Eve Air Mobility Third Quarter 2022 Results December 23, 2022

Eve Holding, Inc. Third Quarter 2022 3Q2022 financial highlights Eve reported a net loss of $36.7 million in 3Q22 versus $3.8 million in 3Q21 driven by higher Research & Development (R&D) expenses and Selling, General & Administrative (SG&A) costs as well as non-cash charges related to warrant expenses of $17.4 million. Our R&D efforts are primarily driven by a Master Service Agreement (MSA) with Embraer – which intensified in the last year as the design of Eve’s eVTOL advances, having reached $14.3 million in 3Q2022, vs. $2.8 million during the same period of 2021. Including employees contracted through its MSA with Embraer and Atech, Eve now has approximately 450 team members engaged in the development of its eVTOL and other elements of the UAM ecosystem versus approximately 120 in 3Q21. The MSA costs are included in Eve’s R&D and represent most of the R&D expenses. SG&A costs have also increased due to the growth in the number of direct employees at Eve, who perform critical corporate functions including program management, sales, finance, planning, etc. During the third quarter of 2022, Eve’s operating activities consumed $17.0 million of cash, versus $2.4 million in 3Q21. Net cash provided by financing activities reached $15.0 million in 3Q22 driven by the investment from United Airlines, announced in September. For the 9M22, Eve reported a net loss of $154.0 million, $144.0 million higher than the $10.0 million net loss in the 9M21. Setting aside non-recurring, non-cash expenses associated with the business combination with Zanite Acquisition Corp. of $104.8 million value of warrants – the higher net losses in the 9M22 compared to the same period of 2021 were driven by higher R&D activities necessary to progress the eVTOL design, including the MSA, and an increase in SG&A expenses. R&D expenses in the 9M22 reached $33.8 million or five times the amount invested in the program in the 9M21 of $6.6 million, while SG&A expenses increased from $3.3 million in the 9M21 to $23.9 million in the 9M22. During the first nine months of 2022, Eve consumed $39.1 million of cash to fund its operating activities, versus $7.5 million in 9M22. Net cash provided by financing activities reached $352.7 million thus far in 2022, on a combination of the listing in the NYSE and the United Airlines Ventures (UAV) investment in Eve. At the end of 3Q22, Eve had $329.9 million in total liquidity (cash, cash equivalents and financial investments) versus $330.8 million at the beginning of the quarter. Development expenses associated with Eve’s aircraft were mostly offset by the United (UAV) investment. Lastly, accounts payable – mostly MSA agreement with Embraer, increased by $5.6 million in the quarter, which had a positive impact on retained cash in Eve’s balance sheet. As of 3Q22, Eve did not have any debt on its balance sheet. The proceeds from the business combination with Zanite Acquisition Corp., and strategic PIPE investors combined with potential advances from customers and future finance lines are important sources of capital to fund Eve’s development and certification of its eVTOL aircraft. Eve has also announced today the support of Brazil’s National Development Bank (“BNDES”) to its eVTOL development efforts with two distinct credit lines, totaling $92.5 million. Both credit lines offer beneficial conditions with 12-year maturity and amortization grace period. The support from BNDES is an ideal fit for our project with long-term profile that matches Eve’s cash-flow needs and strengthens our balance sheet. Eve’s 3Q22 cash position of $329.9 million does not include this additional funding from BNDES. As Eve continues to advance its eVTOL program, it expects portions of its non-binding order backlog to be converted into firm contracts. Those firm orders may result in significant cash advances and inflows to the company through down payments that may occur prior to final eVTOL delivery. Eve restated its 2Q22 results to properly recognize non-cash costs associated with specific classes of warrants issued to certain investors in the business combination with Zanite Acquisition Corp. that were not expensed at the time the transaction was concluded. With that, Eve recognized total warrant-related non-cash costs of $87.4 million in 2Q22. Additionally, Eve also restated its 2021 and 2Q22 results to allocate certain transaction costs (financial, accounting, and legal advisory) related to the business combination with Zanite Acquisition Corp. that had been previously recognized by Embraer, increasing Eve’s previously reported net loss for those periods. Importantly, these are non-cash and non-recurring accounting adjustments with no impact on Eve’s balance-sheet, cash-flow statements and/or ability of Eve to fund the development and certification of its solutions for the UAM industry. eveairmobility.com 1

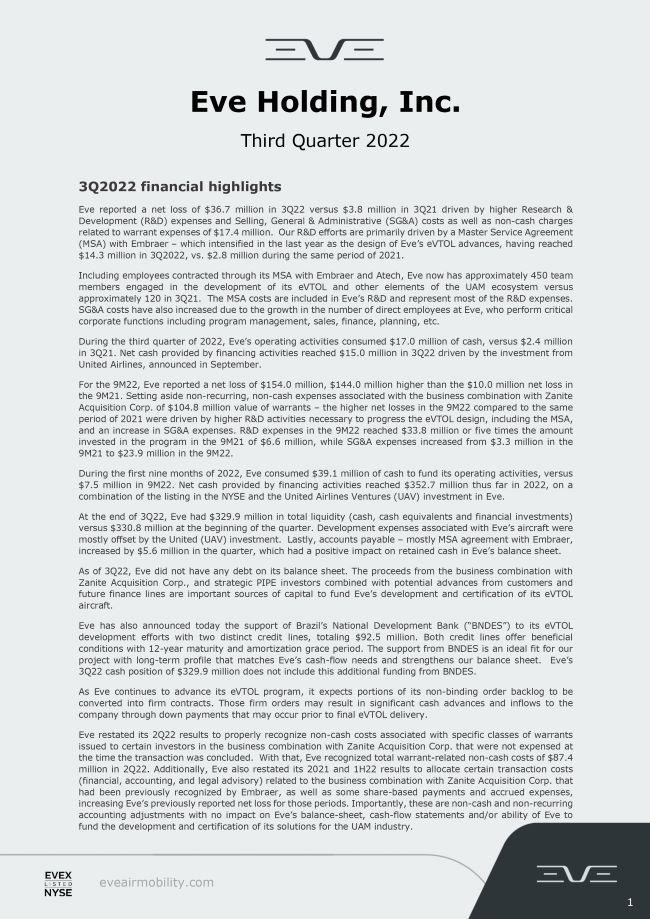

BNDES to support Eve’s eVTOL development program Today, Eve is announcing the support of Brazil’s National Development Bank (“BNDES”) to its eVTOL development efforts with two distinct credit lines, totaling $92.5 million. Both credit lines offer favorable conditions with 12-year maturity and amortization grace period. The financing consummation is subject to the fulfillment of previous conditions established by BNDES and the execution of the respective contract. The first credit line is under the Climate Fund (“Fundo Nacional Sobre Mudança Climática”, or “Fundo Clima”). This program is designed to secure financing to support businesses and projects that help mitigate climate change and reduce carbon emissions, with Urban Mobility as one of its nine sub-programs. The Climate Fund helps fund entrepreneurial projects, the acquisition of machinery and equipment, as well as the development of technologies to reduce carbon and greenhouse-gas emissions. Besides Urban Mobility, the fund also focuses on Sustainable Cities and Climate Change, Efficient Machinery and Equipment, Renewable Energy, Solid Residue, Charcoal, Native Forestry, Carbon Management and Services, and Innovative Projects. In parallel, Eve has access to an additional line of credit under Innovation Finance (“Financiamento a Empreendimentos de Inovação”, or “FINEM Inovação”), that provides long-term funding for disruptive industrial projects that generate social benefits, such as urban mobility, energy generation, education, sewage, among others. This long-term partnership with the BNDES will strengthen Eve’s ability to advance in the development and certification of its e-VTOL and amplify its capability of transforming the ecosystem of future urban air mobility. Key financial indicators USD MILLIONS 3Q22 3Q21 9M22 9M21 INCOME STATEMENT Research and Development (14.3) (2.8) (33.8) (6.6) Selling, General and Administrative (6.8) (0.9) (23.9) (3.3) Warrant expenses (17.4) - (104.8) - Net Earnings (Loss) (36.7) (3.8) (154.0) (10.0) CASH FLOW Net Cash Used in Operating Activities (17.0) (2.4) (38.7) (7.5) Net Aditions to PP&E- - (0.4) - Free Cash Flow* (17.0) (2.4) (39.1) (7.5) Net Cash Provided by Financing Activities 15.0 - 352.7 22.1 Cash, Equivalents and Investments, Beginning of Period 330.8 - 14.4 - Cash, Equivalents and Investments, End of Period 329.9 - 329.9 14.6 3Q22 2Q22 9M22 9M21 BALANCE SHEET Other Assets 3.0 0.2 3.0 0.6 Related Party Receivable 0.2 0.3 0.2 - Total Payables 21.9 16.3 21.9 1.3 Total Debt- - - - Net Cash* 329.9 330.8 329.9 14.6 * Net Cash and Cash-Flow items are non-GAAP meaures eveairmobility.com 2

Design matures, cash-consumption intensifies Through 9M22, the development of our aircraft and portfolio of products for the UAM industry consumed $39.1 million of cash, vs. $7.5 million in 9M21. Management expects cash consumption to intensify going forward, as further program advancements will demand increased engineering, test and administrative support through its direct employees, suppliers and our MSA agreement with Embraer and Atech. In addition to flight tests through various vehicle configurations, Eve continues its rigorous design and development program through the testing of key components of its aircraft design such as battery-thermal management systems; flight simulators and wind tunnels to test flight envelope, aircraft performance, safety and expected structural stress; and computer simulations, among others. The frequency and diversity of component and flight tests will increase as the development advances. Increased confidence in the individual parts and components will support the production of full-scale, commercial aircraft prototypes. Lastly, management expects the total number of employees (direct and indirect via MSA with Embraer and Atech) to growth in 2023 compared to 2022 as well as total investments in the program development as Eve continues to advance in the eVTOL development. Initial production in Brazil Through its partnership with Porsche Consulting, Eve is establishing a flexible and cost-effective industrialization strategy, which will enable the company to scale up volumes with the highest standards of quality and safety in a competitive and sustainable way. The partnership examined all aspects of industrial operations, logistics, supply chain and parts distribution and produced an unprecedented approach optimized for efficiency, productivity and safety. The first production site is planned to be in Brazil, which will maximize synergies with product development and the vast expertise and resources of Embraer. eveairmobility.com 3

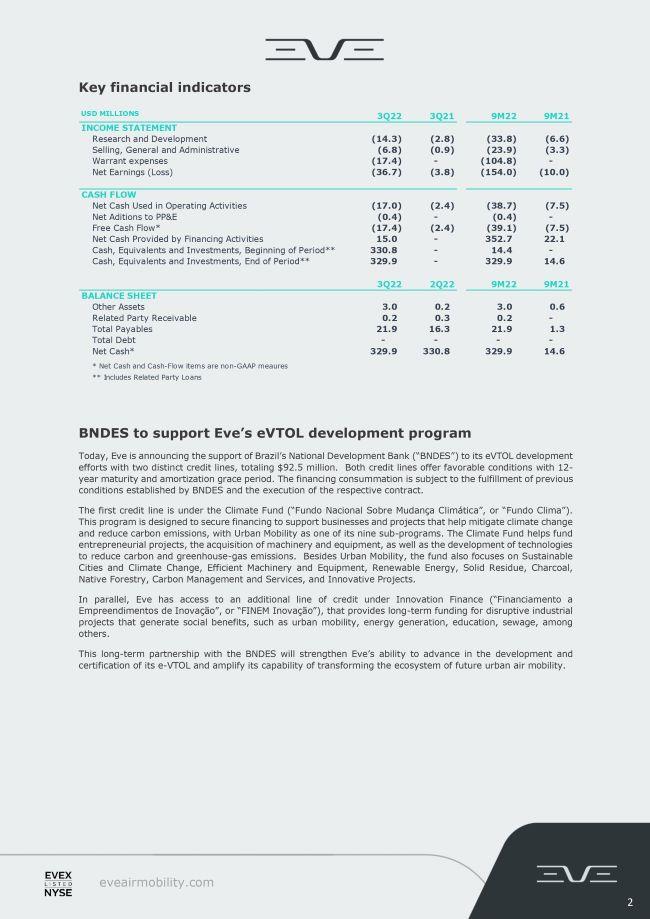

Eve partners with United Airlines On September 8, United Airlines – through United Airlines Ventures (UAV), announced a $15 million investment in Eve. Eve and United intend to work on future projects, including studies on the development, use and application of Eve’s aircraft and the UAM ecosystem. Concurrently with the investment, United also announced a conditional purchase agreement for 200 four-seat electric aircraft plus 200 options, expecting the first deliveries as early as 2026. Importantly, United already operates Embraer aircraft and has access to its service centers, parts warehouses, and field-service technicians, paving the way for a reliable operation. Upon entry into service, United could have its entire eVTOL fleet serviced by Eve’s agnostic service and support operations. Moreover, United joined the consortium led by Eve, which simulated UAM operations in Chicago in September. Chicago ConOps Eve conducted its first North American UAM simulation using helicopters powered by Blade Air Mobility, Inc. as a substitute for an eVTOL. The goal was to study operations, ground services, passenger journeys and eVTOL-operator needs, creating more accessible and faster connections to and from Downtown Chicago. Eve conducted its Chicago UAM simulation over three weeks, starting with ground tests on September 12th and passenger flights on the 14th. Flights were available through Blade’s app and website and averaged 15 minutes over 20 kilometers (12.5 miles); vs. 60 to 90 minutes by car and 60 by train. The simulation will provide the city of Chicago with critical information about the necessary infrastructure and ecosystem to enable the launch and expected long-term growth of UAM in the area. This adds to Eve’s understanding of the ecosystem requirements for products and services in one of the most prominent and populated cities in the US. The experience in Chicago provided detailed insights into potential pain points and opportunities for UAM in that area. At the same time, it reinforces Eve’s hypothesis for the suburb-to-downtown use case, where transportation options are limited, and where most users own a car and experience commutes of more than 30 minutes. Not surprisingly, surveys with passengers suggest time saving to be the main advantage in this mode of transportation. Eve performed the ground tests at Vertiport Chicago, simulating services, infrastructure and equipment requirements for eVTOLs – this will help operators fine tune the sequence of activities for passenger check-in, boarding and deboarding. In the UAM infrastructure, a vertiport is an area of land or a structure used for the landing, take-off, charging and operation of eVTOLs. Understanding and addressing the challenges involved with these projects are important pillars of the UAM ecosystem Eve is developing. Eve’s solutions bring together all stakeholders and solicit different views and feedback to structure and deliver the best alternatives. After a total of 86 flights with 275 passengers in the Chicago area, Eve’s modelling indicated the potential for approximately 240 eVTOLs in that region by the time the market matures in 2035. Chicago and its surrounding regions may accommodate more than 150 different routes taking off from 20 different vertiports. eveairmobility.com 4

For The Chicago simulation, Eve formed a consortium of partners, including Blade, Republic Airways, Halo Aviation, United Airlines, Vertiport Chicago, Village of Tinley Park, Village of Schaumburg, ACCIONA, SkyWest, Inc. and Speedbird Aero. A helicopter replicating Eve’s future eVTOL transported passengers from the Vertiport Chicago facility to two helistops located northwest and southwest of Chicago – Schaumburg Municipal Helistop and Tinley Park Helistop, respectively. Urban Air Traffic Management, a key pillar of the UAM ecosystem In addition to the aircraft program, Eve is harnessing the expertise of both Embraer and its subsidiary Atech to develop Air Traffic Management (ATM) software to help safely scale the UAM industry globally. Currently, Atech deploys ATM systems to control the airspace in Brazil, India, Venezuela and Paraguay, in different capacities. Its solutions have a proven track record of safety and reliability. Eve’s Urban Air Traffic Management (UATM) software is an agnostic solution that will enable the integration of all airspace users in urban environments. This is critical to support the safety, efficiency, and improvement of the entire UAM ecosystem, including fleet and vertiport operators. Over the last few months, Eve has signed numerous letters of intent (LOI) for its UATM solution: On July 18, Halo Aviation Ltd., a provider of bespoke private UAM travel services, signed an LOI to collaborate in the development and launch of Eve’s UATM software solution. As part of the agreement, Halo will acquire the software from Eve to maximize its UAM operations. The companies also intend to develop an operational model to be deployed in specific missions and regions in the United States and the United Kingdom where Halo operates. On September 27, FlyBlade India announced a strategic partnership that includes Eve’s UATM software solution. The companies also plan to collaborate on a three-month pilot project connecting passengers using helicopters. The data collected through Blade India’s customer experience and operations will be used to further develop Eve’s eVTOL, service and support solutions, and its UATM software. On October 12, Eve signed a letter of intent with Skyway Technologies Corp. to provide its UATM software solution, ensuring the traffic management for future UAM solutions supports the needs and growth of the industry. On November 22, Eve signed a letter of intent with Bluenest, a vertiport infrastructure company powered by Globalvia, to collaborate in the development of Eve’s UATM solution in support of future Vertiport Automation Systems. And more recently, on December 6, the company signed an LOI with Volatus Infrastructure, LLC, to supply a vertiport automation solution that will support traffic management of future eVTOL vehicles. Eve’s UATM software solution will be used to improve the capacity and efficiency of Volatus’ vertiports. These new partnerships reinforce Eve’s commitment to safely integrate and scale global UAM operations. eveairmobility.com 5

New eVTOL orders During the third quarter of 2022 Eve signed non-binding LOIs for a total of up to 600 new orders, from United Airlines and FlyBlade India. Eve and United announced a conditional purchase agreement for 200 four-seat electric aircraft plus 200 options. These orders are part of the UAV investment in Eve. United’s investment in Eve was driven in part by confidence in the potential growth opportunities in the UAM market and Eve’s unique relationship with Embraer, a trusted aircraft manufacturer with a proven track record of building and certifying aircraft over the company’s 53-year history. FlyBlade India, a joint venture between Hunch Ventures and Blade Air Mobility, Inc. a strategic partnership which includes an order of up to 200 eVTOL, service and support, and Eve’s UATM software solution. The companies also plan to collaborate on a three-month pilot project connecting passengers using helicopters. India is a unique market with its vast expanse, accessibility concerns, traffic congestion and regulations. As the pioneers of providing short-haul air mobility services in India, Blade India will act as Eve’s on-the-ground knowledge partner to create the UAM ecosystem. The data collected through Blade India’s customer experience and operations will be used to further develop Eve’s eVTOL, service and support solutions, and its UATM software. Blade India will initially underwrite 50,000 hours of flight time per year using Eve’s eVTOL in the country. More recently, during the fourth quarter, Eve signed LOIs for additional 110 eVTOL vehicles of which, 40 which, 40 which, 40 which, 40 which, 40 which, 40 which, 40 which, 40 are are are are to to to FlyBIS, an advanced air mobility start-up based in southern Brazil and 70 to an undisclosed client. Backlog, order pipeline Currently, Eve’s order pipeline totals 2,770 units with a total backlog value of approximately $8.3 billion. Our initial order pipeline is based on non-binding letters of intent and therefore subject to change, consistent with common aviation practices. Eve’s current client base is comprised of 26 customers. No client represents more than 14% of the total order book, including options. The order book is further diversified by the industries in which these customers operate, with airlines representing 35%, helicopter operators 25%, ride platforms 20%, lessors 14%, and the remaining orders are from a defense contract between BAE and Embraer. Lastly, Eve has received LOI’s from clients in 12 different countries spread over five continents in the world. The Americas is home to close to two thirds of Eve’s orders (North is 46% and South 18%), while Europe houses 16% of orders, and Asia 13%. eveairmobility.com 6

Rather than relying on traditional combustion engines, eVTOL (electric Vertical Take Off and Landing) aircraft are designed to use electric motors, providing an alternative means of transportation in urban markets that do not produce carbon emissions. Eve’s design uses a conventional fixed wing and empennage, rotors and pusher, giving it a practical and intuitive lift-plus-cruise design, which favors safety, efficiency, reliability and certifiability, while being environmentally friendly at the same time. With an expected range of 60 miles (approx. 100 kilometers), Eve’s aircraft have the potential to not only offer a sustainable and affordable commute, but also to reduce noise levels compared to current conventional helicopters. Eve is also creating a new air-traffic-management (ATM) solution, specifically designed to help safely scale the Urban Air Mobility (UAM) industry. This software is intended to perform at the same safety level as Embraer’s existing ATM software – provided by its subsidiary, Atech – and expected to be a strategic asset to support the growth of the entire UAM ecosystem. eveairmobility.com 7

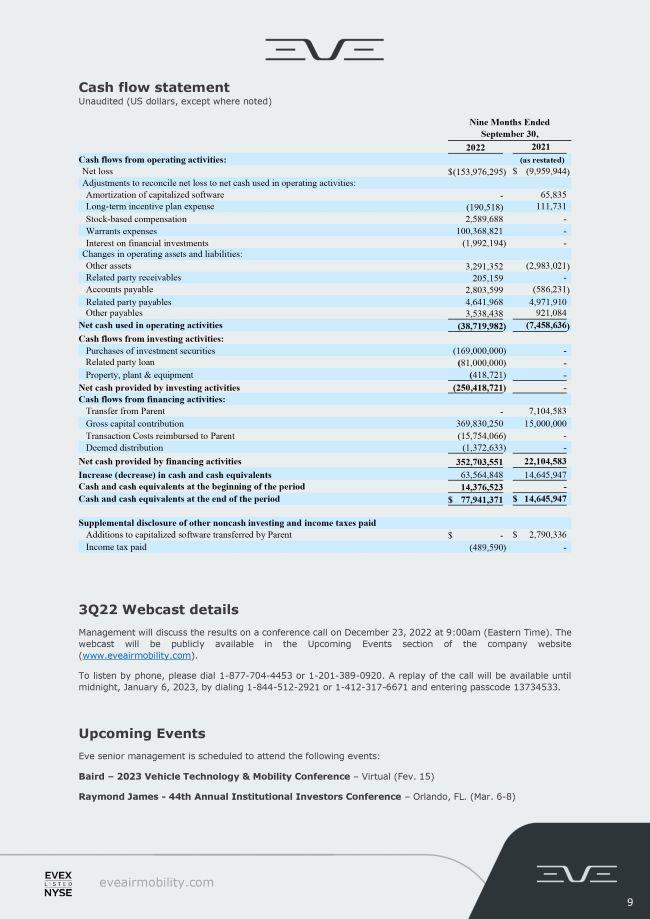

Financial Performance Income statement Unaudited (US dollars, except where noted) Balance sheet Unaudited (US dollars, except where noted) Three Months Ended September 30, Nine Months Ended September 30, 2022 2021 2022 2021 Operating expenses (as restated) (as restated) Research and development $ (14,298,925 ) $ (2,805,955 ) $ (33,830,890 ) $ (6,636,418 ) Selling, general and administrative (6,845,045 ) (939,106 ) (23,892,011 ) (3,265,612 ) New Warrants expenses (17,424,230 ) - (104,776,230 ) - Loss from operations (38,568,200 ) (3,745,061 ) (162,499,131 ) (9,902,030 ) Change in fair value of derivative liabilities 285,000 - 6,127,500 - Financial and foreign exchange gain/(loss), net 2,028,854 (14,041 ) 3,015,420 (57,914 ) Loss before income taxes (36,254,346 ) (3,759,102 ) (153,356,211 ) (9,959,944 ) Income tax expense (490,376 ) - (620,084 ) - Net loss $ (36,744,722 ) $ (3,759,102 ) $ (153,976,295 ) $ (9,959,944 ) Net loss per share basic and diluted (0.14 ) (0.02 ) (0.62 ) (0.05 ) Weighted-average number of shares outstanding – basic and diluted 272,040,343 220,000,000 247,010,044 220,000,000 September 30, December 31, 2022 2021 Assets Current: Cash and cash equivalents $ 77,941,371 $ 14,376,523 Financial investments 170,354,049 - Related party receivables 205,358 220,000 Related party loan 81,638,146 - Other current assets 2,974,478 6,274,397 Total current assets 333,113,402 20,870,920 Property, plant & equipment, net 418,721 - Capitalized software, net - 699,753 Total assets $ 333,532,123 $ 21,570,673 Liabilities and Stockholders' equity Current: Accounts payable $ 2,963,007 $ 877,641 Related party payables 14,394,340 8,642,340 Derivative financial instruments 6,982,500 32,226 Other payables 3,677,865 616,156 Total current liabilities 28,017,712 10,168,363 Other noncurrent payables 838,845 702,921 Total liabilities 28,856,557 10,871,284 STOCKHOLDERS' EQUITY Common stock, $0.001 par value; 1,000,000,000 shares authorized; 266,371,485 and 220,000,000 shares issued and outstanding on September 30, 2022 and December 31, 2021, respectively 266,371 220,000 Additional paid-in capital 501,363,454 53,489,579 Accumulated deficit (196,954,259 ) (42,977,964 ) Accumulated other comprehensive income/(loss) - (32,226 ) Total stockholders' equity 304,675,566 10,699,389 Total liabilities and stockholders' equity $ 333,532,123 $ 21,570,673 eveairmobility.com 8

Cash flow statement Unaudited (US dollars, except where noted) 3Q22 Nine Months Ended September 30, 2022 2021 Cash flows from operating activities: (as restated) Net loss $ (153,976,295 ) $ (9,959,944 ) Adjustments to reconcile net loss to net cash used in operating activities: Amortization of capitalized software - 65,835 Long-term incentive plan expense (190,518) 111,731 Stock-based compensation 2,589,688 - Warrants expenses 100,368,821 - Interest on financial investments (1,992,194 ) - Changes in operating assets and liabilities: Other assets 3,291,352 (2,983,021 ) Related party receivables 205,159 - Accounts payable 2,803,599 (586,231 ) Related party payables 4,641,968 4,971,910 Other payables 3,538,438 921,084 Net cash used in operating activities (38,719,982 ) (7,458,636 ) Cash flows from investing activities: Purchases of investment securities (169,000,000 ) - Related party loan (81,000,000 ) - Property, plant & equipment (418,721 ) - Net cash provided by investing activities (250,418,721 ) - Cash flows from financing activities: Transfer from Parent - 7,104,583 Gross capital contribution 369,830,250 15,000,000 Transaction Costs reimbursed to Parent (15,754,066 ) - Deemed distribution (1,372,633 ) - Net cash provided by financing activities 352,703,551 22,104,583 Increase (decrease) in cash and cash equivalents 63,564,848 14,645,947 Cash and cash equivalents at the beginning of the period 14,376,523 - Cash and cash equivalents at the end of the period $ 77,941,371 $ 14,645,947 Supplemental disclosure of other noncash investing and income taxes paid Additions to capitalized software transferred by Parent $ - $ 2,790,336 Income tax paid (399,991 ) - Webcast details Management will discuss the results on a conference call on December 23, 2022 at 9:00am (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-877-704-4453 or 1-201-389-0920. A replay of the call will be available until midnight, January 6, 2023, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 13734533. Upcoming Events Eve senior management is scheduled to attend the following events: Baird – 2023 Vehicle Technology & Mobility Conference – Virtual (Fev. 15) Raymond James - 44th Annual Institutional Investors Conference – Orlando, FL. (Mar. 6-8) eveairmobility.com 9

Glossary of commonly-used terms ACMI – Aircraft, Crew, Maintenance and Insurance AL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência de Aviação Civil ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures for the development of expansion of the telecommunications infrastructure COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Environment Impact Statement / Entry Into Service Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after-sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. Embraer holds 238,5million Eve shares, or 87% of our equity. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation Agency GAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Condition LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Progressive Down Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) – Accrued expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air Mobility UAS – Unmanned Aircraft Systems UATM – Urban Air Traffic Management eveairmobility.com 10

About Eve Holding, Inc. Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, comprehensive global services and support network and a unique air traffic management solution. Since May 10, 2022, Eve is listed on the New York Stock Exchange, where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”. Forward Looking Statements Certain statements in this press release include “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”, “predict”, “should”, “would”, “predict”, “potential”, “seem”, “future”, “outlook” or other similar expressions (or negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. All statements other than statements of historical facts are forward-looking statements and include, but are not limited to, statements regarding the Company’s expectations with respect to future performance and anticipated financial impacts of the business combination. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) failure to realize the anticipated benefits of the business combination with Zanite Acquisition Corp.; (iii) risks relating to the uncertainty of the projected financial information with respect to the Company; (iv) the outcome of any legal proceedings that may be instituted against the Company related to the completion of the business combination; (v) future global, regional or local economic and market conditions, including the growth and development of the urban air mobility market; (vi) the development, effects and enforcement of laws and regulations; (vii) the Company’s ability to grow and manage future growth, maintain relationships with customers and suppliers and retain its key employees; (viii) the Company’s ability to develop new products and solutions, bring them to market in a timely manner, and make enhancements to its platform; (ix) the Company’s ability to successfully develop, obtain certification for and commercialize its aircraft, (x) the effects of competition on the Company’s future business; (xi) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; (xi) the impact of the global COVID-19 pandemic and (xii) those factors discussed under the heading “Risk Factors” in the Company’s Registration Statement on Form S-1/A filed on July 29, 2022, and subsequent filings with the Securities and Exchange Commission (SEC). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release and undue reliance should not be placed upon the forward-looking statements. Investor Relations: Lucio Aldworth Caio Pinez [email protected] https://ir.eveairmobility.com/ Media: [email protected] 11