,376,523 - Cash and cash equivalents at the end of the period $ 49,146,063 $ 14,376,523 Supplemental disclosure of other noncash investing and income taxes paid Additions to capitalized software transferred by parent $ - $ 784,241 Income tax paid 970,253 - Recognition of the operating assets ROU assets 224,210 - Recognition of the operating lease liabilities (224,210 ) - Webcast details Management will discuss the results on a conference call on March 16, 2023 at 8:00am (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-877-704-4453 or 1-201-389-0920. A replay of the call will be available until midnight, March 31, 2023, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 13735465.

Upcoming Events Eve senior management is scheduled to attend the following investor events: Jefferies eVTOL Summit – New York (Mar. 28) Non-deal roadshow – Boston (tentative for Mar. 29) Investor Presentation, Cabin Mockup – Melbourne, FL. (Apr. 13) Wolfe Research 16th Annual Global Transportation & Industrials Conference – New York (May 25) Cantor Fitzgerald Mobility & Industrial Tech Day – New York (June 15) Glossary of commonly-used terms ACMI – Aircraft, Crew, Maintenance and Insurance AL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência de Aviação Civil ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures for the development of expansion of the telecommunications infrastructure COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Environment Impact Statement / Entry Into Service Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after-sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. Embraer holds 238,5million Eve shares, or 87% of our equity. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation Agency GAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Condition LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Progressive Down Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) – Accrued expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air Mobility UAS – Unmanned Aircraft Systems UATM – Urban Air Traffic Management

About Eve Holding, Inc. Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global services and support network and a unique air traffic management solution. Since May 10, 2022, Eve is listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”. Forward Looking Statements Certain statements in this press release include “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”, “predict”, “should”, “would”, “predict”, “potential”, “seem”, “future”, “outlook” or other similar expressions (or negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. All statements other than statements of historical facts are forward-looking statements and include, but are not limited to, statements regarding the Company’s expectations with respect to future performance and anticipated financial impacts of the business combination. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) failure to realize the anticipated benefits of the business combination with Zanite Acquisition Corp.; (iii) risks relating to the uncertainty of the projected financial information with respect to the Company; (iv) the outcome of any legal proceedings that may be instituted against the Company related to the completion of the business combination; (v) future global, regional or local economic and market conditions, including the growth and development of the urban air mobility market; (vi) the development, effects and enforcement of laws and regulations; (vii) the Company’s ability to grow and manage future growth, maintain relationships with customers and suppliers and retain its key employees; (viii) the Company’s ability to develop new products and solutions, bring them to market in a timely manner, and make enhancements to its platform; (ix) the Company’s ability to successfully develop, obtain certification for and commercialize its aircraft, (x) the effects of competition on the Company’s future business; (xi) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; (xi) the impact of the global COVID-19 pandemic and (xii) those factors discussed under the heading “Risk Factors” in the Company’s Registration Statement on Form S-1/A filed on July 29, 2022, and subsequent filings with the Securities and Exchange Commission (SEC). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release and undue reliance should not be placed upon the forward-looking statements. Investor Relations: Lucio Aldworth Caio Pinez [email protected] https://ir.eveairmobility.com/ Media: [email protected]