Eve Air Mobility Second Quarter 2022 Results August 4, 2022 eveairmobility.com EVEX LISTED NYSE

Eve Holding, Inc. Second Quarter 2022 Eve ready for a new chapter Eve Holding, Inc. (“Eve”) (NYSE: EVEX and EVEXW) is a leading developer of next-generation Urban Air Mobility (UAM) solutions. Our goal is to create a comprehensive, practical and capital-efficient UAM solution that includes: • Design and production of electric Vertical Takeoff and Landing aircraft (eVTOLs); • Portfolio of agnostic maintenance and support services for both Eve and third-party aircraft; • Fleet operations services in collaboration with partners; • New Urban Air Traffic Management system designed to allow eVTOLs to operate safely and efficiently in densely-populated urban areas alongside conventional aircraft and drones. Eve’s business was formerly part of Embraer S.A., the third largest aircraft manufacturer in the world specialized in the development of regional and executive jets. Eve intends to leverage Embraer’s extensive experience in designing, delivering and certifying commercial aircraft. While Embraer is engaged in several projects, Eve is fully dedicated to the eVTOL ecosystem and at the same time enjoys comprehensive support from Embraer – from engineering to certification as well as sustainment and support of products on a global basis. To achieve its vision, Eve brings together the best of an entrepreneurial technology disruptor with the depth and experience of a world-leading aviation OEM. Eve is the first company to graduate from EmbraerX, an organization fully dedicated to developing disruptive businesses, and unveiled the first iteration of its eVTOL solution in May 2018. As a separate company, Eve has the resources, agility and autonomy to pursue innovative business models and will be able to serve as a protagonist in shaping the UAM market that is in its early stages. Eve is uniquely positioned to develop, certify and commercialize its UAM solution on a global scale given its aviation heritage, its strategic relationship with Embraer, its technology and intellectual property portfolio and the experience of its management team and employees, complemented by the strategic partners involved with Eve’s project. Eve’s strategic partnership with Embraer is a key competitive advantage. The partnership includes a royalty-free license to Embraer's more than 50-year background Intellectual Property (IP) as well as access to thousands of skilled engineers on a flexible, first-priority basis along with access to Embraer's global infrastructure. The strategic alignment with Embraer also provides important cost and execution advantages as Eve seeks certification and entry-into-service of its eVTOL and to scale its UAM solution globally. Eve has multiple aviation partners that helped to fund its project independently, including Zanite Acquisition Corp., which was formed by the Directional Aviation group and that includes many aviation companies such as FlexJet, Halo, Simcom, Nextant and several others. Zanite Acquisition Corp.’s sponsor has been engaged in UAM since the early stages of the eVTOL industry, and ultimately selected Eve due to its combination of simple design, strategic relationship with Embraer and a shared belief in the competitive advantages of Eve’s business model and aircraft design. Other strategic partners were also engaged, and Eve’s public-listing ambition quickly gained traction throughout 2021 and 2022. An independent team was formed at Eve by key personnel from Embraer (and other companies as well) with a long and unique experience in the aviation industry. In May 2022, Eve raised $377 million in PIPE and de-SPAC transactions, pricing its shares at $10.00 per share and implying a total market capitalization above $2.5 billion. In addition to Embraer, the PIPE included Zanite’s sponsors and a consortium of leading financial and strategic investors, including Acciona, Azorra Aviation, BAE Systems, Bradesco BBI, Falko Regional Aircraft, Republic Airways, Rolls-Royce, SkyWest, Inc., Space Florida, Thales USA and others. These partners include customers, experts in air transportation, logistics and technology, and equipment suppliers that bring critical expertise in the aviation industry that will help Eve to better shape its aircraft design, vertiport solutions and other components to the UAM market. Now with the right partners, an experienced and independent team, and an extensive amount of funding secured, Eve is fully engaged to make history. eveairmobility.com EVEX LISTED NYSE

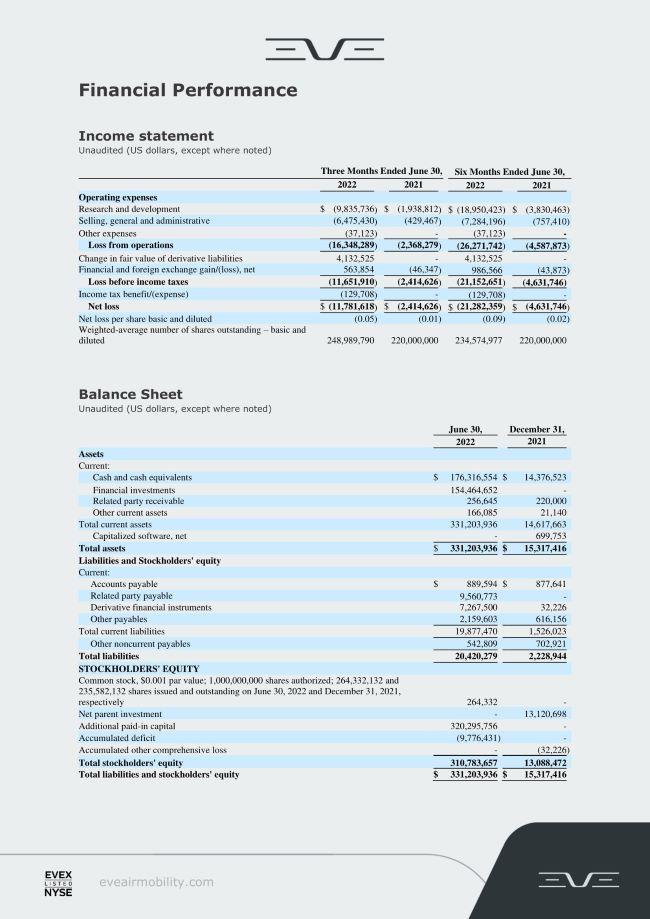

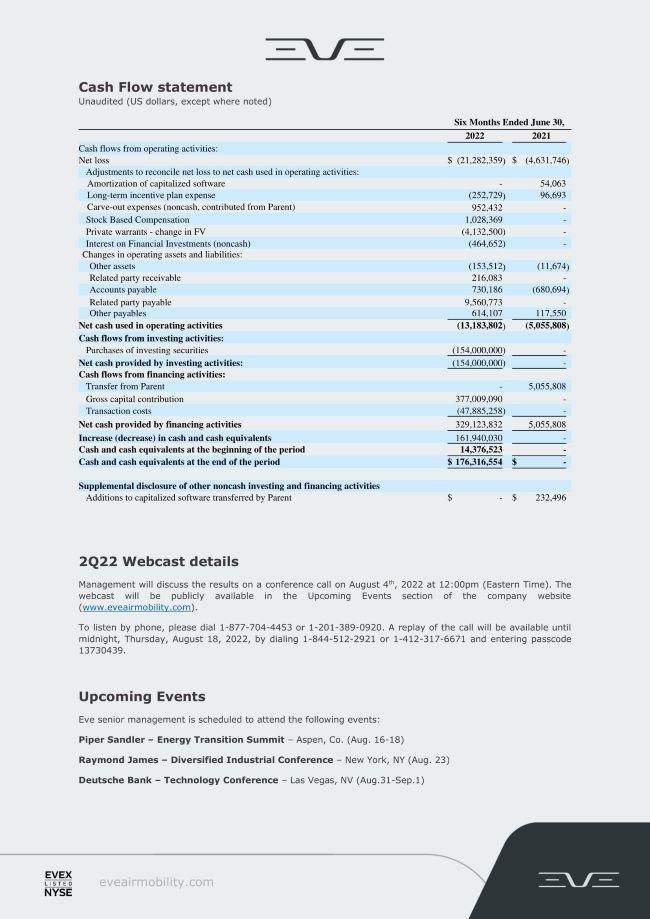

2Q2022 financial highlights Eve reported a net loss of $11.8 million in 2Q22 versus $2.4 million in 2Q21 mostly driven by higher Research & Development (R&D) expenses and Selling, General & Administrative (SG&A) costs. Our R&D efforts are primarily driven by a master service agreement (MSA) with Embraer which intensified in the last year as the eVTOL project continues to advance, having reached $9.8 million in 2Q2022, vs. $1.9 million during the same period of 2021. It is important to highlight Embraer currently has almost two hundred full-time employees dedicated to the eVTOL development program through its MSA with Eve. The MSA costs are included in Eve’s R&D and represent most of its R&D expenses. SG&A costs have also increased due mostly to the growth in the number of collaborators at Eve – we now have the equivalent of more than 300 equivalent people working on the program, almost twice the number of 2Q21. In the 1H2022, Eve reported a net loss of $21.3 million, $16.7 million higher than the $4.6 million net loss in the 1H2021. Similar to the quarterly numbers, higher net losses in the 1H2022 compared to the same period of 2021 are driven by higher R&D activities necessary to progress the eVTOL design, including the MSA, and an increase on SG&A expenses. R&D expenses in the 1H2022 reached $19.0 million or five times the amount spent in the 1H2021 of $3.8 million while SG&A expenses increased from $0.8 million in the 1H2021 to $7.3 million in the 1H2022. During the first half of 2022, Eve consumed $13.2 million of net cash used in operating activities, versus $5.1 million in 1H2021. Additionally, the 1H2022 free cash flow reflects an $11.2 million working-capital gain – most of which is due to higher accounts payable with Embraer. On the finance side, net cash provided by financing activities reached $329.1 million during 1H2022 with the net proceeds from our listing on the New York Stock Exchange. At the end of 2Q2022, Eve had $330.8 million in total liquidity (including cash, cash equivalents and financial investments) versus $14.4 million at the beginning of the quarter. Eve’s significantly higher cash position comes primarily from the capital raise of $377 million in May 2022 partially offset by development expenses and transaction costs. As of the end of 2Q2022, Eve did not have any debt on its balance sheet. In our view, the proceeds from the business combination with Zanite Acquisition Corp., and from the strategic PIPE investors combined with potential advances from customers and future finance lines are important sources of capital to fund Eve’s certification and development of its eVTOL aircraft before entry into service, expected in 2026. Our management team is always monitoring the capital markets for debt financing options to bring additional cash resources to Eve at attractive terms as the company currently does not have any debt on its balance sheet. Before service is commenced, Eve may also seek incremental capex lines – via corporate loans, to help fund its manufacturing and production facilities. As we continue to advance our eVTOL development, Eve expects to transition part of its non-binding orders into firm contracts. Those firm orders may result in significant cash advances and inflow to the company through down payments that tend to occur several months prior to final eVTOL delivery. USD MILLIONS 2Q22 2Q21 1H22 1H21 INCOME STATEMENT Research and Development (9.8) (1.9) (19.0) (3.8) Selling, General and Administrative(6.5) (0.4) (7.3) (0.8) Net Earnings (Loss)(11.8) (2.4) (21.3) (4.6) CASH FLOW Net Cash Used in Operating Activities- - (13.2) (5.1) Net Aditions to PP&E- - - - Free Cash Flow- - (13.2) (5.1) Net Cash Provided by Financing Activities- - 329.1 5.1 Cash, Equivalents and Investments, Beginning of Period- - 14.4 - Cash, Equivalents and Investments, End of Period- - 330.8 - 1H22 2H21 BALANCE SHEET Other Assets- - 0.2 - Related Party Receivable- - 0.3 0.2 Total Payables- - 12.6 1.5 Total Debt- - - - Cash, Equivalents and Investments- - 330.8 - eveairmobility.com EVEX LISTED NYSE

Powerful partner network Eve enjoys support from several companies – some of which are also PIPE investors in Eve. Some of these partners offer operational support, some are customers, while others provide support to develop concepts of operations and our efforts to obtain the necessary certifications. We also enjoy support from infrastructure developers, who will assist in designing the necessary facilities to accommodate this new type of transportation. In sum, these partners bring critical expertise in aircraft design, power and battery management, propulsion systems, vertiport operations and fleet management and are helping us in the design of all components of our holistic approach to UAM. In total, Eve has partnered with a myriad of companies in many different capacities: • Customers – As the end of 2Q2022, Eve had non-binding Letters Of Intent (LOIs) for 1,910 eVTOL aircraft orders from 21 different clients, from helicopter to fixed-wing operators and ride-sharing platforms and lessors. Eve will also allocate a pre-determined number of flight hours per year to several partners who will be in charge of the customer-facing aspects of the operations; • Infrastructure – Eve is working with select airport and fixed-base operators and experts in renewable energy to optimize the infrastructure that will be necessary for vertiport operations; • Technology suppliers – Our team is working closely with potential suppliers of avionics and propulsion systems to better define the operating specifications and requirements of our eVTOL aircraft and UATM solutions; and • Financial partners – Eve is leveraging Embraer relationships with several financial partners to assist in the funding needs for our operations and manufacturing facilities. In addition to funding from Zanite Acquisition Corp., Eve also raised equity capital from several strategic – and non-financial partners shown above that injected cash into the company. This further aligns our interests with some of our most important customers and development partners. As noted previously, Eve’s strategic partnership with Embraer is our most significant competitive advantage. The partnership includes a royalty-free license to Embraer’s background IP to be used within the UAM market as well as access to thousands of skilled Embraer employees on a flexible, first-priority basis and use of Embraer’s global infrastructure. The strategic alignment with Embraer also provides Eve with important cost and execution advantages as it seeks to scale its UAM solution globally. eveairmobility.com EVEX LISTED NYSE

EVE now listed on the NYSE Eve’s common stock began trading on the New York Stock Exchange (NYSE) on May 10, 2022, under symbol EVEX, following the business combination with Zanite Acquisition Corp. – a special purpose acquisition company focused on the aviation sector. The closing of the business combination brought $377 million of gross proceeds to Eve, which will be used, among other uses, to accelerate the development, certification and commercialization of our UAM solution. Certification In February 2022, Eve formalized the process to obtain Type Certification for its eVTOL aircraft with the Brazilian Civil Aviation Authority – ANAC. As formally agreed with ANAC, the eVTOL certification process will follow the process of obtaining a “normal category” aircraft Type Certificate, considering the requirements established by the Brazilian Civil Aviation Regulation (RBAC) no. 23, among other additional requirements. With ANAC’s support, Eve will continue engaging with other leading aviation authorities in the United States (Federal Aviation Authority – FAA) and Europe (EASA) to formalize the Type Certificate validation process for Eve around the world. Cabin unveiled at Advisory Board In June, Eve brought together representatives from its customers and partners to discuss and define important aspects of the UAM environment, including operations, services and support, aircraft performance, UATM, cabin design and the passenger journey. The event took place in Lisbon, Portugal, where more than 20 participants from over 10 countries gathered to help shape our shared approach to urban air mobility. Eve’s broad spectrum of customers joined the event, including fixed-wing and rotorcraft operators, rideshare platforms and lessors, all with the objective of co-creating the future of UAM. Companies such as Republic Airways, Halo Aviation, Blade, Falko, Fahari Aviation (a subsidiary of Kenya Airways), Bristow Group, Helisul Aviação, Flapper, Helipass, Widerøe Zero, Falcon Aviation, Avantto and others joined multiple collaborative workshops and presentations during which votes and feedback were captured to incorporate insights into the development processes. Included in this event was the unveiling of Eve’s cabin mock-up, the most advanced yet, allowing the Advisory Board’s participants to share their operational knowledge and advocate on behalf of their end customers. eveairmobility.com EVEX LISTED NYSE

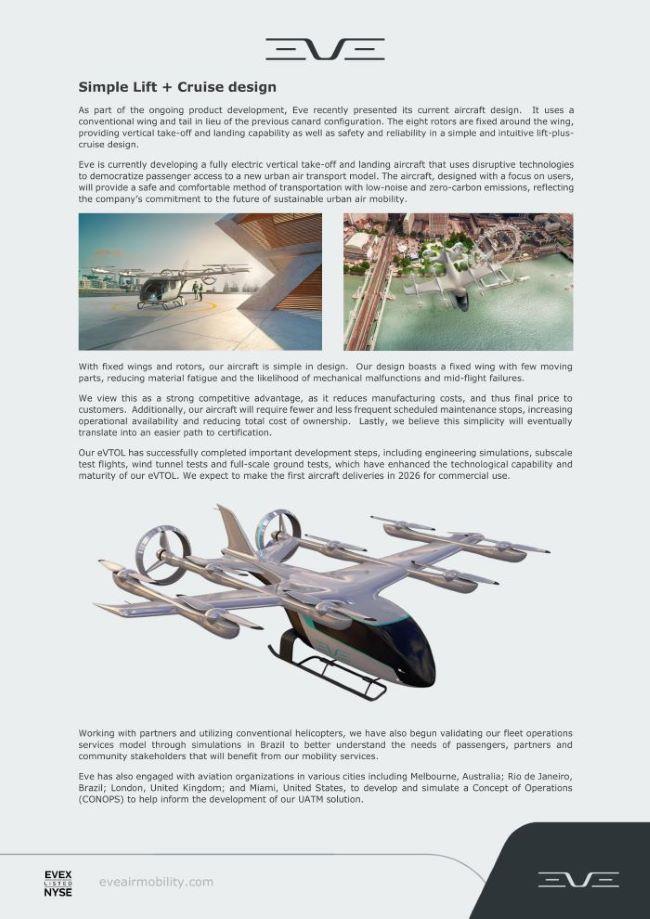

Simple Lift + Cruise design As part of the ongoing product development, Eve recently presented its current aircraft design. It uses a conventional wing and tail in lieu of the previous canard configuration. The eight rotors are fixed around the wing, providing vertical take-off and landing capability as well as safety and reliability in a simple and intuitive lift-plus-cruise design. Eve is currently developing a fully electric vertical take-off and landing aircraft that uses disruptive technologies to democratize passenger access to a new urban air transport model. The aircraft, designed with a focus on users, will provide a safe and comfortable method of transportation with low-noise and zero-carbon emissions, reflecting the company’s commitment to the future of sustainable urban air mobility. With fixed wings and rotors, our aircraft is simple in design. Our design boasts a fixed wing with few moving parts, reducing material fatigue and the likelihood of mechanical malfunctions and mid-flight failures. We view this as a strong competitive advantage, as it reduces manufacturing costs, and thus final price to customers. Additionally, our aircraft will require fewer and less frequent scheduled maintenance stops, increasing operational availability and reducing total cost of ownership. Lastly, we believe this simplicity will eventually translate into an easier path to certification. Our eVTOL has successfully completed important development steps, including engineering simulations, subscale test flights, wind tunnel tests and full-scale ground tests, which have enhanced the technological capability and maturity of our eVTOL. We expect to make the first aircraft deliveries in 2026 for commercial use. Working with partners and utilizing conventional helicopters, we have also begun validating our fleet operations services model through simulations in Brazil to better understand the needs of passengers, partners and community stakeholders that will benefit from our mobility services. Eve has also engaged with aviation organizations in various cities including Melbourne, Australia; Rio de Janeiro, Brazil; London, United Kingdom; and Miami, United States, to develop and simulate a Concept of Operations (CONOPS) to help inform the development of our UATM solution. eveairmobility.com EVEX LISTED NYSE

Manufacturing and infrastructure partnerships Eve has partnered with Porsche Consulting, Inc. to help optimize the eVTOL supply chain, global manufacturing, and logistics macro strategy. Utilizing advanced manufacturing research and innovation, the companies will combine their aeronautical and automotive expertise to support Eve’s implementation plan. The effort includes studies on industrial operation, logistics, supply chain and parts distribution in a new approach to optimize efficiency, productivity and safety. The study will address scalability and distributed production to meet demand as the UAM market evolves. Leveraging digital transformation and applying innovative, agile technologies will allow for integration of a global supply chain and lean production model that facilitates the business and sustainability goals of Eve Additionally, Eve signed an MOU with Corporación América Airports S.A. – a private-sector airport concession operator to design and integrate a service and support ecosystem for UAM operations in Europe and Latin America. The companies will combine their expertise and efforts to assess the market readiness of ground infrastructure for eVTOL operations at airports that Corporación América Airports S.A. currently operates, including studies of the regulatory environment. New eVTOL orders During the second quarter of 2022 Eve signed non-binding LOIs for a total of up to 125 new orders, from Falcon Aviation Services, Kenya Airway’s subsidiary Fahari Aviation and an undisclosed customer. In June, Falcon Aviation Services – a leading Business Aviation Services operator in the Middle East and Africa region, signed a non-binding LOI for up to 35 Eve eVTOL aircraft. Deliveries are expected to start in 2026 and will introduce the first eVTOL touristic flights from the Atlantis, The Palm in Dubai. Eve and Falcon will work together with the local stakeholders and authorities to develop UAM ecosystem in the United Arab Emirates. Also in June, Fahari Aviation – a subsidiary of Kenya Airways, signed a non-binding LOI for up to 40 of our eVTOLs. Similar to other LOIs, this agreement is non-binding and includes studies to develop and scale the UAM market in Kenya. Notably, it also includes efforts to develop a business model for cargo-drone operations there as well. Deliveries are also expected to start in 2026. eveairmobility.com EVEX LISTED NYSE

First Defense order Subsequent to the second quarter, Eve announced at the recent Farnborough Airshow a non-binding LOI with Embraer and BAE Systems to explore a potential order of up to 150 eVTOL aircraft with the aim of examining the application of the aircraft for the defense and security market. BAE Systems and Embraer are studying the formation of a joint venture to collaboratively develop an innovative defense eVTOL variant using Eve’s platform. BAE Systems and Embraer will continue to work together to explore how our eVTOLs can provide cost-effective, sustainable, and adaptable capability as a defense variant, which could include humanitarian and relief-response applications. We believe the Defense market can be another future revenue stream for Eve as governments in different regions around the world increase the focus on sustainable and environmentally-friendly platforms to serve humanitarian and military missions. Backlog, order pipeline At the end of the second quarter 2022, Eve’s total order pipeline totaled 1,910 units (not including the 150 orders from Embraer/BAE subsequent to the quarter), with a total backlog value of approximately $5.5 billion. Our initial order pipeline is based on non-binding letters of intent and therefore subject to change, consistent with common aviation practices. Eve’s current client base is comprised of 22 customers, from 10 countries spread over 6 continents, and further diversified by the industries in which they operate. No client represents more than 10% of the total order book. We plan to participate in the fleet operations market in collaboration with operating partners through various revenue and risk-sharing arrangements. Eve does not plan to hold eVTOLs on its own balance sheet and will instead establish joint operations with partners and grow its fleet operations services in a capital efficient manner, on a partner-by-partner basis. ConOps – Rio de Janeiro In May 2022, Eve published the Concept of Operations (CONOPS) for the future Urban Air Mobility (UAM) market in Rio de Janeiro. The document is a first for Brazil and brings together data and analyses that cover the perspective, points of attention and operational needs of eVTOL aircraft, passenger journey, and services and support. The CONOPS was developed through unprecedented cooperation with eleven strategic partners and government entities, including ANAC (Civil Aviation Agency of Brazil), DECEA (Department of Airspace Control), EDP Brasil, Helisul Aviação, Skyports, Flapper, RIOgaleão, Universal Aviation, ABAG (Brazilian General Aviation Association), in addition to Beacon, a platform that connects the ecosystem of aircraft maintenance services, and Atech, a company specializing in the control and management of air traffic (civil and military), both from the Embraer Group. eveairmobility.com EVEX LISTED NYSE

The design of the CONOPS included studies on aspects that impact the UAM ecosystem, discussion groups involving the main pillars for its development, and a period of flight operations performed in November 2021 between the Barra da Tijuca neighborhood and RIOgaleão International Airport that simulated the UAM ecosystem utilizing a helicopter. The community was also able to participate in this simulation by purchasing affordable tickets on one of the six daily flights conducted over the 30-day simulation period. The data and information collected from this simulation will contribute to defining the characteristics and needs for the development of urban air mobility not only in Rio de Janeiro but around the world, creating a UAM blueprint for any city. The CONOPS is available on Eve’s website for the entire community to better understand how the UAM ecosystem will enable a new means of affordable, safe and sustainable transportation. Eve hopes that the CONOPS will encourage all those responsible for this ecosystem to evolve together so that the industry, regulatory agencies, civil and government entities, and the community can continue investing in, developing, and integrating this new mode of transportation. eveairmobility.com EVEX LISTED NYSE

Financial Performance Income statement Unaudited (US dollars, except where noted) Balance Sheet Unaudited (US dollars, except where noted) Three Months Ended June 30, Six Months Ended June 30, 2022 2021 2022 2021 Operating expenses Research and development $ (9,835,736 ) $ (1,938,812 ) $ (18,950,423 ) $ (3,830,463 ) Selling, general and administrative (6,475,430 ) (429,467 ) (7,284,196 ) (757,410 ) Other expenses (37,123 ) - (37,123 ) - Loss from operations (16,348,289 ) (2,368,279 ) (26,271,742 ) (4,587,873 ) Change in fair value of derivative liabilities 4,132,525 - 4,132,525 - Financial and foreign exchange gain/(loss), net 563,854 (46,347 ) 986,566 (43,873 ) Loss before income taxes (11,651,910 ) (2,414,626 ) (21,152,651 ) (4,631,746) Income tax benefit/(expense) (129,708 ) - (129,708 ) - Net loss $ (11,781,618 ) $ (2,414,626 ) $ (21,282,359 ) $ (4,631,746 ) Net loss per share basic and diluted (0.05 ) (0.01 ) (0.09 ) (0.02 ) Weighted-average number of shares outstanding – basic and diluted 248,989,790 220,000,000 234,574,977 220,000,000 June 30, December 31, 2022 2021 Assets Current: Cash and cash equivalents $ 176,316,554 $ 14,376,523 Financial investments 154,464,652 - Related party receivable 256,645 220,000 Other current assets 166,085 21,140 Total current assets 331,203,936 14,617,663 Capitalized software, net - 699,753 Total assets $ 331,203,936 $ 15,317,416 Liabilities and Stockholders' equity Current: Accounts payable $ 889,594 $ 877,641 Related party payable 9,560,773 - Derivative financial instruments 7,267,500 32,226 Other payables 2,159,603 616,156 Total current liabilities 19,877,470 1,526,023 Other noncurrent payables 542,809 702,921 Total liabilities 20,420,279 2,228,944 STOCKHOLDERS' EQUITY Common stock, $0.001 par value; 1,000,000,000 shares authorized; 264,332,132 and 235,582,132 shares issued and outstanding on June 30, 2022 and December 31, 2021, respectively 264,332 - Net parent investment - 13,120,698 Additional paid-in capital 320,295,756 - Accumulated deficit (9,776,431 ) - Accumulated other comprehensive loss - (32,226 ) Total stockholders' equity 310,783,657 13,088,472 Total liabilities and stockholders' equity $ 331,203,936 $ 15,317,416 eveairmobility.com EVEX LISTED NYSE

Cash Flow statement Unaudited (US dollars, except where noted) Six Months Ended June 30, 2022 2021 Cash flows from operating activities: Net loss $ (21,282,359 ) $ (4,631,746 ) Adjustments to reconcile net loss to net cash used in operating activities: Amortization of capitalized software - 54,063 Long-term incentive plan expense (252,729 ) 96,693 Carve-out expenses (noncash, contributed from Parent) 952,432 - Stock Based Compensation 1,028,369 - Private warrants - change in FV (4,132,500 ) - Interest on Financial Investments (noncash) (464,652 ) - Changes in operating assets and liabilities: Other assets (153,512 ) (11,674 ) Related party receivable 216,083 - Accounts payable 730,186 (680,694 ) Related party payable 9,560,773 - Other payables 614,107 117,550 Net cash used in operating activities (13,183,802 ) (5,055,808 ) Cash flows from investing activities: Purchases of investing securities (154,000,000 ) - Net cash provided by investing activities: (154,000,000 ) - Cash flows from financing activities: Transfer from Parent - 5,055,808 Gross capital contribution 377,009,090 - Transaction costs (47,885,258 ) - Net cash provided by financing activities 329,123,832 5,055,808 Increase (decrease) in cash and cash equivalents 161,940,030 - Cash and cash equivalents at the beginning of the period 14,376,523 - Cash and cash equivalents at the end of the period $ 176,316,554 $ - Supplemental disclosure of other noncash investing and financing activities Additions to capitalized software transferred by Parent $ - $ 232,496 2Q22 Webcast details Management will discuss the results on a conference call on August 4th, 2022 at 12:00pm (Eastern Time). The webcast will be publicly available in the Upcoming Events section of the company website (www.eveairmobility.com). To listen by phone, please dial 1-877-704-4453 or 1-201-389-0920. A replay of the call will be available until midnight, Thursday, August 18, 2022, by dialing 1-844-512-2921 or 1-412-317-6671 and entering passcode 13730439. Upcoming Events Eve senior management is scheduled to attend the following events: Piper Sandler – Energy Transition Summit – Aspen, Co. (Aug. 16-18) Raymond James – Diversified Industrial Conference – New York, NY (Aug. 23) Deutsche Bank – Technology Conference – Las Vegas, NV (Aug.31-Sep.1) eveairmobility.com EVEX LISTED NYSE

Glossary of commonly-used terms ACMI – Aircraft, Crew, Maintenance and Insurance AL – Airworthiness Limitations AMP – Aircraft Maintenance Program ANAC – Agência de Aviação Civil ATC – Air Traffic Control ATM – Air Traffic Management Capex – Capital expenditures for the development of expansion of the telecommunications infrastructure COGS – Cost of Goods Sold ConOps – Concept of Operations CPA – Capacity Purchase Agreements DMC – Direct Maintenance Cost EASA – European Union Aviation Safety Agency EIS – Environment Impact Statement / Entry Into Service Embraer – A global aerospace company headquartered in Brazil, Embraer has businesses in Commercial and Executive aviation, Defense & Security and Agricultural Aviation. The company designs, develops, manufactures and markets aircraft and systems, providing Services & Support to customers after-sales. Embraer is the leading manufacturer of commercial jets up to 150 seats and the main exporter of high value-added goods in Brazil. The company maintains industrial units, offices, service and parts distribution centers, among other activities, across the Americas, Africa, Asia and Europe. Embraer holds 238,5mn Eve shares, or 87% of our equity. eVTOL – electric Vertical Take Off and Landing aircraft FAA – Federal Aviation Agency GAMA – General Aviation Manufacturers Association IMC – Instrument Meteorological Condition LOI – Letter of Intent for new aircraft orders and/or business partnership MEL – Minimum Equipment List MOU – Memorandum of Understanding MPP – Master Phase Plan MRB – Maintenance Review Board MRO – Maintenance, Repair and Operations MSA – Master Service Agreement OEM – Original Equipment Manufacturer PBH – Pay-by-the-hour contracts PDP – Progressive Down Payment POC – Proof of Concept PSA – Product Support Agreements QMS – Quality Management System Research and Development (R&D) – Accrued expenses related to the development of technologies of our eVTOL aircraft and UATM solutions S&S MPP – Service and Support Master Phase Plan SoS – System of Systems SoSE – System-of-Systems Engineering SVO – Simplified Vehicle operation T&M – Time and Materials contracts TRL – Technology Readiness Level UAM – Urban Air Mobility UAS – Unmanned Aircraft Systems UATM – Urban Air Traffic Management eveairmobility.com EVEX LISTED NYSE

About Eve Holding, Inc. Eve is dedicated to accelerating the Urban Air Mobility ecosystem. Benefitting from a start-up mindset, backed by Embraer S.A.’s more than 50-year history of aerospace expertise, and with a singular focus, Eve is taking a holistic approach to progressing the UAM ecosystem, with an advanced eVTOL project, a comprehensive global services and support network and a unique air traffic management solution. Eve is listed on the New York Stock Exchange where its shares of common stock and public warrants trade under the tickers “EVEX” and “EVEXW”. For more information, please visit www.eveairmobility.com. Forward Looking Statements Certain statements in this press release include “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target”, “may”, “intend”, “predict”, “should”, “would”, “predict”, “potential”, “seem”, “future”, “outlook” or other similar expressions (or negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. All statements other than statements of historical facts are forward-looking statements and include, but are not limited to, statements regarding the Company’s expectations with respect to future performance and anticipated financial impacts of the business combination. These statements are based on various assumptions, whether or not identified herein, and on the current expectations of the Company’s management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ from assumptions, and such differences may be material. Many actual events and circumstances are beyond the control of the Company. These forward-looking statements are subject to a number of risks and uncertainties, including: (i) changes in domestic and foreign business, market, financial, political and legal conditions; (ii) failure to realize the anticipated benefits of the business combination with Zanite Acquisition Corp.; (iii) risks relating to the uncertainty of the projected financial information with respect to the Company; (iv) the outcome of any legal proceedings that may be instituted against the Company related to the completion of the business combination; (v) future global, regional or local economic and market conditions, including the growth and development of the urban air mobility market; (vi) the development, effects and enforcement of laws and regulations; (vii) the Company’s ability to grow and manage future growth, maintain relationships with customers and suppliers and retain its key employees; (viii) the Company’s ability to develop new products and solutions, bring them to market in a timely manner, and make enhancements to its platform; (ix) the Company’s ability to successfully develop, obtain certification for and commercialize its aircraft, (x) the effects of competition on the Company’s future business; (xi) the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; (xi) the impact of the global COVID-19 pandemic and (xii) those factors discussed under the heading “Risk Factors” in the Company’s Registration Statement on Form S-1/A filed on July 29, 2022, and subsequent filings with the Securities and Exchange Commission (SEC). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release and undue reliance should not be placed upon the forward-looking statements. Investor Relations: Lucio Aldworth Caio Pinez [email protected] https://ir.eveairmobility.com/ Media: [email protected] eveairmobility.com EVEX LISTED NYSE