Exhibit 99.1 Investor Presentation April 2022

Disclaimer Confidentiality and Disclosures exemption under the Securities Act. The transfer of the Securities may also be subject to conditions set forth in an agreement under which they are to This presentation has been prepared for use by EVE UAM, LLC (“Eve” or the “Company”) and Zanite Acquisition Corp. ( Zanite ) in connection with their be issued. Investors should be aware that they might be required to bear the financial risk of their investment for an indefinite period of time. Neither proposed business combination (the “Transaction”). This presentation is for information purposes only and is being provided to you solely in your Zanite nor the Company is making an offer of the Securities in any state where the offer is not permitted. capacity as a potential investor in considering an investment in Zanite and may not be reproduced or redistributed, in whole or in part, without the prior written consent of Eve and Zanite. By accepting this presentation, each recipient and its directors, partners, officers, employees, attorney(s), agents This communication is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use and representatives (“recipient”) agrees: (i) to maintain the confidentiality of all information that is contained in this presentation and not already in the would be contrary to local law or regulation. public domain; and (ii) to return or destroy all copies of this presentation or portions thereof in its possession following the request for the return or destruction of such copies. This presentation supersedes and supplements any prior presentation and any oral or written communication with respect Forward-Looking Statements to Eve and its business. This presentation includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1996. Zanite’s and Eve’s actual results may differ from their expectations, estimates and projections and consequently, you should not rely on The Company and Zanite are free to conduct the process of the potential transaction as they deem in their sole discretion (including, without these forward-looking statements as predictions of future events. Words such as “expect”, “estimate”, “project”, “budget”, “forecast”, “anticipate”, limitation, terminating further participation in the process by any party, negotiating with prospective transaction counterparties and entering into an “intend”, “plan”, “may”, “will”, “could”, “should”, “believes”, “predicts”, “potential”, “continue”, and similar expressions are intended to identify such agreement with respect to the Transaction without prior notice to you or any other person) and any procedures relating to such Transaction may be forward-looking statements. These forward-looking statements include, without limitation, Zanite’s and Eve’s expectations with respect to future changed at any time without prior notice to you or any other person. None of Eve, Zanite or any other person undertakes any obligation to provide you performance and anticipated financial impacts of the Transaction, the satisfaction of closing conditions to the Transaction and the timing of the with access to any additional information. This presentation shall not be deemed an indication of the state of affairs of Eve nor shall it constitute an completion of the Transaction. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to indication that there has been no change in the business or affairs of Eve since the date hereof. differ materially from the expected results. You should carefully consider the risks and uncertainties described in the “Risk Factors” section of Zanite’s registration statement on Form S-1 and annual report on Form 10-K/A and Embraer S.A.’s (“Embraer”) annual report on Form 20-F. In addition, there No Representations and Warranties will be risks and uncertainties described in the proxy statement relating to the proposed Transaction, a preliminary version of which has been filed by None of Eve, Zanite or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, investment Zanite with the Securities and Exchange Commission (the “SEC”) and other documents filed by Zanite from time to time with the SEC. These filings banks, agents or advisers makes any express or implied representation or warranty as to the accuracy or completeness of the information contained identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the in this presentation or any other written, oral or other communications transmitted or otherwise made available to any party in the course of its forward looking statements. Most of these factors are outside Zanite’s and Eve’s control and are difficult to predict. Factors that may cause such evaluation of a possible transaction between Eve and Zanite. To the fullest extent permitted by law, in no circumstances will the Company, Zanite or differences include, but are not limited to: (1) the outcome of any legal proceedings that may be instituted against Zanite or Eve following the any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, investment banks, agents or announcement of the Transaction; (2) the inability to complete the proposed Transaction, including due to the inability to concurrently close the advisers be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its proposed Transaction and the private placement of common stock or due to failure to obtain approval of the securityholders of Zanite; (3) delays in omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection obtaining, adverse conditions contained in, or the inability to obtain necessary regulatory approvals or complete regular reviews required to complete therewith. the Transaction; (4) the risk that the Transaction disrupts current plans and operations as a result of the announcement and consummation of the Transaction; (5) the inability to recognize the anticipated benefits of the Transaction, which may be affected by, among other things, competition, the You will be entitled to rely solely on the representations and warranties made to you by Zanite in a definitive written agreement relating to a ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its key Transaction, when and if executed, and subject to any limitations and restrictions as may be specified in such definitive agreement. No other employees; (6) costs related to the Transaction; (7) changes in the applicable laws or regulations; (8) the possibility that the combined company may representations and warranties will have any legal effect. The Company and Zanite expressly disclaim any and all liability for representations, be adversely affected by other economic, business, and/or competitive factors; (9) the impact of the global COVID-19 pandemic; and (10) other risks expressed or implied, contained herein or for errors, omissions or misstatements, negligent or otherwise, in this presentation or any other written or and uncertainties indicated from time to time described in Zanite’s registration on Form S-1 and Embraer’s annual report on Form 20-F, including those oral communication transmitted to you in the course of your evaluation of a potential transaction. under “Risk Factors” therein, and in Zanite’s and Embraer’s other filings with the SEC. Zanite and Eve caution that the foregoing list of factors is not exclusive and not to place undue reliance upon any forward-looking statements, including projections, which speak only as of the date made. Except to The recipient agrees and acknowledges that this presentation is not intended to form the basis of any investment decision by the recipient and does the extent required by applicable federal securities laws (including a registrant’s responsibility to make full and prompt disclosure of material facts, not constitute investment, tax or legal advice regarding any securities. You should consult your own legal, regulatory, tax, business, financial and both favorable and unfavorable, regarding its financial condition, which responsibility may extend to situations where management knows or has accounting advisors to the extent you deem necessary, and must make your own decisions and perform your own independent investment and reason to know that its previously disclosed projections no longer have a reasonable basis), neither Zanite nor Eve undertakes or accepts any analysis of an investment in Zanite and the transactions contemplated in this presentation. The recipient also acknowledges and agrees that the obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in information contained in this presentation and any oral statements made in connection with this presentation are preliminary in nature, subject to events, conditions or circumstances on which any such statement is based. material change and not intended to be all-inclusive or to contain all the information that a person may desire in considering an investment in Zanite. Zanite and Eve disclaim any duty to update the information contained in this presentation. Use of Data This presentation contains information concerning Eve's industry, including market size and growth rates of the markets in which Eve participates, that By participating in this Presentation, the recipient acknowledges that such recipient is aware that the United States securities laws restrict persons are based on industry surveys and publications or other publicly available information, other third-party survey data and research reports with material non-public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such commissioned by Eve and its internal sources. This information involves many assumptions and limitations, there can be no guarantee as to the company, or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information. Further, no representation is made as likely to purchase or sell such securities on the basis of such information. to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein. No Offer or Solicitation This presentation and any oral statements made in connection with this presentation shall neither constitute an offer to sell nor the solicitation of an Any data on past performance or modeling contained herein is not an indication as to future performance. Neither Eve nor Zanite have independently offer to buy any securities, or the solicitation of any proxy, vote, consent, authorization or approval in any jurisdiction in connection with the proposed verified this third-party information. Similarly, other third-party survey data and research reports commissioned by Eve or Zanite, while believed to be Transaction, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration reliable, are based on limited sample sizes and have not been independently verified by Eve or Zanite. In addition, projections, assumptions, estimates, or qualification under the securities laws of any such jurisdictions. No such offering of securities shall be made except by means of a prospectus goals, targets, plans and trends of the future performance of the industry in which Eve operates, and its future performance, are necessarily subject to meeting the requirements of Section 10 of the Securities Act of 1933, as amended (the “Securities Act”). Investment in any securities described herein uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from has not been approved or disapproved by the SEC or any other regulatory authority nor has any authority passed upon or endorsed the merits of the those expressed in the estimates made by independent parties and by Eve and Zanite. Eve and Zanite assume no obligation to update the information offering or the accuracy or adequacy of the information contained herein. in this presentation. Accordingly, this presentation is being delivered to you with the understanding that you will conduct your own independent investigation of those matters, which you deem appropriate without reliance on Zanite, Eve or any materials set out in this presentation. Any offering of securities (the Securities ) will not be registered under the Securities Act, and will be offered as a private placement to a limited number of institutional accredited investors as defined in Rule 501(a)(1), (2), (3) or (7) under the Securities Act and Institutional Accounts as All summaries and discussions of documentation and/or financial information contained herein are qualified in their entirety by reference to the actual defined in FINRA Rule 4512(c). Accordingly, the Securities must continue to be held unless a subsequent disposition is exempt from the registration documents and/or financial statements. requirements of the Securities Act. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any 1

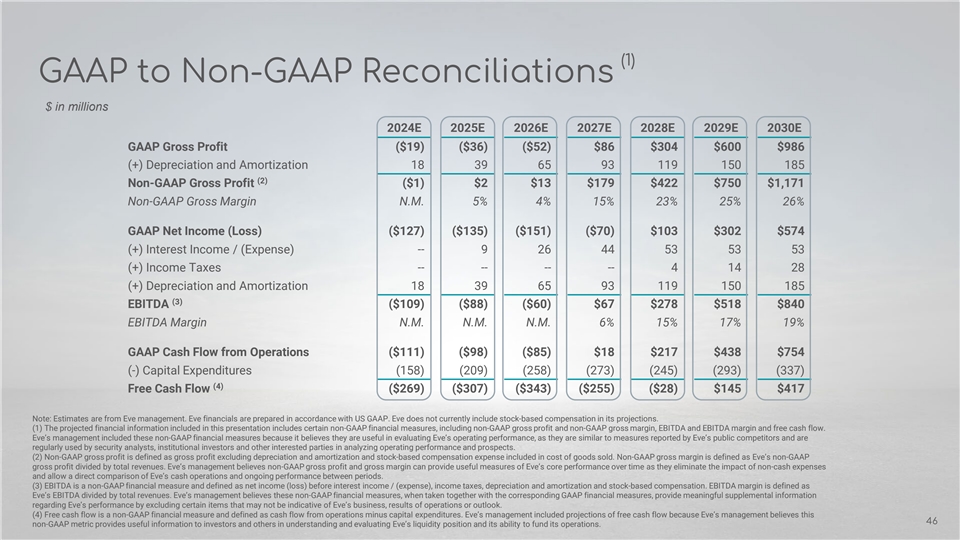

Disclaimer (cont.) Projections Participation in Solicitation This Presentation contains financial forecasts for the Company with respect to certain financial results for the Company’s fiscal years 2020 through Eve and Zanite and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of 2030. All projections, estimates, goals, targets, plans, trends or other statements with respect to future results or future events in this presentation, Zanite's shareholders in connection with the proposed Transaction. Investors and security holders may obtain more detailed information regarding the including projected revenue, are forward-looking statements that (i) reflect various estimates and assumptions concerning future industry names and interests in the proposed Transaction of Zanite's directors and officers in Zanite's filings with the SEC, including Zanite's annual report on performance, general business, economic and regulatory conditions, market conditions for the Company’s products and other matters, which Form 10-K/A, which was originally filed with the SEC on June 14, 2021. To the extent that holdings of Zanite's securities have changed from the assumptions may or may not prove to be correct, (ii) are inherently subject to significant contingencies and uncertainties, many of which are outside amounts reported in Zanite's registration statement on Form S-1, such changes have been or will be reflected on Statements of Change in Ownership the control of Eve and Zanite and (iii) should not be regarded as a representation by Eve, Zanite or any other person that such estimates, forecasts or on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to projections will be achieved. Neither Zanite’s nor Eve’s independent auditors have studied, reviewed, compiled or performed any procedures with Zanite's shareholders in connection with the proposed Transaction is set forth in the proxy statement for the proposed Transaction, a preliminary respect to the projections for the purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any version of which has been filed by Zanite with the SEC. other form of assurance with respect thereto for the purpose of this presentation. These projections are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. Actual results can be expected to vary and those variations may be material. Trademarks Unanticipated events may occur that could affect the outcome of such projections, estimates, goals, targets, plans, trends and other statements. You This presentation includes logos or other words or devices that may be registered trademarks of their respective owners. Solely for convenience, must make your own determinations as to the reasonableness of these projections, estimates, goals, targets, plans, trends and other statements and some of the trademarks, service marks, trade names and copyrights referred to in this presentation may be listed without the TM, SM, © or ® symbols, should also note that if one or more estimates change, or one or more assumptions are not met, or one or more unexpected events occur, the but Zanite and Eve will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, performance and results set forth in such projections, estimates, goals, targets, plans, trends and other statements may not be achieved. We can give trade names and copyrights. This presentation and its contents are not endorsed, sponsored or affiliated with any trademark owner. no assurance as to future operations, performance, results or events. The inclusion of financial projections, estimates and targets in this presentation should not be regarded as an indication that Eve and Zanite, or their representatives, considered or consider the financial projections, estimates and Additional Information About the Transaction and Where to Find It targets to be a reliable prediction of future events. Zanite intends to submit the Transaction to its security holders for their consideration. The Company has filed a preliminary proxy statement with the SEC and intends to file a proxy statement with the SEC, which will include a preliminary proxy statement and a definitive proxy statement, to be Use of Non-GAAP Financial Metrics distributed to Zanite’s securityholders in connection with Zanite’s solicitation for proxies for the vote by Zanite’s shareholders in connection with the This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles in the United States Transaction and other matters as described in the definitive proxy statement. After the definitive proxy statement on Form DEFM14A has been filed, ( GAAP ), including EBITDA, EBITDA margin, free cash flow, non-GAAP gross profit and non-GAAP gross margin (including on a forward-looking basis) Zanite will mail the definitive proxy statement and other relevant documents to its securityholders as of the record date established for voting on the and certain other ratios and other metrics derived therefrom. The Company defines EBITDA as net income (loss) before interest income / (expense), Transaction. Investors and security holders of Zanite and Eve are urged to read the proxy statement and other relevant documents that have been or income taxes, depreciation and amortization and stock-based compensation, and EBITDA margin as EBITDA divided by revenue. The Company defines will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the proposed free cash flow as cash flow from operations minus capital expenditures. The Company defines non-GAAP gross profit as gross profit excluding Transaction. Investors and security holders will be able to obtain free copies of the proxy statement and other documents containing important depreciation and amortization and stock-based compensation expense included in cost of goods sold, and non-GAAP gross margin as non-GAAP information about Zanite and Eve through the website maintained by the SEC at www.sec.gov. Copies of the documents filed with the SEC by Zanite gross profit divided by revenue. These financial measures are not measures of financial performance in accordance with GAAP and may exclude can be obtained free of charge by directing a written request to Zanite at 25101 Chagrin Boulevard, Suite 350, Cleveland, Ohio 44122. Inquiries items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as regarding this presentation may be directed to Steven H. Rosen, Co-Chief Executive Officer, at 25101 Chagrin Boulevard, Suite 350, Cleveland, Ohio an alternative to net loss or other measures of profitability, liquidity or performance under GAAP. You should be aware that our presentation of these 44122 or by calling (216) 292-0200. measures may not be comparable to similarly titled measures used by other companies, which may be defined and calculated differently. Eve believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY Eve. Eve's management uses forward-looking non-GAAP measures to evaluate Eve's projected financials and operating performance. Other companies AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore the Company’s non- INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. GAAP measures may not be directly comparable to similarly titled measures of other companies. Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company’s financial statements. Given the inherent uncertainty regarding projections, projected non-GAAP measures have not been reconciled back to the nearest GAAP measure. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expense and income are excluded or included in determining these non-GAAP financial measures. You should review the Company’s and Zanite’s audited financial statements, which will be included in the definitive proxy statement relating to the Transaction. Reconciliations of historical non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Private Placement The securities to which this presentation relates have not been registered under the Securities Act, or the securities laws of any other jurisdiction. This presentation relates to securities that Zanite intends to offer in reliance on exemptions from the registration requirements of the Securities Act and other applicable laws. These exemptions apply to offers and sales of securities that do not involve a public offering. The securities have not been approved or recommended by any federal, state or foreign securities authorities, nor have any of these authorities passed upon the merits of this offering or determined that this presentation is accurate or complete. Any representation to the contrary is a criminal offense. 2020 Preliminary Financial Information Eve's audited consolidated financial statements for the twelve months ended December 31, 2020 are not yet available. This presentation includes certain preliminary unaudited financial information for the twelve months ended December 31, 2020 that is based solely on Eve's management's estimates reflecting currently available preliminary information, and remains subject to Eve's consideration of subsequent events. Eve's independent registered public accounting firm has not audited or reviewed, and does not express an opinion with respect to, this financial information. Eve's final consolidated financial results as of and for the twelve months ended December 31, 2020 may materially differ from the estimates and the interim balances set forth in this presentation. Such estimates constitute forward-looking statements and are subject to risks and uncertainties, including those described under Forward-Looking Statements. 2

1. INTRODUCTION

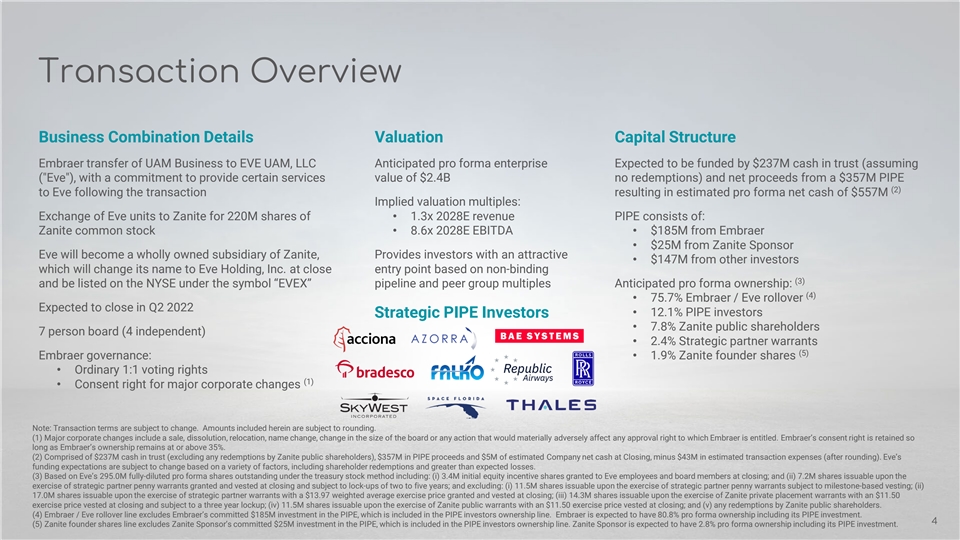

Transaction Overview Business Combination Details Valuation Capital Structure Embraer transfer of UAM Business to EVE UAM, LLC Anticipated pro forma enterprise Expected to be funded by $237M cash in trust (assuming ( Eve ), with a commitment to provide certain services value of $2.4B no redemptions) and net proceeds from a $357M PIPE (2) to Eve following the transaction resulting in estimated pro forma net cash of $557M Implied valuation multiples: Exchange of Eve units to Zanite for 220M shares of • 1.3x 2028E revenue PIPE consists of: Zanite common stock • 8.6x 2028E EBITDA • $185M from Embraer • $25M from Zanite Sponsor Eve will become a wholly owned subsidiary of Zanite, Provides investors with an attractive • $147M from other investors which will change its name to Eve Holding, Inc. at close entry point based on non-binding (3) and be listed on the NYSE under the symbol “EVEX” pipeline and peer group multiples Anticipated pro forma ownership: (4) • 75.7% Embraer / Eve rollover Expected to close in Q2 2022 • 12.1% PIPE investors Strategic PIPE Investors • 7.8% Zanite public shareholders 7 person board (4 independent) • 2.4% Strategic partner warrants (5) Embraer governance: • 1.9% Zanite founder shares • Ordinary 1:1 voting rights (1) • Consent right for major corporate changes Note: Transaction terms are subject to change. Amounts included herein are subject to rounding. (1) Major corporate changes include a sale, dissolution, relocation, name change, change in the size of the board or any action that would materially adversely affect any approval right to which Embraer is entitled. Embraer’s consent right is retained so long as Embraer’s ownership remains at or above 35%. (2) Comprised of $237M cash in trust (excluding any redemptions by Zanite public shareholders), $357M in PIPE proceeds and $5M of estimated Company net cash at Closing, minus $43M in estimated transaction expenses (after rounding). Eve’s funding expectations are subject to change based on a variety of factors, including shareholder redemptions and greater than expected losses. (3) Based on Eve’s 295.0M fully-diluted pro forma shares outstanding under the treasury stock method including: (i) 3.4M initial equity incentive shares granted to Eve employees and board members at closing; and (ii) 7.2M shares issuable upon the exercise of strategic partner penny warrants granted and vested at closing and subject to lock-ups of two to five years; and excluding: (i) 11.5M shares issuable upon the exercise of strategic partner penny warrants subject to milestone-based vesting; (ii) 17.0M shares issuable upon the exercise of strategic partner warrants with a $13.97 weighted average exercise price granted and vested at closing; (iii) 14.3M shares issuable upon the exercise of Zanite private placement warrants with an $11.50 exercise price vested at closing and subject to a three year lockup; (iv) 11.5M shares issuable upon the exercise of Zanite public warrants with an $11.50 exercise price vested at closing; and (v) any redemptions by Zanite public shareholders. (4) Embraer / Eve rollover line excludes Embraer’s committed $185M investment in the PIPE, which is included in the PIPE investors ownership line. Embraer is expected to have 80.8% pro forma ownership including its PIPE investment. 4 (5) Zanite founder shares line excludes Zanite Sponsor’s committed $25M investment in the PIPE, which is included in the PIPE investors ownership line. Zanite Sponsor is expected to have 2.8% pro forma ownership including its PIPE investment.

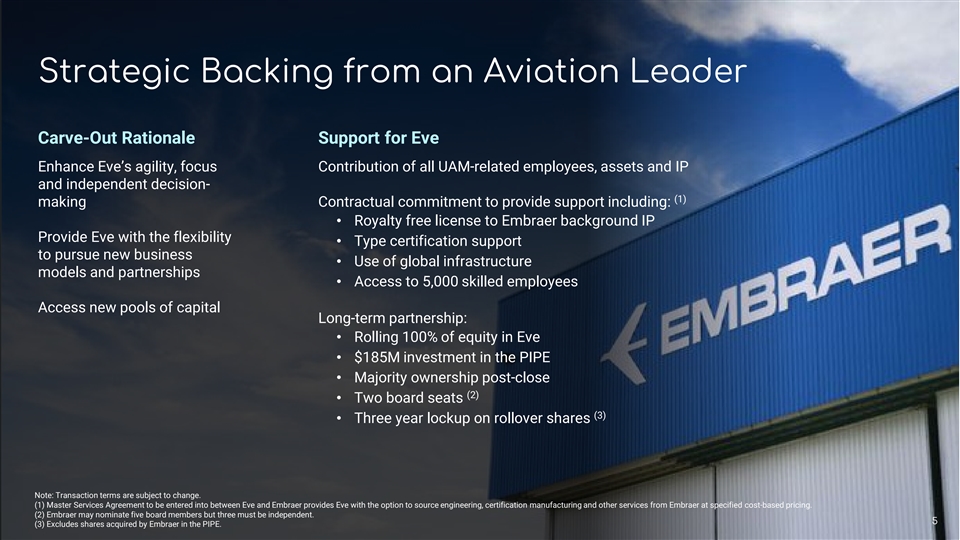

Strategic Backing from an Aviation Leader Carve-Out Rationale Support for Eve Enhance Eve’s agility, focus Contribution of all UAM-related employees, assets and IP and independent decision- (1) making Contractual commitment to provide support including: • Royalty free license to Embraer background IP Provide Eve with the flexibility • Type certification support to pursue new business • Use of global infrastructure models and partnerships • Access to 5,000 skilled employees Access new pools of capital Long-term partnership: • Rolling 100% of equity in Eve • $185M investment in the PIPE • Majority ownership post-close (2) • Two board seats (3) • Three year lockup on rollover shares Note: Transaction terms are subject to change. (1) Master Services Agreement to be entered into between Eve and Embraer provides Eve with the option to source engineering, certification manufacturing and other services from Embraer at specified cost-based pricing. (2) Embraer may nominate five board members but three must be independent. 5 (3) Excludes shares acquired by Embraer in the PIPE.

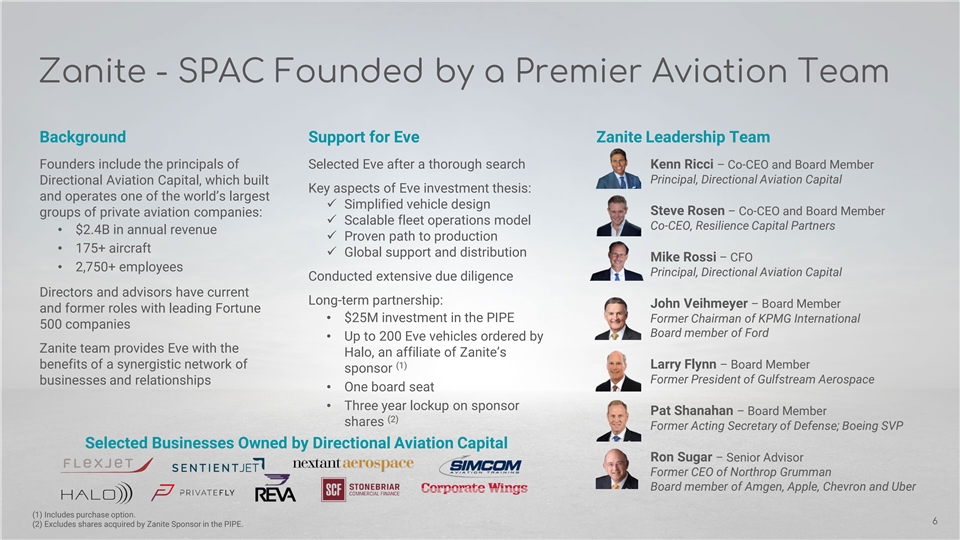

Zanite - SPAC Founded by a Premier Aviation Team Background Support for Eve Zanite Leadership Team Founders include the principals of Selected Eve after a thorough search Kenn Ricci – Co-CEO and Board Member Principal, Directional Aviation Capital Directional Aviation Capital, which built Key aspects of Eve investment thesis: and operates one of the world’s largest ü Simplified vehicle design Steve Rosen – Co-CEO and Board Member groups of private aviation companies: ü Scalable fleet operations model Co-CEO, Resilience Capital Partners • $2.4B in annual revenue ü Proven path to production • 175+ aircraft ü Global support and distribution Mike Rossi – CFO • 2,750+ employees Principal, Directional Aviation Capital Conducted extensive due diligence Directors and advisors have current Long-term partnership: John Veihmeyer – Board Member and former roles with leading Fortune • $25M investment in the PIPE Former Chairman of KPMG International 500 companies Board member of Ford • Up to 200 Eve vehicles ordered by Zanite team provides Eve with the Halo, an affiliate of Zanite’s benefits of a synergistic network of (1) Larry Flynn – Board Member sponsor Former President of Gulfstream Aerospace businesses and relationships • One board seat • Three year lockup on sponsor Pat Shanahan – Board Member (2) shares Former Acting Secretary of Defense; Boeing SVP Selected Businesses Owned by Directional Aviation Capital Ron Sugar – Senior Advisor Former CEO of Northrop Grumman Board member of Amgen, Apple, Chevron and Uber (1) Includes purchase option. 6 (2) Excludes shares acquired by Zanite Sponsor in the PIPE.

Investment Highlights Attractive Business Fundamentals Addressing a Massive Global TAM Scalable and Sustainable Solution Highly Experienced Team Pure play focus on a $0.76T revenue Most practical eVTOL design, capital efficient Senior leadership team and board with (1) opportunity 2025E – 2040E fleet operations model and carbon neutrality proven aviation credentials Significant Execution Advantages Strategic Support from Embraer Powerful Partner Network Significant Revenue Visibility Aviation leader with 30+ aircraft models MOUs and LOIs with dozens of leading Order pipeline of $5.5B for 1,825 vehicles (2) (3) certified and produced over 25 years partners across the UAM ecosystem to 19 launch customers (1) Total addressable market (“TAM”) estimate as per “Market for Urban Air Mobility” from KPMG dated June 2021 (includes passenger travel; excludes cargo, defense and emergency services). (2) Partnerships with Eve or one of its affiliates are non-binding. The number of memoranda of understanding (“MOUs”) and LOIs signed by Eve is current as of 4/6/22. (3) Eve pipeline is based on launch orders (including purchase options) and capacity deals that are non-binding and subject to material change. Capacity deals are converted from annual hourly commitments to vehicles 7 assuming 1,000 hours per vehicle per year. Eve pipeline is current as of 4/6/22.

2. HIGHLY SCALABLE UAM SOLUTION

Highly Scalable UAM Solution EVTOL DESIGN AND SERVICE AND FLEET URBAN AIR TRAFFIC PRODUCTION SUPPORT OPERATIONS MANAGEMENT Practical design choice drives Leveraging Embraer global Capital efficient strategy of Applying the knowledge from lowest operational cost and footprint to enable a sizable aligning with operators and designing Brazil’s ATC system simplest certification path and profitable revenue stream scaling partner-by-partner to enable safe eVTOL flights 9

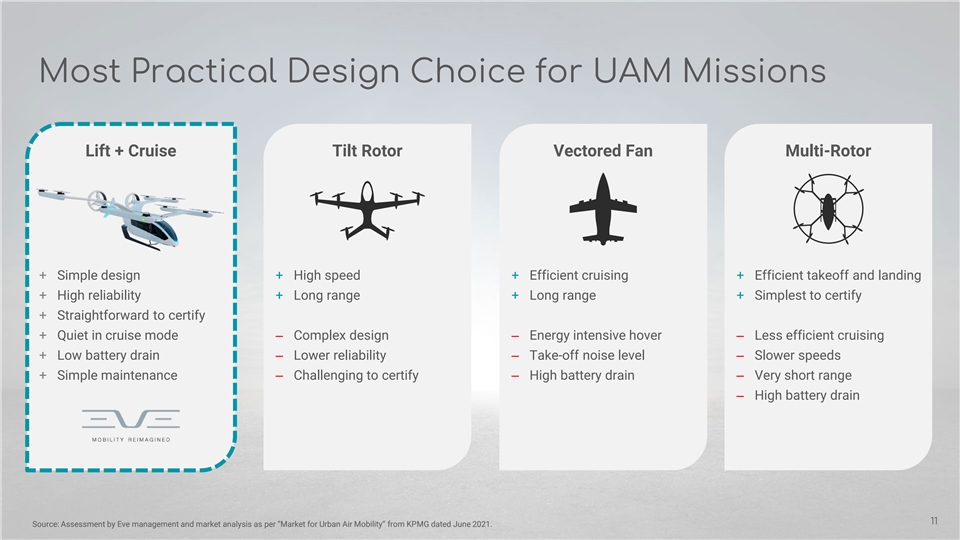

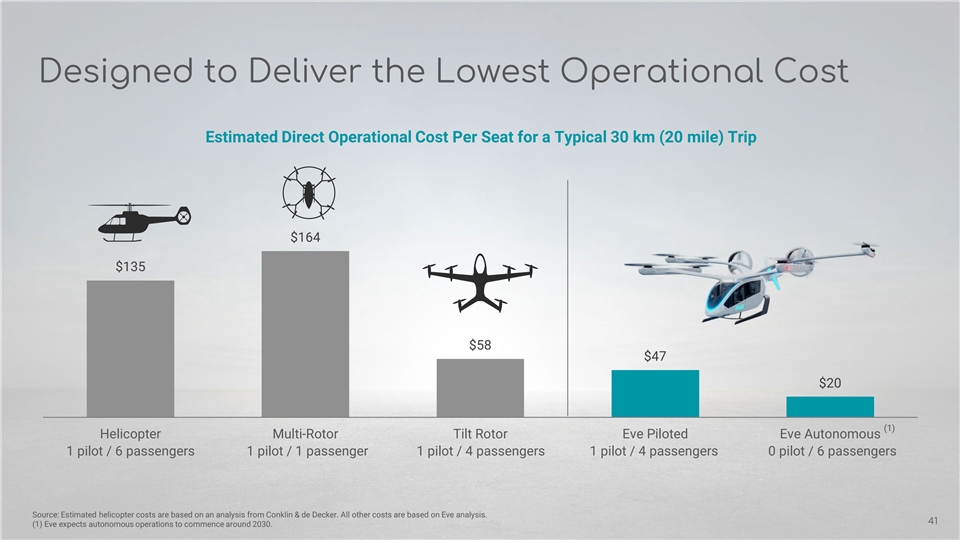

Vehicle Design Optimized for Urban Mobility Flexible Seating Capacity Tailored for Urban Mobility 4 passengers at entry into service 100 km (60 mile) range at EIS (1) Up to 6 in autonomous mode Addresses 99% of UAM missions in cities (2) and metropolitan areas High Utilization Rate Leading Cost Efficiency Designed for thousands of flight cycles Over 6x lower cost-per-seat than helicopters per year with industry-leading reliability (3) and best-in-class for eVTOLs Lift + Cruise Design Community Friendly Most practical design choice for Approximately 90% lower noise footprint (4) efficiency and certifiability compared to equivalent helicopters Note: Expected vehicle performance metrics are based on preliminary models, simulations and proof of concepts (“PoCs”). Actual performance characteristics are subject to validation and change. (1) Eve expects autonomous operations to commence around 2030. (2) EIS = entry into service. Eve’s estimate of serving 99% of UAM missions in cities and metropolitan areas is based on a study of 1,500 markets worldwide conducted by Eve and Massachusetts Institute of Technology. (3) Helicopter costs are based on an analysis from Conklin & de Decker. Eve vehicle costs are based on Eve analysis. 10 (4) Data is based on simulations performed by Eve and publicly available noise profile data for a Bell 430 helicopter.

Most Practical Design Choice for UAM Missions Lift + Cruise Tilt Rotor Vectored Fan Multi-Rotor + Simple design + High speed + Efficient cruising + Efficient takeoff and landing + High reliability + Long range + Long range + Simplest to certify + Straightforward to certify + Quiet in cruise mode ‒ Complex design‒ Energy intensive hover‒ Less efficient cruising + Low battery drain‒ Lower reliability‒ Take-off noise level‒ Slower speeds + Simple maintenance ‒ Challenging to certify‒ High battery drain‒ Very short range ‒ High battery drain 11 Source: Assessment by Eve management and market analysis as per “Market for Urban Air Mobility” from KPMG dated June 2021.

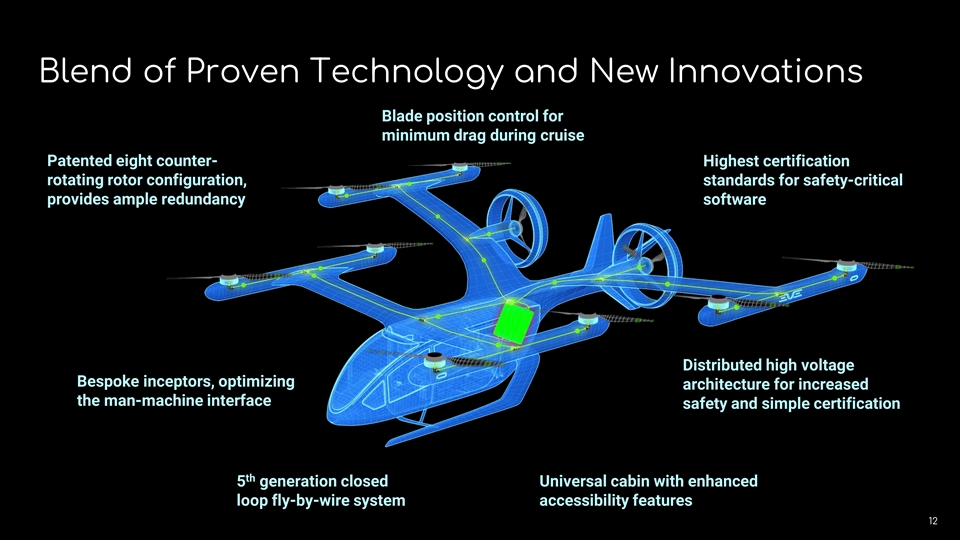

Blend of Proven Technology and New Innovations Blade position control for minimum drag during cruise Patented eight counter- Highest certification rotating rotor configuration, standards for safety-critical provides ample redundancy software Distributed high voltage Bespoke inceptors, optimizing architecture for increased the man-machine interface safety and simple certification th 5 generation closed Universal cabin with enhanced loop fly-by-wire system accessibility features 12

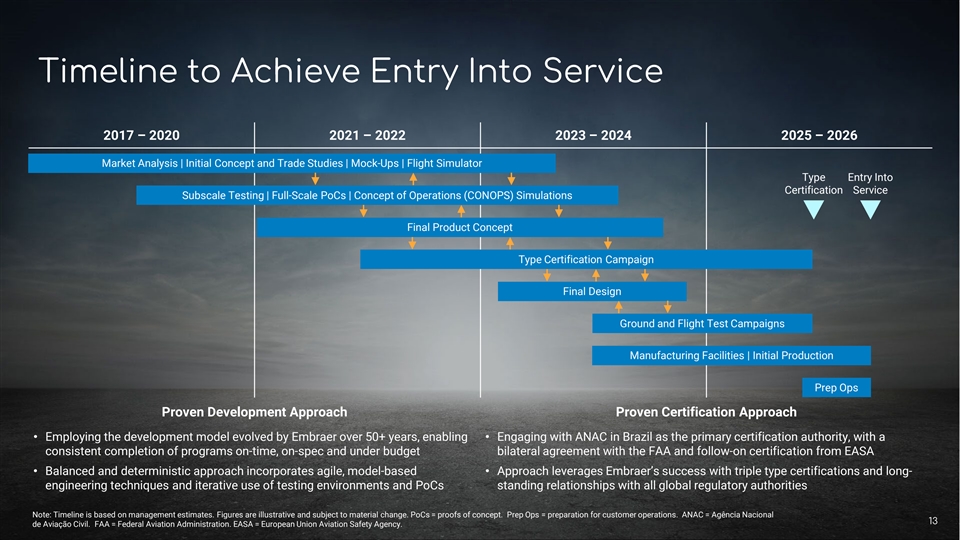

Timeline to Achieve Entry Into Service 2017 – 2020 2021 – 2022 2023 – 2024 2025 – 2026 Market Analysis | Initial Concept and Trade Studies | Mock-Ups | Flight Simulator Type Entry Into Certification Service Subscale Testing | Full-Scale PoCs | Concept of Operations (CONOPS) Simulations Final Product Concept Type Certification Campaign Final Design Ground and Flight Test Campaigns Manufacturing Facilities | Initial Production Prep Ops Proven Development Approach Proven Certification Approach • Employing the development model evolved by Embraer over 50+ years, enabling • Engaging with ANAC in Brazil as the primary certification authority, with a consistent completion of programs on-time, on-spec and under budget bilateral agreement with the FAA and follow-on certification from EASA • Balanced and deterministic approach incorporates agile, model-based • Approach leverages Embraer’s success with triple type certifications and long- engineering techniques and iterative use of testing environments and PoCs standing relationships with all global regulatory authorities Note: Timeline is based on management estimates. Figures are illustrative and subject to material change. PoCs = proofs of concept. Prep Ops = preparation for customer operations. ANAC = Agência Nacional 13 de Aviação Civil. FAA = Federal Aviation Administration. EASA = European Union Aviation Safety Agency.

Scalable Approach to Global Fleet Operations Eve plans to build out its fleet operations business in collaboration with partners Eve will not own aircraft, but will instead establish joint operations and grow partner-by-partner Benefits to Eve: ü Maximize capital efficiency ü Accelerate time-to-market ü Leverage partner capabilities ü Share revenues and risks Eve has signed MOUs and LOIs with 19 (1) operating partners: • 6 fixed wing operators • 9 helicopter operators • 4 ride sharing platform providers 14 (1) Potential collaborations for aircraft operations are non-binding and subject to material change. Number of MOUs and LOIs is current as of 4/6/22. Eve or one of its affiliates is party to such MOUs and LOIs.

Experienced Leadership Team Senior Management Team Jerry DeMuro Andre Stein Eduardo Couto Luiz Valentini Flávia Pavie Co-CEO Co-CEO CFO CTO General Counsel and CCO Alice Altíssimo Luiz Mauad Flavia Ciaccia David Rottblatt Luana Campos Head of Program Head of Services Head of User Head of Business Head of Employee Management and Fleet Operations Experience Development Journey Post-Closing Directors Agreed To Date Luis Carlos Affonso Michael Amalfitano Kenn Ricci Marion Clifton Blakey Paul Eremenko Sergio Pedreiro José Manuel Entrecanales SVP, Engineering, Technology CEO, Embraer Co-CEO, Zanite Acquisition Former CEO, Rolls-Royce CEO, Universal Hydrogen; Former COO, Revlon; Former Chairman and CEO, Acciona and Strategy, Embraer Executive Aircraft Corp. and Principal, North America; Former FAA Former CTO, Airbus CEO, Estre Ambiental Directional Aviation Capital Administrator 15

3. STRATEGIC SUPPORT FROM EMBRAER

Heritage of Aviation Leadership #1 share of commercial jets with up to 150 seats For 50+ years, Embraer has established itself as a leader in 200 commercial airline customers in 75 countries a number of aviation categories #1 selling executive jet in the industry UAM is the next major growth 940 executive jet customers in 65 countries opportunity for Embraer to capitalize on via Eve 4,350 aircraft currently in operation 17 Note: Statistics from Embraer management and public filings, current as of 4/6/22.

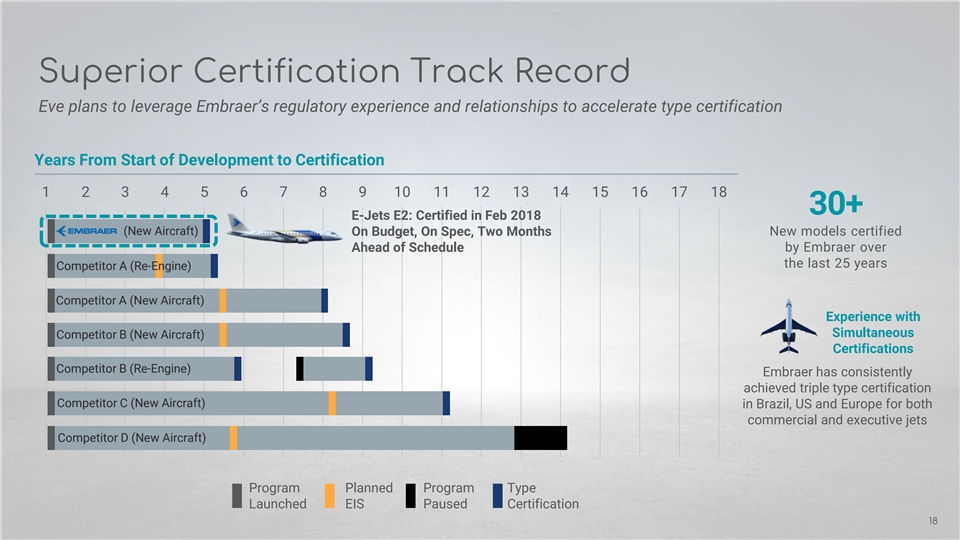

Superior Certification Track Record Eve plans to leverage Embraer’s regulatory experience and relationships to accelerate type certification Years From Start of Development to Certification 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 30+ E-Jets E2: Certified in Feb 2018 (New Aircraft) On Budget, On Spec, Two Months New models certified Ahead of Schedule by Embraer over the last 25 years Competitor A (Re-Engine) Competitor A (New Aircraft) Experience with Simultaneous Competitor B (New Aircraft) Certifications Competitor B (Re-Engine) Embraer has consistently achieved triple type certification Competitor C (New Aircraft) in Brazil, US and Europe for both commercial and executive jets Competitor D (New Aircraft) Program Planned Program Type Launched EIS Paused Certification 18

Leveraging World-Class Capabilities of Embraer Significant cost advantage over startups (1) ü Service agreements with Embraer will provide Eve with vast resources at favorable rates ü Contribution of UAM IP and a royalty-free license to Embraer’s background IP (2) ü 5,000 Embraer employees will be available to support Eve on a first priority basis ü Includes 1,600 named engineers with world-class design and aeronautical expertise ü As-a-service model allows Eve to efficiently flex-up and flex-down resource utilization ü Eve benefits from Embraer’s infrastructure and cost-competitive production capabilities (1) Master Services Agreement to be entered into between Eve and Embraer provides Eve with the option to source engineering, certification manufacturing and other services from Embraer at specified cost-based pricing. 19 (2) Pursuant to Master Services Agreement entered into between Eve and Embraer.

Global Presence with Local Support Eve is uniquely suited to support its customers by leveraging Embraer’s worldwide infrastructure Embraer Service Centers 10 Third-Party Countries 80 Service Centers 66 Flight Warehouses Simulators 24 77 Pilot Training Centers 5 Note: Data from Eve management and is current as of 4/6/22. Master Services Agreement entered into between Eve and Embraer provides Eve with the option to source engineering, certification manufacturing and other 20 services from Embraer at specified cost-based pricing.

4. POWERFUL PARTNER NETWORK

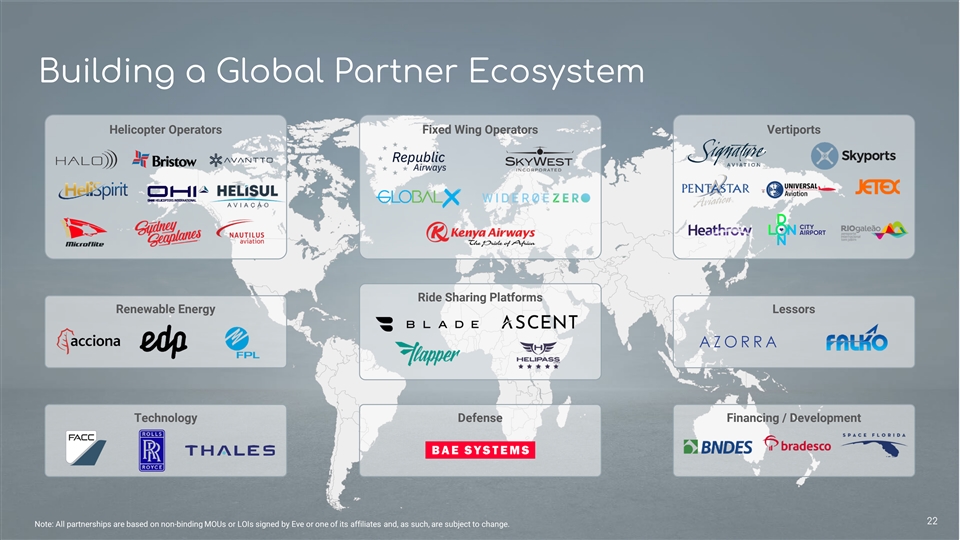

Building a Global Partner Ecosystem Helicopter Operators Fixed Wing Operators Vertiports Ride Sharing Platforms Renewable Energy Lessors Technology Defense Financing / Development 22 Note: All partnerships are based on non-binding MOUs or LOIs signed by Eve or one of its affiliates and, as such, are subject to change.

Airline Partnership SkyWest operates a fleet of over 450 aircraft connecting passengers to over 230 destinations throughout North America Operates regional jets (including Embraer jets) for major US carriers (1) Partnership with Eve: • 100 eVTOL launch order • Potential collaboration for aircraft operations • Strategic investor in the PIPE Hubs Chicago | Denver | Detroit | Houston | Los Angeles Minneapolis/St. Paul | Phoenix | Portland | Salt Lake City San Francisco | Seattle 23 (1) Launch order and potential collaboration for aircraft operations are non-binding and subject to material change.

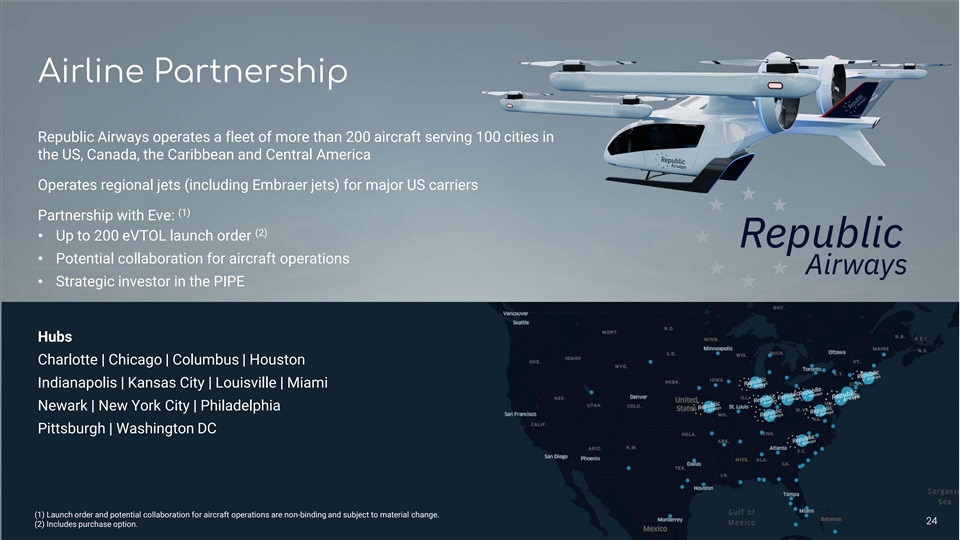

Airline Partnership Republic Airways operates a fleet of more than 200 aircraft serving 100 cities in the US, Canada, the Caribbean and Central America Operates regional jets (including Embraer jets) for major US carriers (1) Partnership with Eve: (2) • Up to 200 eVTOL launch order • Potential collaboration for aircraft operations • Strategic investor in the PIPE Hubs Charlotte | Chicago | Columbus | Houston Indianapolis | Kansas City | Louisville | Miami Newark | New York City | Philadelphia Pittsburgh | Washington DC (1) Launch order and potential collaboration for aircraft operations are non-binding and subject to material change. 24 (2) Includes purchase option.

Selected Helicopter Partnerships Avantto operates aircraft and helicopters, completing more than 6,000 flights per year with over 450 active customers (1) Partnership with Eve: • 100 eVTOL launch order • Potential collaboration for aircraft operations Halo provides bespoke helicopter and private urban air mobility travel services in the US and UK Formed through the combination of Halo Aviation and Associated Aircraft Group in May 2021 (1) (2) Partnership with Eve: (3) • Up to 200 eVTOL launch order • Potential collaboration for aircraft operations • Vehicles expected to operate in the US and UK (1) Launch order and potential collaboration for aircraft operations are non-binding and subject to material change. (2) Halo Aviation is an affiliate of Directional Aviation and Zanite Sponsor. 25 (3) Includes purchase option.

Lessor Partnerships Falko is a specialist aircraft operating leasing, asset management and aircraft services company focused on the regional aircraft sector. It is currently the world’s third largest lessor of regional aircraft by value and aircraft numbers with offices in the UK, Ireland and Singapore. (1) Partnership with Eve • 200 eVTOL launch order • Potential collaboration to develop a network of eVTOL operators • Strategic investor in the PIPE Azorra is a full-service aircraft leasing platform with a clean balance sheet focusing on regional, crossover and small narrowbody aircraft. Azorra’s team has a 25+ year track record and has owned and managed more than 275 aircraft in over 70 countries (1) Partnership with Eve (2) • Up to 200 eVTOL launch order • Potential collaboration to develop a network of eVTOL operators • Strategic investor in the PIPE (1) Launch order is non-binding and subject to material change. 26 (2) Includes purchase option.

Defense Partnership BAE Systems is a global leader in defense technology spanning air, maritime, land and cyber domains Significant scale with 89,600 employees in 40 countries and annual revenue of $26B (1) Partnership with Eve and Embraer • Global defense collaboration • Strategic investor in the PIPE Leading Defense Franchises Electronic Warfare | Cyber | Combat Air Combat Ships | Combat Vehicles | Cyber Undersea Warfare | Multi-Domain Capabilities 27 (1) Potential collaboration for defense applications is non-binding and subject to material change.

5. COMPELLING INVESTMENT OPPORTUNITY

Addressing a $0.76 Trillion Global TAM Eve’s 2030E revenue forecast implies only 15% market penetration (1) (2) UAM Passenger Total Addressable Market Embraer Market Share Examples $119B $125B UATM Service and Support $100B Fleet Operations eVTOLs $75B #1 Market Share | 29% Commercial Jets <150 seats $58B $50B $31B $25B $10B $0B 2025E 2030E 2035E 2040E #1 Market Share | 28% Light Jets Note: TAM of $0.76T refers to the aggregate revenue opportunity from 2025E – 2040E. (1) TAM estimate as per “Market for Urban Air Mobility” from KPMG dated June 2021 (includes passenger travel; excludes cargo, defense and emergency services). 29 (2) Market share statistics from Embraer management and public filings.

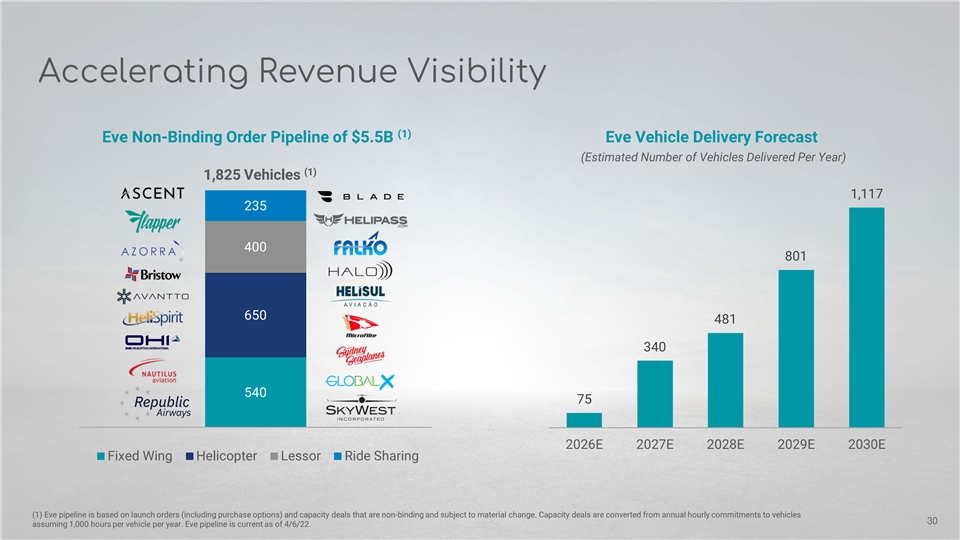

Accelerating Revenue Visibility (1) Eve Non-Binding Order Pipeline of $5.5B Eve Vehicle Delivery Forecast (Estimated Number of Vehicles Delivered Per Year) (1) 1,825 Vehicles 1,117 235 400 801 650 481 340 540 75 2026E 2027E 2028E 2029E 2030E Fixed Wing Helicopter Lessor Ride Sharing (1) Eve pipeline is based on launch orders (including purchase options) and capacity deals that are non-binding and subject to material change. Capacity deals are converted from annual hourly commitments to vehicles 30 assuming 1,000 hours per vehicle per year. Eve pipeline is current as of 4/6/22.

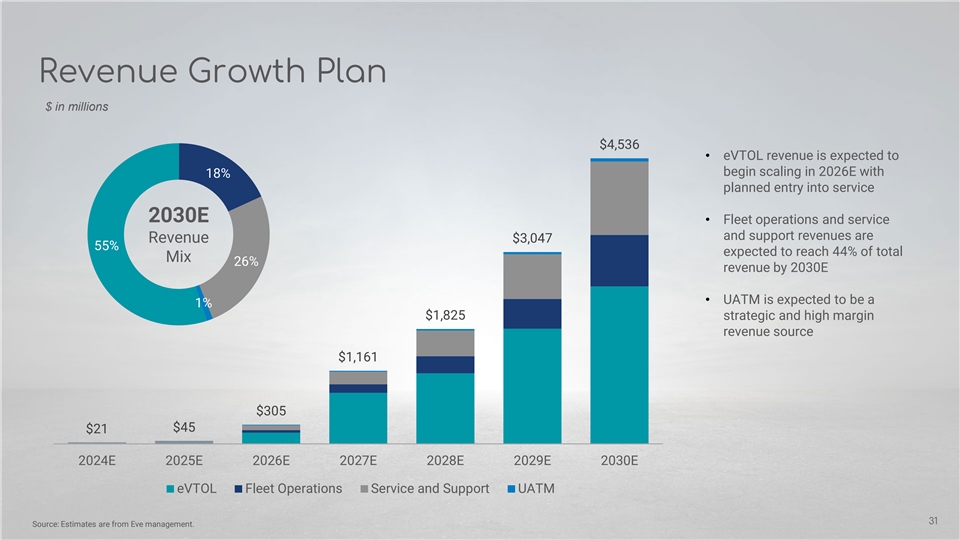

Revenue Growth Plan $ in millions $4,536 • eVTOL revenue is expected to begin scaling in 2026E with 18% planned entry into service 2030E • Fleet operations and service and support revenues are Revenue $3,047 55% expected to reach 44% of total Mix 26% revenue by 2030E • UATM is expected to be a 1% $1,825 strategic and high margin revenue source $1,161 $305 $45 $21 2024E 2025E 2026E 2027E 2028E 2029E 2030E eVTOL Fleet Operations Service and Support UATM 31 Source: Estimates are from Eve management.

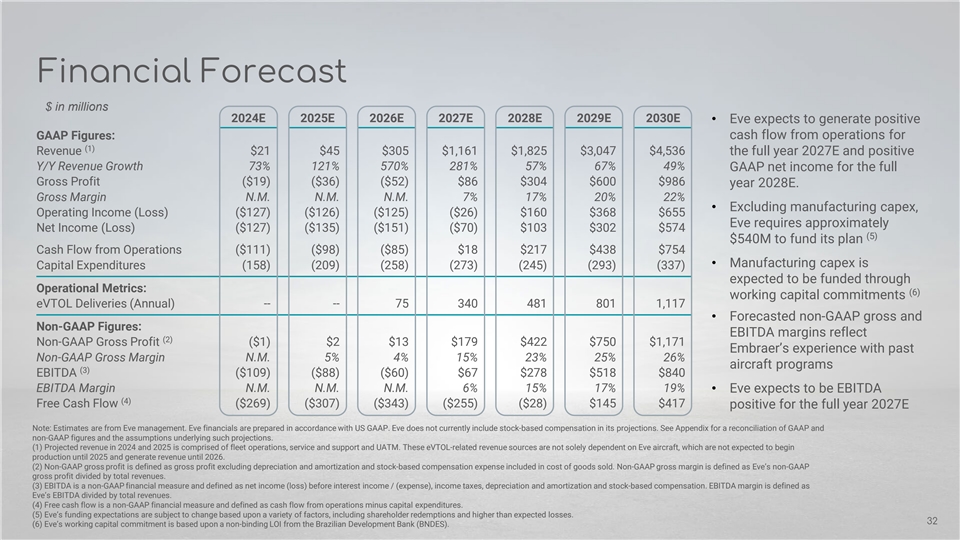

Financial Forecast $ in millions 2024E 2025E 2026E 2027E 2028E 2029E 2030E • Eve expects to generate positive GAAP Figures: cash flow from operations for (1) Revenue $21 $45 $305 $1,161 $1,825 $3,047 $4,536 the full year 2027E and positive Y/Y Revenue Growth 73% 121% 570% 281% 57% 67% 49% GAAP net income for the full Gross Profit ($19) ($36) ($52) $86 $304 $600 $986 year 2028E. Gross Margin N.M. N.M. N.M. 7% 17% 20% 22% • Excluding manufacturing capex, Operating Income (Loss) ($127) ($126) ($125) ($26) $160 $368 $655 Eve requires approximately Net Income (Loss) ($127) ($135) ($151) ($70) $103 $302 $574 (5) $540M to fund its plan Cash Flow from Operations ($111) ($98) ($85) $18 $217 $438 $754 • Manufacturing capex is Capital Expenditures (158) (209) (258) (273) (245) (293) (337) expected to be funded through Operational Metrics: (6) working capital commitments eVTOL Deliveries (Annual) -- -- 75 340 481 801 1,117 • Forecasted non-GAAP gross and Non-GAAP Figures: EBITDA margins reflect (2) Non-GAAP Gross Profit ($1) $2 $13 $179 $422 $750 $1,171 Embraer’s experience with past Non-GAAP Gross Margin N.M. 5% 4% 15% 23% 25% 26% aircraft programs (3) EBITDA ($109) ($88) ($60) $67 $278 $518 $840 EBITDA Margin N.M. N.M. N.M. 6% 15% 17% 19% • Eve expects to be EBITDA (4) Free Cash Flow ($269) ($307) ($343) ($255) ($28) $145 $417 positive for the full year 2027E Note: Estimates are from Eve management. Eve financials are prepared in accordance with US GAAP. Eve does not currently include stock-based compensation in its projections. See Appendix for a reconciliation of GAAP and non-GAAP figures and the assumptions underlying such projections. (1) Projected revenue in 2024 and 2025 is comprised of fleet operations, service and support and UATM. These eVTOL-related revenue sources are not solely dependent on Eve aircraft, which are not expected to begin production until 2025 and generate revenue until 2026. (2) Non-GAAP gross profit is defined as gross profit excluding depreciation and amortization and stock-based compensation expense included in cost of goods sold. Non-GAAP gross margin is defined as Eve’s non-GAAP gross profit divided by total revenues. (3) EBITDA is a non-GAAP financial measure and defined as net income (loss) before interest income / (expense), income taxes, depreciation and amortization and stock-based compensation. EBITDA margin is defined as Eve’s EBITDA divided by total revenues. (4) Free cash flow is a non-GAAP financial measure and defined as cash flow from operations minus capital expenditures. (5) Eve’s funding expectations are subject to change based upon a variety of factors, including shareholder redemptions and higher than expected losses. 32 (6) Eve’s working capital commitment is based upon a non-binding LOI from the Brazilian Development Bank (BNDES).

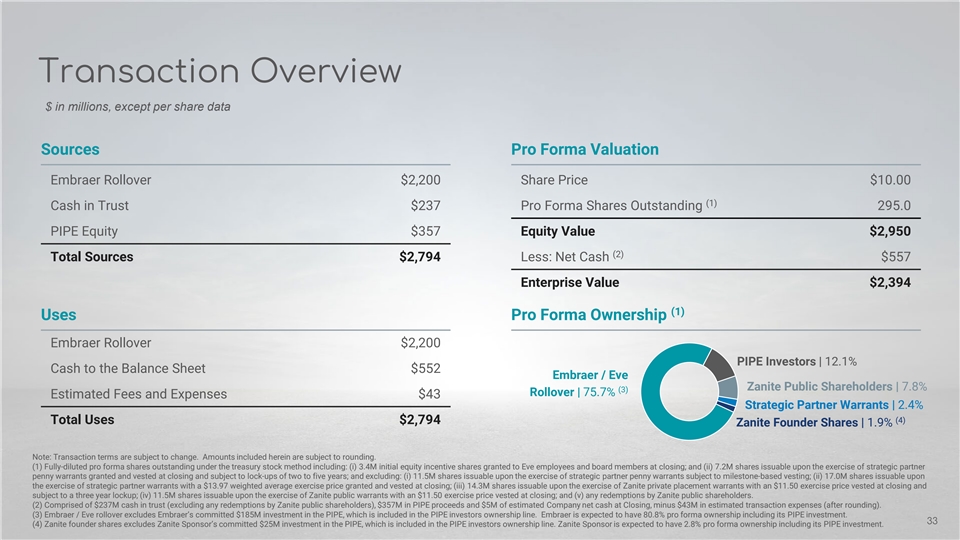

Transaction Overview $ in millions, except per share data Sources Pro Forma Valuation Embraer Rollover $2,200 Share Price $10.00 (1) Cash in Trust $237 Pro Forma Shares Outstanding 295.0 PIPE Equity $357 Equity Value $2,950 (2) Total Sources $2,794 Less: Net Cash $557 Enterprise Value $2,394 (1) Uses Pro Forma Ownership Embraer Rollover $2,200 PIPE Investors | 12.1% Cash to the Balance Sheet $552 Embraer / Eve Zanite Public Shareholders | 7.8% (3) Rollover | 75.7% Estimated Fees and Expenses $43 Strategic Partner Warrants | 2.4% (4) Total Uses $2,794 Zanite Founder Shares | 1.9% Note: Transaction terms are subject to change. Amounts included herein are subject to rounding. (1) Fully-diluted pro forma shares outstanding under the treasury stock method including: (i) 3.4M initial equity incentive shares granted to Eve employees and board members at closing; and (ii) 7.2M shares issuable upon the exercise of strategic partner penny warrants granted and vested at closing and subject to lock-ups of two to five years; and excluding: (i) 11.5M shares issuable upon the exercise of strategic partner penny warrants subject to milestone-based vesting; (ii) 17.0M shares issuable upon the exercise of strategic partner warrants with a $13.97 weighted average exercise price granted and vested at closing; (iii) 14.3M shares issuable upon the exercise of Zanite private placement warrants with an $11.50 exercise price vested at closing and subject to a three year lockup; (iv) 11.5M shares issuable upon the exercise of Zanite public warrants with an $11.50 exercise price vested at closing; and (v) any redemptions by Zanite public shareholders. (2) Comprised of $237M cash in trust (excluding any redemptions by Zanite public shareholders), $357M in PIPE proceeds and $5M of estimated Company net cash at Closing, minus $43M in estimated transaction expenses (after rounding). (3) Embraer / Eve rollover excludes Embraer’s committed $185M investment in the PIPE, which is included in the PIPE investors ownership line. Embraer is expected to have 80.8% pro forma ownership including its PIPE investment. 33 (4) Zanite founder shares excludes Zanite Sponsor’s committed $25M investment in the PIPE, which is included in the PIPE investors ownership line. Zanite Sponsor is expected to have 2.8% pro forma ownership including its PIPE investment.

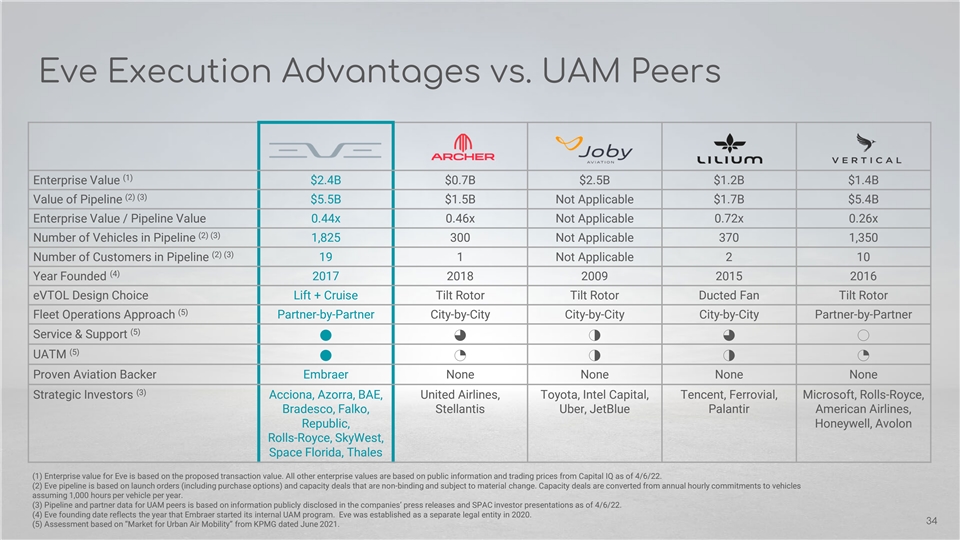

Eve Execution Advantages vs. UAM Peers (1) Enterprise Value $2.4B $0.7B $2.5B $1.2B $1.4B (2) (3) Value of Pipeline $5.5B $1.5B Not Applicable $1.7B $5.4B Enterprise Value / Pipeline Value 0.44x 0.46x Not Applicable 0.72x 0.26x (2) (3) Number of Vehicles in Pipeline 1,825 300 Not Applicable 370 1,350 (2) (3) Number of Customers in Pipeline 19 1 Not Applicable 2 10 (4) Year Founded 2017 2018 2009 2015 2016 eVTOL Design Choice Lift + Cruise Tilt Rotor Tilt Rotor Ducted Fan Tilt Rotor (5) Fleet Operations Approach Partner-by-Partner City-by-City City-by-City City-by-City Partner-by-Partner (5) Service & Support 43230 (5) UATM 41221 Proven Aviation Backer Embraer None None None None (3) Strategic Investors Acciona, Azorra, BAE, United Airlines, Toyota, Intel Capital, Tencent, Ferrovial, Microsoft, Rolls-Royce, Bradesco, Falko, Stellantis Uber, JetBlue Palantir American Airlines, Republic, Honeywell, Avolon Rolls-Royce, SkyWest, Space Florida, Thales (1) Enterprise value for Eve is based on the proposed transaction value. All other enterprise values are based on public information and trading prices from Capital IQ as of 4/6/22. (2) Eve pipeline is based on launch orders (including purchase options) and capacity deals that are non-binding and subject to material change. Capacity deals are converted from annual hourly commitments to vehicles assuming 1,000 hours per vehicle per year. (3) Pipeline and partner data for UAM peers is based on information publicly disclosed in the companies’ press releases and SPAC investor presentations as of 4/6/22. (4) Eve founding date reflects the year that Embraer started its internal UAM program. Eve was established as a separate legal entity in 2020. 34 (5) Assessment based on “Market for Urban Air Mobility” from KPMG dated June 2021.

Positioned to be the Premier Player in UAM ü Transformational $0.76T Market Opportunityü $5.5B Pipeline Driven by Best-in-Class Partners ü Efficient and Certifiable Vehicle Designü Experienced Executive Team and Board ü Proven Certification / Production Track-Recordü High-Growth, Capital Efficient Business Model ü Worldwide Sales and Support Networkü Attractive Valuation Entry Point 35

APPENDIX Confidential |

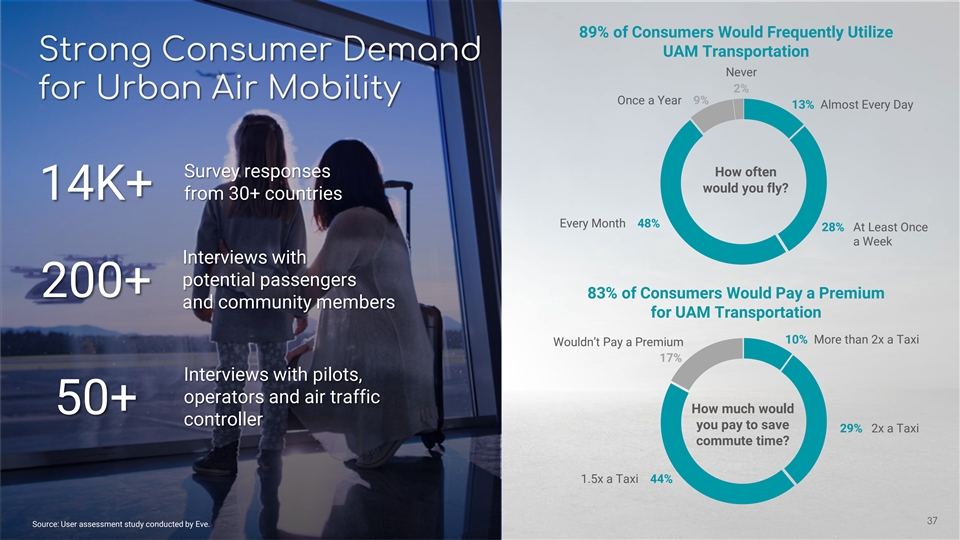

89% of Consumers Would Frequently Utilize UAM Transportation Strong Consumer Demand Never 2% for Urban Air Mobility Once a Year 9% 13% Almost Every Day Survey responses How often would you fly? 14K+ from 30+ countries Every Month 48% 28% At Least Once a Week Interviews with potential passengers 200+ 83% of Consumers Would Pay a Premium and community members for UAM Transportation 10% More than 2x a Taxi Wouldn’t Pay a Premium 17% Interviews with pilots, operators and air traffic How much would 50+ controller you pay to save 29% 2x a Taxi commute time? 1.5x a Taxi 44% 37 Source: User assessment study conducted by Eve.

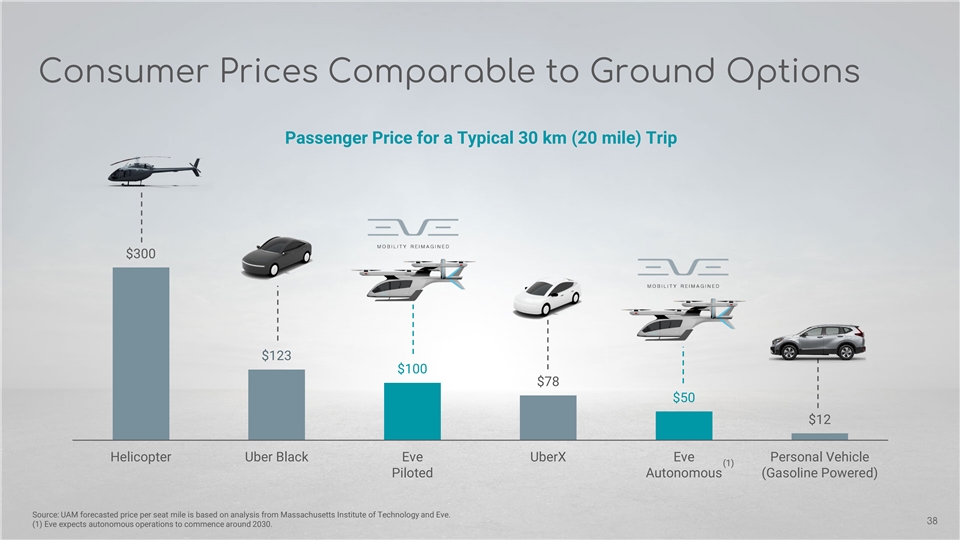

Consumer Prices Comparable to Ground Options Passenger Price for a Typical 30 km (20 mile) Trip $300 $123 $100 $78 $50 $12 Helicopter Uber Black Eve UberX Eve Personal Vehicle (1) Piloted Autonomous (Gasoline Powered) Source: UAM forecasted price per seat mile is based on analysis from Massachusetts Institute of Technology and Eve. 38 (1) Eve expects autonomous operations to commence around 2030.

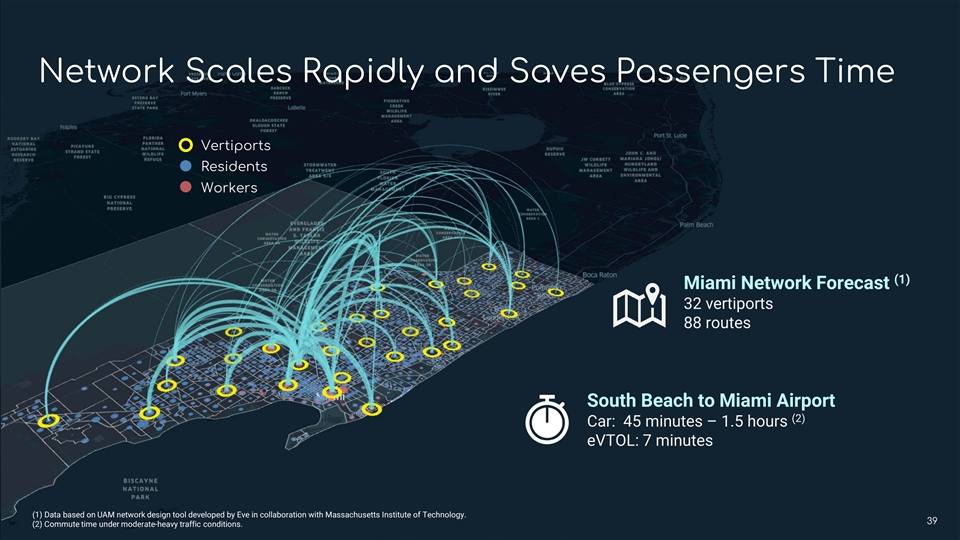

Network Scales Rapidly and Saves Passengers Time Vertiports Residents Workers (1) Miami Network Forecast 32 vertiports 88 routes South Beach to Miami Airport (2) Car: 45 minutes – 1.5 hours eVTOL: 7 minutes (1) Data based on UAM network design tool developed by Eve in collaboration with Massachusetts Institute of Technology. 39 (2) Commute time under moderate-heavy traffic conditions.

Environmentally Friendly Aviation 0 ZERO FULL UP to 80% CARBON 100% LIFE-CYCLE local CO emission NEUTRALITY 2 design achievable with electric carbon reduction (1) vehicle emissions approach minimum cost versus cars 40 (1) Data for internal combustion engine vehicles from the European Environmental Agency.

Designed to Deliver the Lowest Operational Cost Estimated Direct Operational Cost Per Seat for a Typical 30 km (20 mile) Trip $164 $135 $58 $47 $20 (1) Helicopter Multi-Rotor Tilt Rotor Eve Piloted Eve Autonomous 1 pilot / 6 passengers 1 pilot / 1 passenger 1 pilot / 4 passengers 1 pilot / 4 passengers 0 pilot / 6 passengers Source: Estimated helicopter costs are based on an analysis from Conklin & de Decker. All other costs are based on Eve analysis. 41 (1) Eve expects autonomous operations to commence around 2030.

Cabin Experience Driven by Human-Centered Design Co-Created Eve engaged with future passengers to create the ideal cabin experience Inclusive Welcoming to all passengers based on lifestyle, age, culture and accessibility needs Optimized Efficient design for optimal cabin space, vehicle weight and passenger comfort 42

Comprehensive Service and Support Eve plans to provide eVTOL services leveraging Embraer’s top-ranked product (1) support capabilities Material Maintenance Services Services Technical Flight Operations Services and Training Ground Data Services Handling ü Vital element to scale UAM services ü Key selling point for eVTOL customers ü Provides a predictable revenue stream ü Leverages Embraer’s global network ü Agnostic approach (Eve and third parties) 43 (1) Embraer was ranked #1 in the 2021 Corporate Aircraft Product Support Survey based on data compiled by Conklin & de Decker and reported by Pro Pilot.

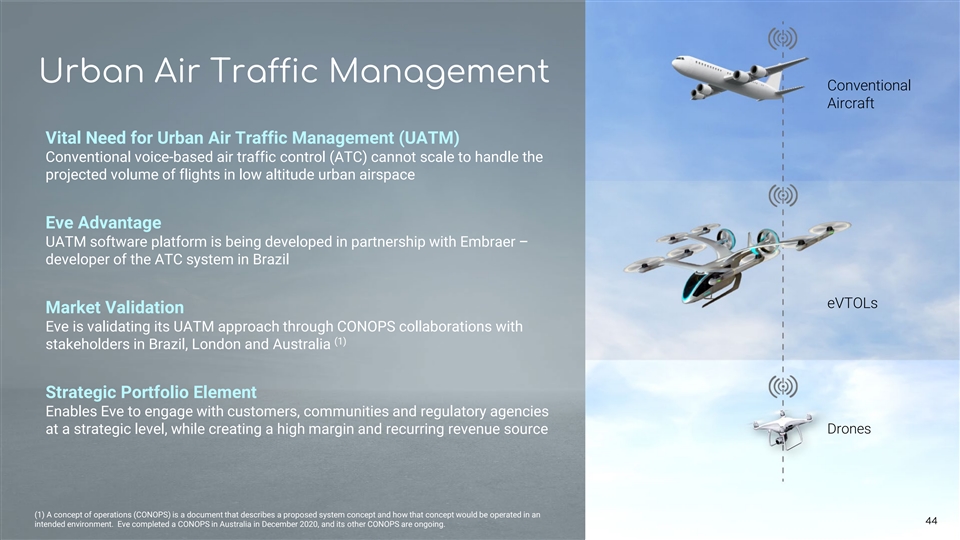

Urban Air Traffic Management Conventional Aircraft Vital Need for Urban Air Traffic Management (UATM) Conventional voice-based air traffic control (ATC) cannot scale to handle the projected volume of flights in low altitude urban airspace Eve Advantage UATM software platform is being developed in partnership with Embraer – developer of the ATC system in Brazil eVTOLs Market Validation Eve is validating its UATM approach through CONOPS collaborations with (1) stakeholders in Brazil, London and Australia Strategic Portfolio Element Enables Eve to engage with customers, communities and regulatory agencies Drones at a strategic level, while creating a high margin and recurring revenue source (1) A concept of operations (CONOPS) is a document that describes a proposed system concept and how that concept would be operated in an 44 44 intended environment. Eve completed a CONOPS in Australia in December 2020, and its other CONOPS are ongoing.

Fostering Development of UAM Operations Globally Eve is developing and testing a Concept of Operations (CONOPS) in selected cities to help define the airspace design, procedures and infrastructure for safely integrating eVTOL operations into low altitude urban airspace CONOPS leadership allows Eve to engage early with regulatory agencies and other key stakeholders to optimize Eve’s vehicle design and foster UAM market development by defining the rules and regulations that do not exist today Initial CONOPS locations and collaborators: Rio de Janeiro, Brazil London, UK Melbourne, Australia Miami, Florida Skyports | L3Harris Skyports | Universal Atech | Vertical Airservices Rio Galeão | ABAG | Flapper Volocopter | Skyports Community Air Mobility EDP | Beacon | Helisul London City Airport Initiative Atech | ANAC | DECEA NATS | Heathrow 45

(1) GAAP to Non-GAAP Reconciliations $ in millions 2024E 2025E 2026E 2027E 2028E 2029E 2030E GAAP Gross Profit ($19) ($36) ($52) $86 $304 $600 $986 (+) Depreciation and Amortization 18 39 65 93 119 150 185 (2) Non-GAAP Gross Profit ($1) $2 $13 $179 $422 $750 $1,171 Non-GAAP Gross Margin N.M. 5% 4% 15% 23% 25% 26% GAAP Net Income (Loss) ($127) ($135) ($151) ($70) $103 $302 $574 (+) Interest Income / (Expense) -- 9 26 44 53 53 53 (+) Income Taxes -- -- -- -- 4 14 28 (+) Depreciation and Amortization 18 39 65 93 119 150 185 (3) EBITDA ($109) ($88) ($60) $67 $278 $518 $840 EBITDA Margin N.M. N.M. N.M. 6% 15% 17% 19% GAAP Cash Flow from Operations ($111) ($98) ($85) $18 $217 $438 $754 (-) Capital Expenditures (158) (209) (258) (273) (245) (293) (337) (4) Free Cash Flow ($269) ($307) ($343) ($255) ($28) $145 $417 Note: Estimates are from Eve management. Eve financials are prepared in accordance with US GAAP. Eve does not currently include stock-based compensation in its projections. (1) The projected financial information included in this presentation includes certain non-GAAP financial measures, including non-GAAP gross profit and non-GAAP gross margin, EBITDA and EBITDA margin and free cash flow. Eve’s management included these non-GAAP financial measures because it believes they are useful in evaluating Eve’s operating performance, as they are similar to measures reported by Eve’s public competitors and are regularly used by security analysts, institutional investors and other interested parties in analyzing operating performance and prospects. (2) Non-GAAP gross profit is defined as gross profit excluding depreciation and amortization and stock-based compensation expense included in cost of goods sold. Non-GAAP gross margin is defined as Eve’s non-GAAP gross profit divided by total revenues. Eve’s management believes non-GAAP gross profit and gross margin can provide useful measures of Eve’s core performance over time as they eliminate the impact of non-cash expenses and allow a direct comparison of Eve’s cash operations and ongoing performance between periods. (3) EBITDA is a non-GAAP financial measure and defined as net income (loss) before interest income / (expense), income taxes, depreciation and amortization and stock-based compensation. EBITDA margin is defined as Eve’s EBITDA divided by total revenues. Eve’s management believes these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provide meaningful supplemental information regarding Eve’s performance by excluding certain items that may not be indicative of Eve’s business, results of operations or outlook. (4) Free cash flow is a non-GAAP financial measure and defined as cash flow from operations minus capital expenditures. Eve’s management included projections of free cash flow because Eve’s management believes this 46 non-GAAP metric provides useful information to investors and others in understanding and evaluating Eve’s liquidity position and its ability to fund its operations.

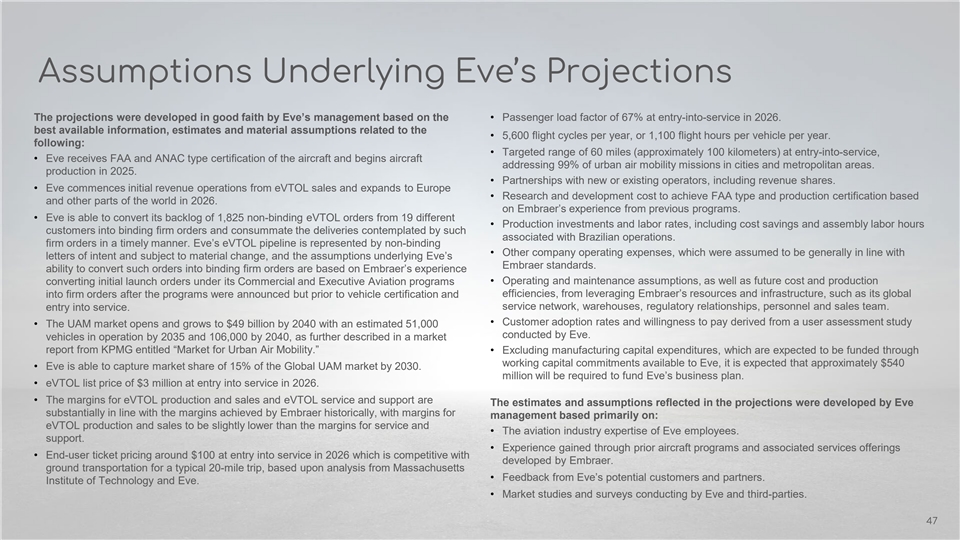

Assumptions Underlying Eve’s Projections The projections were developed in good faith by Eve’s management based on the • Passenger load factor of 67% at entry-into-service in 2026. best available information, estimates and material assumptions related to the • 5,600 flight cycles per year, or 1,100 flight hours per vehicle per year. following: • Targeted range of 60 miles (approximately 100 kilometers) at entry-into-service, • Eve receives FAA and ANAC type certification of the aircraft and begins aircraft addressing 99% of urban air mobility missions in cities and metropolitan areas. production in 2025. • Partnerships with new or existing operators, including revenue shares. • Eve commences initial revenue operations from eVTOL sales and expands to Europe • Research and development cost to achieve FAA type and production certification based and other parts of the world in 2026. on Embraer’s experience from previous programs. • Eve is able to convert its backlog of 1,825 non-binding eVTOL orders from 19 different • Production investments and labor rates, including cost savings and assembly labor hours customers into binding firm orders and consummate the deliveries contemplated by such associated with Brazilian operations. firm orders in a timely manner. Eve’s eVTOL pipeline is represented by non-binding • Other company operating expenses, which were assumed to be generally in line with letters of intent and subject to material change, and the assumptions underlying Eve’s Embraer standards. ability to convert such orders into binding firm orders are based on Embraer’s experience • Operating and maintenance assumptions, as well as future cost and production converting initial launch orders under its Commercial and Executive Aviation programs efficiencies, from leveraging Embraer’s resources and infrastructure, such as its global into firm orders after the programs were announced but prior to vehicle certification and entry into service. service network, warehouses, regulatory relationships, personnel and sales team. • Customer adoption rates and willingness to pay derived from a user assessment study • The UAM market opens and grows to $49 billion by 2040 with an estimated 51,000 conducted by Eve. vehicles in operation by 2035 and 106,000 by 2040, as further described in a market report from KPMG entitled “Market for Urban Air Mobility.” • Excluding manufacturing capital expenditures, which are expected to be funded through working capital commitments available to Eve, it is expected that approximately $540 • Eve is able to capture market share of 15% of the Global UAM market by 2030. million will be required to fund Eve’s business plan. • eVTOL list price of $3 million at entry into service in 2026. • The margins for eVTOL production and sales and eVTOL service and support are The estimates and assumptions reflected in the projections were developed by Eve substantially in line with the margins achieved by Embraer historically, with margins for management based primarily on: eVTOL production and sales to be slightly lower than the margins for service and • The aviation industry expertise of Eve employees. support. • Experience gained through prior aircraft programs and associated services offerings • End-user ticket pricing around $100 at entry into service in 2026 which is competitive with developed by Embraer. ground transportation for a typical 20-mile trip, based upon analysis from Massachusetts • Feedback from Eve’s potential customers and partners. Institute of Technology and Eve. • Market studies and surveys conducting by Eve and third-parties. 47

Risk Factors The risks presented below are certain of the general risks related to EVE UAM LLC, including the urban air mobility business it • There is a shortage of pilots and mechanics which could increase the costs of operating Eve's eVTOL and reduce the will own (collectively, Eve ), Zanite Acquisition Corp. ( Zanite ) and the proposed business combination between Eve and ability to deploy Eve's eVTOL service at scale. Zanite (the Business Combination ), and such list is not exhaustive. The list below has been prepared solely for purposes of • Eve currently relies and will continue to rely on Embraer and third-party partners to provide and store the services, products, the private placement transaction, and solely for potential private placement investors, and not for any other purpose. You parts and components required to manufacture our aircraft, transport the aircraft to final customer and to supply critical should carefully consider these risks and uncertainties, and should carry out your own diligence and consult with your own services, components and systems, which exposes us to a number of risks and uncertainties outside its control. financial and legal advisors concerning the risks and suitability of an investment in this offering before making an investment • Eve's ability to operate its business effectively depends in large part on certain administrative and other support functions decision. Risks relating to the business of Eve will be disclosed in future documents filed or furnished by Eve and Zanite with provided to it by Embraer pursuant to the Services Agreements. Following the expiration or termination of the Services the U.S. Securities and Exchange Commission ( SEC ), including the documents filed or furnished in connection with the Agreements, Eve's ability to operate its business effectively may suffer if it is unable to cost-effectively establish its own Business Combination. The risks presented in such filings will be consistent with those that would be required for a public administrative and other support functions in order to operate as a stand-alone company. company in its SEC filings, including with respect to the business and securities of Eve and Zanite and the Business • Eve may have received better terms from unaffiliated third parties than the terms it has received in the services Combination, and may differ significantly from, and be more extensive than, those presented below. agreements with Embraer S.A. • Eve will rely on supplier and service partners to transport the aircraft to the final customer and to supply other critical Risks Related to Eve's Business, Industry, Financial Condition, and Results of Operations services and systems necessary for Eve's operations, including to provide aerial ridesharing services and to make the • The market for Urban Air Mobility (UAM) has not been established with precision, is still emerging and may not achieve the necessary changes to, and operate, vertiports using Eve's aircrafts, which exposes Eve to risks and uncertainties outside its growth potential Eve expects, or may grow more slowly than expected. control. Eve's agreements with such supplier and service partners are all non-binding. If Eve does not enter into definitive • There may be reluctance by consumers to adopt this new form of mobility, or unwillingness to pay Eve's projected prices. agreements with such supplier and service partners, or the conditions to any such agreements (if any) are not met, or if • There may be rejection of eVTOL operation in certain localities due to a perceived risk of safety or burden on local such agreements (if any) are cancelled, modified or delayed, or if such third party customers and commercial partners do communities from eVTOL operations. not otherwise make the services sufficiently convenient to drive customer adoption, Eve's prospects, results of operations, • Eve may be unable to obtain relevant regulatory approvals for the commercialization of its aircraft, including Type liquidity and cash flow will be harmed. Certification, Production Certification, Operating Certification, approvals for permitting new infrastructure or access • Changes in government regulation imposing additional requirements and restrictions on Eve's operations could increase its existing infrastructure or otherwise. operating costs and result in service delays and disruptions. • Eve will be subject to rapidly changing and increasingly stringent laws, regulations, industry standards, and other • The UAM Business is subject to stringent U.S. export and import control laws and regulations. Unfavorable changes in obligations relating to privacy, data protection, and data security. The restrictions and costs imposed by these these laws and regulations or U.S. government licensing policies, Eve's failure to secure timely U.S. government requirements, or its actual or perceived failure to comply with them, could harm its business. authorizations under these laws and regulations, or Eve's failure to comply with these laws and regulations could have a • If current airspace regulations are not modified to increase air traffic capacity, or new regulations are introduced that material adverse effect on Eve's business, financial condition and results of operations. restrict air traffic, Eve's business could be adversely affected. • The electric vertical take-off and landing (eVTOL) aircraft industry may not continue to develop, eVTOL aircraft may not be • Eve may not be able to launch its eVTOL and related services on the timeline projected and may not be able to produce adopted by the market or Eve's independent third-party aircraft operators, eVTOL aircraft may not be certified by aircraft in the volumes and on the timeline projected. transportation authorities or eVTOL aircraft may not deliver the expected reduction in operating costs, any of which could • Eve's competitors may commercialize their technology before Eve does, either in general or in specific markets. adversely affect Eve's prospects, business, financial condition and results of operations. • Eve's customers' perception of Eve and Eve's reputation may be impacted by the broader industry, and customers may not • Urban Air Traffic Management (UATM) may not be able to provide adequate situational awareness and equitable airspace differentiate Eve's services from its competitors. access to eVTOLs or may not allow industrial scalability. • Eve’s aircraft may require maintenance at frequencies or at costs which are unexpected and could adversely impact its • The regulatory environment for third-party service and technology providers (which UATM could be labeled as) may not be business and operations. specific enough to support Eve's UATM solution, or may delay its adoption. • Eve's prospects and operations may be adversely affected by changes in consumer preferences, discretionary spending • Eve's UATM solution may underperform if it has a defect or it is not delivered on the projected timeline. and other economic conditions that affect demand for UAM services, including changes resulting from the COVID-19 • Eve is an early stage company with a history of losses, and it expects to incur significant losses for the foreseeable future pandemic. and it may not be able to achieve or maintain profitability. • Neither Eve nor Embraer has yet manufactured or delivered to customers any eVTOL aircraft, which makes evaluating Eve's • Eve may not be able to secure adequate insurance policies, or secure insurance policies at reasonable prices. business and future prospects difficult and increases the risk of investment. • Eve may be unable to manage its future growth effectively, which could make it difficult to execute its business strategy. • Eve's eVTOL aircraft may not perform at the level it expects, and may have potential defects, such as higher than expected • Eve's available capital resources may not be sufficient to meet its requirements for additional capital. noise profile, lower payload than initially estimated, shorter range, higher unit cost, higher cost of operation, perceived • Eve may in the future invest significant resources in developing new offerings and exploring the application of Eve's discomfort during transition phase and/or shorter useful lives than Eve anticipates. proprietary technologies for other uses and those opportunities may never materialize. • Crashes, accidents or incidents of eVTOL aircraft or involving UATM solutions, lithium batteries involving Eve or its • Eve may be unable to make certain advances in technology such as autonomous flying technologies, or such technologies competitors could have a material adverse effect on Eve's business, financial condition, and results of operations. may not mature or be commercially available at the rates projected by Eve, which could adversely affect Eve's business, • Unsatisfactory safety performance of Eve's aircraft could have a material adverse effect on its business, financial financial condition and results of operations. condition, and results of operation. 48